This article was written by Vivian Li, Xiaoyun Zhu and Irene Huang. It appeared first on the Bloomberg Terminal.

Background

HNA Group Inc. in December ceded control of its core airline operations. The Haikou, China-based conglomerate, which filed for bankruptcy reorganization in 2021, was once one of China’s most acquisitive companies.

Starting in 2016, HNA spent $40 billion on purchases that included stakes in Deutsche Bank AG and Hilton Worldwide Holdings Inc. The conglomerate’s total assets more than doubled that year, then peaked at 1.23 trillion yuan ($194 billion) in 2017.

Issue

To support its borrowing, HNA pledged an array of shares of publicly traded companies. By 2018, when the prices of some of those pledged shares dropped, HNA started to sell assets to ease liquidity pressures. One of its units failed to pay interest on a HK$1.4 billion ($179 million) facility in April 2019.

Pledging shares as collateral is a common but potentially risky way to secure a loan. If a stock’s price drops, the value of the pledged collateral falls. Below a certain threshold, such drops can trigger margin calls. The borrower has to either produce more collateral or repay the loans. If neither happens, the lender may sell the pledged shares in the open market, leading to further drops in price. As a result, high levels of pledged shares can be a concern for investors because of the potential for price movements.

Pledged shares can provide an important insight into companies’ creditworthiness and operating stability. To that end, data on pledged shares in the China market have been added to the Bloomberg Terminal.

Tracking

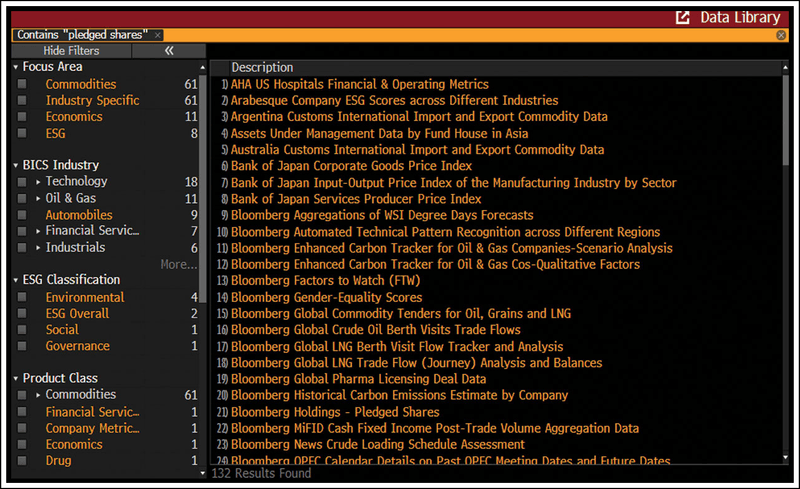

To analyze aggregated issuer collateral statistics, type “data” on the command line of a screen and click on the DATA match. The shortcut is DATA <GO>. In the amber field, type “pledged shares” and press <GO>.

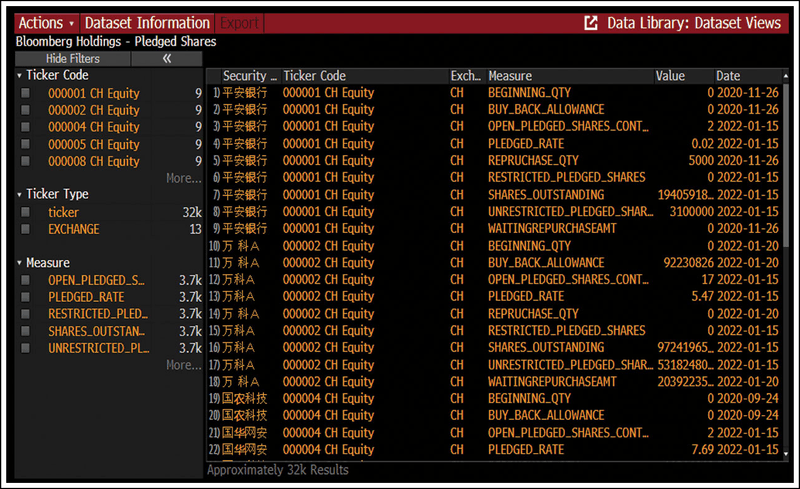

In the results, click on Bloomberg Holdings – Pledged Shares. You can also access the dataset by running DATA HOLDINGS_PLEDGED_SHARES <GO>.

What do these data series represent? Open_Pledged_Shares_Contracts is the number of open contracts for pledged shares. Shares_Outstanding is the number of shares outstanding for the selected company. Pledged_Rate is the percentage of shares outstanding that are being pledged. Restricted_Pledged_Shares is the number of shares being pledged that are restricted from trading on the open market. Unrestricted_Pledged_Shares is the number of shares being pledged that aren’t restricted from trading.