This analysis is by Bloomberg Intelligence Senior Analyst Anurag Rana and Senior Associate Analyst Andrew Girard. It appeared first on the Bloomberg Terminal.

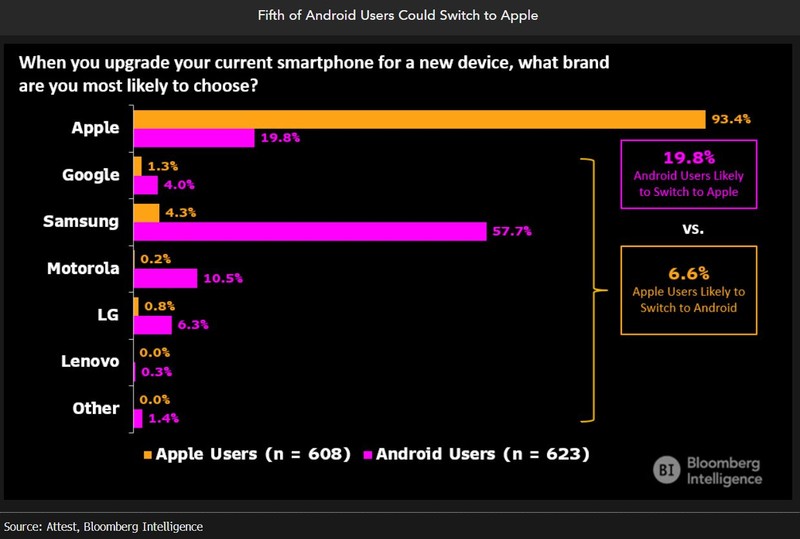

iPhone unit sales could stagnate next year as US customers hold on to their old phones for longer rather than upgrade to Apple’s new iPhone 15, according to our third proprietary annual survey. Even with weaker unit sales, iPhone revenue could increase because of the clear preference for the most-expensive Pro Max model, which starts at $1,199. Also, a much higher percentage of Android users plan on switching, as 93% of Apple users are loyal versus 80% for Android. More customers said they plan to cut back on services such as iCloud and AppleTV+.

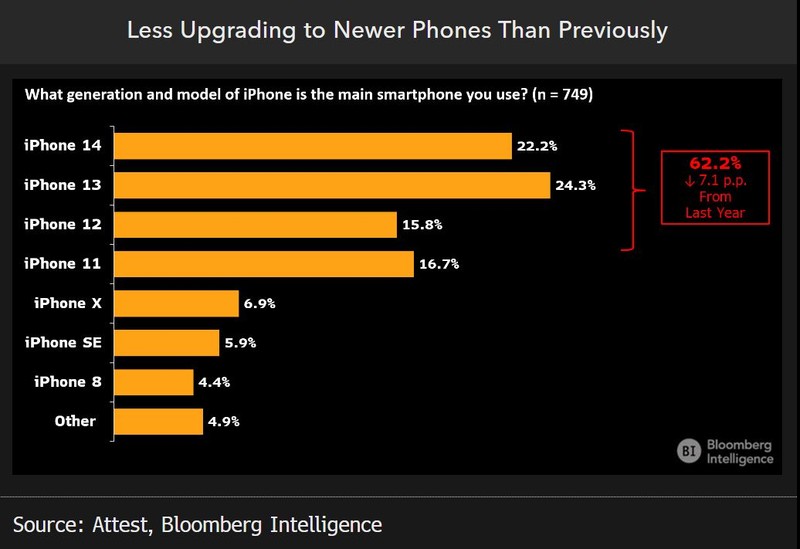

Rate of upgrading to newest iPhone lengthens; switchers can help

The most important finding in our survey was a potential extension in the refresh cycle of phones. Only 62% of the participants owned phones released in the past three years, down from 69% last year. This suggests consumers are holding on to their phones much longer, most likely because of the dent in purchasing power from inflation. This supports our thesis that Apple’s iPhone installed base will likely grow at a modest 2% per year rate, compared to an average 5% the past three years.

Meanwhile, roughly 20% of Android phone users said they may shift to Apple, compared to just 7% of iPhone users, which may offset the potential extension of the phone refresh cycle. Such “switchers” are a critical component of the iPhone growth story, as Apple has just 17% market share of the global smartphone installed base.

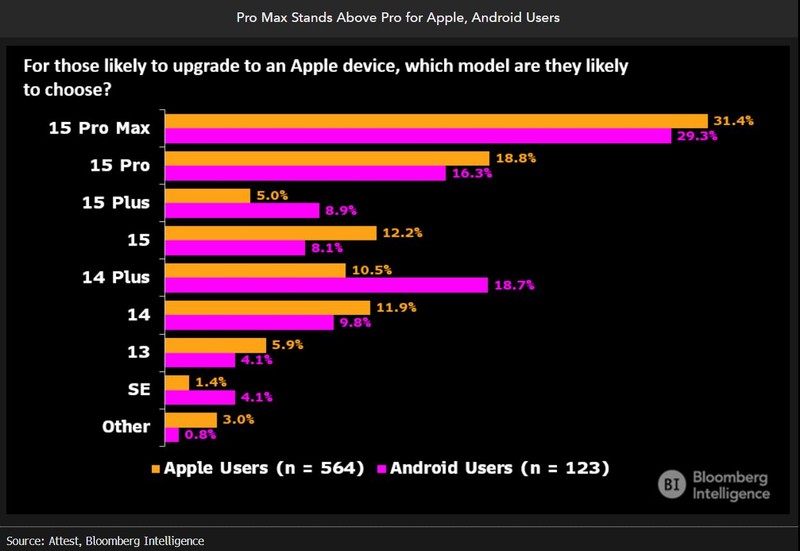

iPhone buyers prefer the higher-priced Pro Max model

Another key finding of our survey of more than 1,600 people was the distinct preference of both iOS and Android users to opt for the highest-end iPhone model (Pro Max), which has a starting price of $1,199 — 20% more than the Pro model and 33% higher than Plus model. This data point supports the high lead time of this premium model, which indicates to us that iPhone revenue in the US could still grow in fiscal 2024 even if unit shipments are flat to slightly down. The Pro Max model has a much more advanced camera, compared to other iPhone 15 models, with a 5x telephoto lens.

Apple customer loyalty shines at 93% versus 80% for Android

Apple ranked much higher than Android in terms of customer loyalty in our survey. Roughly 20% of Android users said they plan to buy an Apple product during their next upgrade, with 30% of those opting for the highest-price Pro Max model. In comparison. Only about 7% of iOS users said that they are looking to switch away from Apple. This high customer loyalty is key to Apple’s long-term gains in market share, as a greater portion of new unit sales will likely come from Android users switching over than from market expansion.

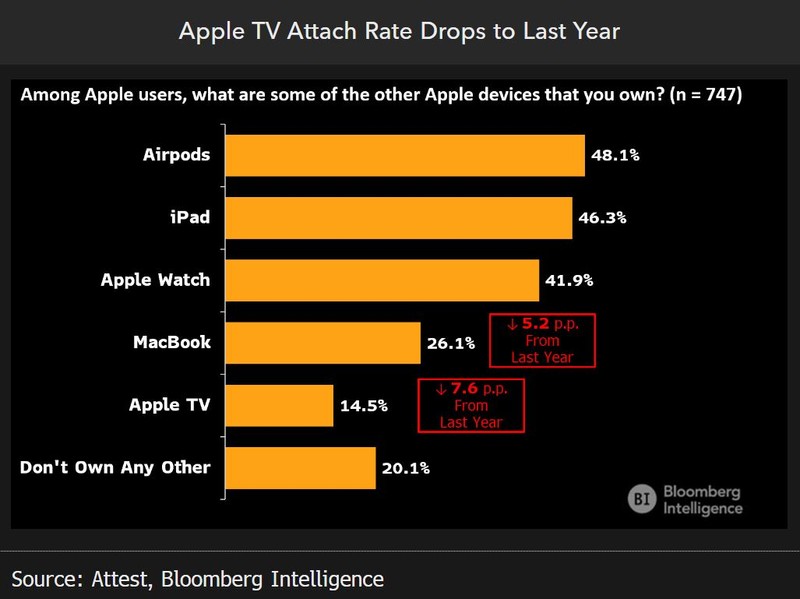

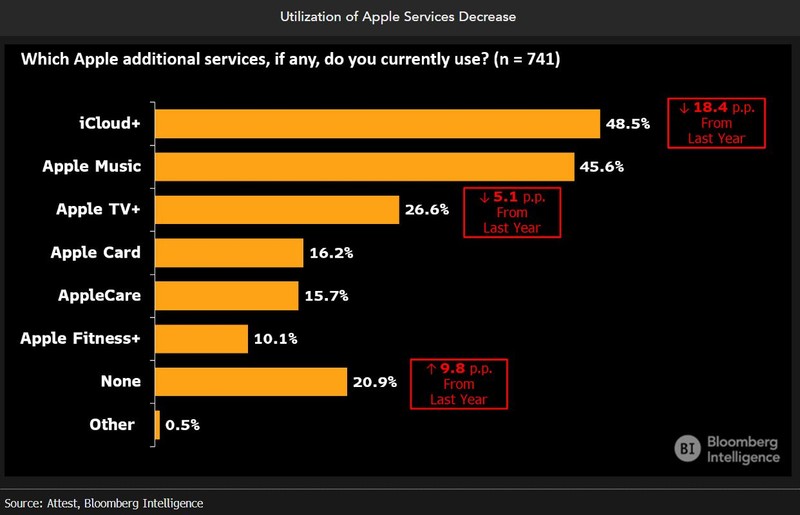

Pressure on services such as iCloud and AppleTV+ from inflation

In addition to consumers holding on to their phones much longer, we also observed a reduction in the use of various Apple services such as iCloud and Apple TV+. We attribute this to inflation and a general reduction in the purchasing power of the consumer. Apple’s financial results have also shown a similar pattern, with services growth slowing to around 6.3% in the past 12 months versus 19.4% a year ago.

We also saw an 11 percentage-point spike in the percentage of Android users who could potentially switch over to iOS if iCloud was included in the phone’s price.

Apple TV product and streaming service losing popularity

Both the Apple TV product and services saw a big drop among participants compared to last year. Only 14.5% of iOS users had an Apple TV device in 2023, compared to 22% last year, a drop of 7.6 percentage points. This sharp drop was likely driven by lower-priced Roku and Amazon’s Fire TV products as well as the growing popularity of smart TVs that is cannibalizing the market for external connected devices. Meanwhile, price increases, lack of content and an overall slowdown in the industry potentially hurt the usage of Apple TV+ service, which fell to 26.6% in 2023 from 31.7% last year.