This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

Rapid uptake of net-zero policies and low-carbon solutions does not mean cumulative investment in fossil fuel supply will diminish over the next 30 years.

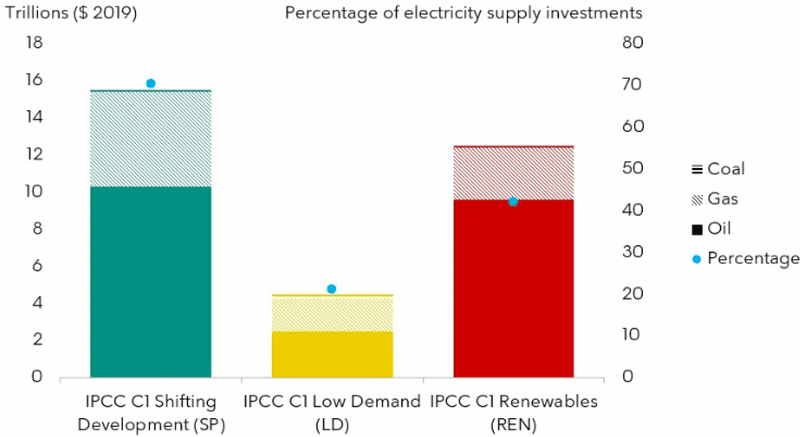

In its most recent report, the Intergovernmental Panel on Climate Change included three ambitious 1.5 degree Celsius pathways. The first, C1-SP, revolves around sustainability. The second, C1-LD, turns to energy demand reduction. The last, C1-REN, leverages high renewables.

BloombergNEF estimates total fossil fuel supply investments by 2050 to be $15.5 trillion, $4.6 trillion, and $12.5 trillion for C1-SP, C1-LD, and C1-REN, respectively.

Oil will dominate energy supply investments, reaching $10.3 trillion for C1-SP. This stems from solid demand for oil products, especially from hard-to-abate sectors such as aviation and petrochemicals. Conversely, coal supply investment dries up.

With economies stalling, and inflation and supply chain issues driving up global levelized costs of electricity, some nations may revert to relying on fossil fuels for the foreseeable future.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.