How you can get an edge by trading on news sentiment data

This article was written by Bloomberg Market Specialist Ian McFarlane. It appeared first on the Bloomberg Terminal.

Background

Algorithmic trading strategies and quants using sophisticated models are taking over many Wall Street trading floors. Traditional fundamental and technical analysis is giving way to strategies based on machines and unique data sets. One such approach: tracking event-driven news. With computer reading of news on the rise, Wall Street is changing how reporting is digested. Many hedge funds and quants have thus developed ways to trade the markets based on news and social media sentiment, confidence, and story counts.

A machine can read news and take action faster than any human. Most adults can read about 200 words per minute, which means it would typically take about three minutes to power through a 600-word article. During the time you’ve got your nose buried in that piece, the stocks or bonds in your portfolio might have been mentioned in hundreds of social media posts and news articles. It’s impossible for a human to keep up with that deluge of real-time data. That’s where distilling sentiment from news and social media provides an advantage.

Bloomberg has applied such techniques to flag a news story or tweet as being relevant for an individual stock and then assign a sentiment score to each article or tweet in the feed. When applied to trading, sentiment can simply be used as a directional signal to figure out whether you should be long or short stocks within your portfolio or universe. A typical behavioral assumption is that if there’s positive news on a company, its share price will rise and vice versa.

The Issue

Bloomberg has developed a news sentiment analysis tool {TREN <GO>}, that leverages this speed with machine-learning techniques to determine news and social sentiment from text, generated in real time. These sentiment scores range from -1 for negative items to 1 for positive, with 0 being neutral.

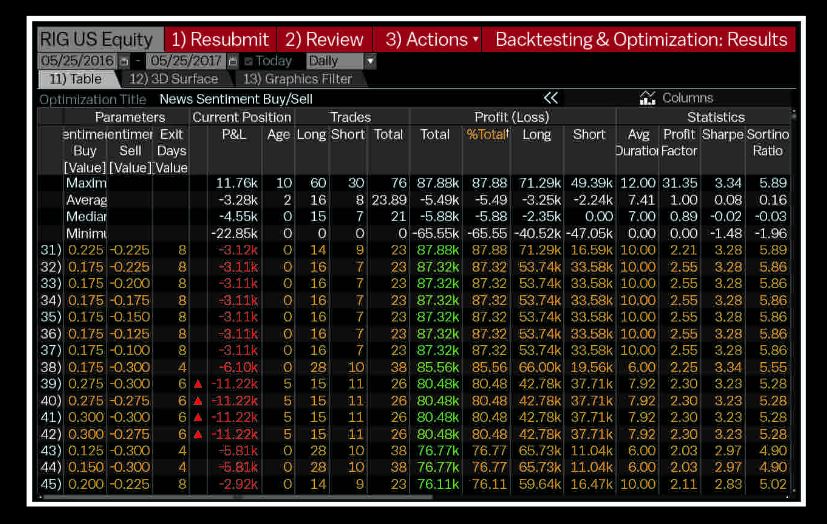

This Bloomberg tool can be used to determine the optimal strategy for trading based on news sentiment data for companies or broader indexes. Bloomberg clients can also evaluate how such strategies would work over the long run through {BT <GO>}, Bloomberg’s Backtesting & Optimization function.

As an example let’s take a look at Transocean. The Switzerland-based offshore drilling contractor was doing well until oil slumped following the OPEC meeting that wrapped up on May 25. Shares of the company plunged 7.6 percent that day, leaving them down 4.5 percent for one year, compared with the S&P 500’s rise of 16 percent during the period.

But what if you’d traded Transocean based purely on news sentiment — that is, buying when the sentiment was positive and selling when negative? Doing so could have generated a gain of about $87,880 once optimized as of May 25, vs. the loss from a simple buy-and-hold strategy. That was achieved by going long when the news sentiment crossed above 0.225 and going short when it dropped below -0.225. The optimal number of days to hold the position after the trade was eight. This example, of course, doesn’t take into account transaction costs. Actual trading could underperform the backtesting result substantially and even lead to a loss. And, as the saying goes, past performance is no guarantee of future returns.

Tracking

Use Bloomberg tools to track news and social media sentiment for stocks and to model optimal returns.

For more information on this or other functionality on the Bloomberg Professional Service, click below to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.