ARTICLE

Reflation or verge of deflation? Commodities vs. China, tariffs

Bloomberg Professional Services

This analysis is by Bloomberg Intelligence Senior Commodity Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

Broad commodities, up slightly on the back of gold and metals in 2024, face economic headwinds in 2025. Waning demand from China, Europe teetering on recession and US tariffs are top pressure points. That the S&P 500’s total return is about 10x the 3% rise in the Bloomberg Commodity Spot Index year over year to Nov. 27 may bode an inordinate burden on more US stock gains to avoid broad deflation reciprocal to the inflation. Commodities could snap back, notably if geopolitics spark a supply shock akin to Russia’s invasion of Ukraine.

Our bias is with the propensity for material prices to get cheap following spikes such as the 2022 highs. US natural gas did, crude oil, iron ore and grains are heading that way and copper is wobbling. A lot may be leaning on industrial metals to rise in 2025, which may show the risks.

Commodities may need to get past overdue beta drop test in 2025

That the S&P 500 hasn’t had a 10% correction since 2H23 may augur the risks of what used to be normal, especially with most commodities declining. The leading elastic sectors — grains and energy — are oversupplied and on track for low-price cures. Getting past some overdue reversion in US stocks may be what record-setting gold is sniffing out.

Are commodities, gold too cold versus hot stocks?

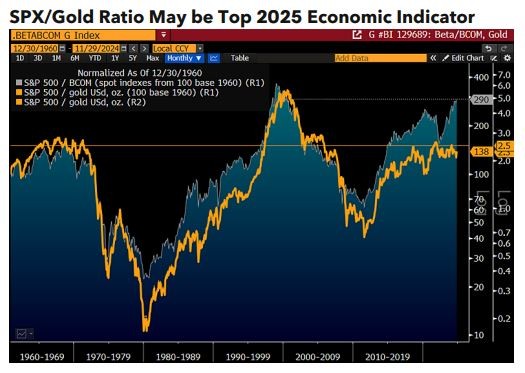

The S&P 500 (SPX) on Nov. 27 at a 24-year high vs. the Bloomberg Commodity Spot Index (BCOM), and about the same vs. gold as when the US exited the gold standard in 1971, may emphasize the potential for reversion. Our primary takeaway from the graphic is the need for the stock index to keep rising in terms of ounces of the metal despite the SPX/gold ratio bumping up against key pivotal resistance around 2.5x from 60 years ago. At 2.3x at the end of November, SPX/gold has dropped from the stretch to 2.7x at the start 2022 — the highest since 2005.

The SPX/BCOM ratio at about 290 — the highest since 2000 — from a base of 100 in 1960 could suggest what matters: To avoid deflation, US equity prices need to keep going up from an elevated base. US stock market cap to GDP at about 2.2x was around to 1.5x at the start of 2000.

Gold may continue rising and commodities falling

A key question for 2025 is what might stop rising gold and most commodities falling since China and Russia announced their “unlimited friendship” in February 2022. Detente in geopolitical tensions is a top force to pressure the precious metal and buttress copper and industrial metals, but there may be little to reverse oversupplied crude oil and grains from achieving low-price cures. US tariffs, notably set to be focused on China in president-elect Donald Trump’s second term, are coming amid underlying downward paths for most commodities, with gold the exception.

Gold’s roughly 50% gain vs. a 10% decline for the Bloomberg Commodity Spot Index since the start of February 2022 appear as trends gaining momentum, on the back of the new US leadership’s focus on reducing unfavorable global trade imbalances.

Crude oil on track toward $50, gold $3,000

Bitcoin, the S&P 500 and gold on the top of our annual macroeconomic performance scorecard and crude oil on the bottom may show the proliferation of rapidly advancing technology and rising geopolitical tensions, and commodity deflation. Technology is accelerating the process of energy and grain supply exceeding demand and buttressing stock-market profits, at the same time the crypto is demonetizing the precious metal. Gold has demonetized silver for centuries, but the old guard metal appears on a mission toward $3,000 an ounce in 2025, especially if performance competition from the stock market wanes.

Central-bank buying of gold appears entrenched absent a significant global shift toward detente. Crude oil is oversupplied and may need to spend some time below the US break-even cost around $56 a barrel to start rebalancing.

Elasticity in action – Gold up, energy, grains down

Whether gold and precious metals continue outperforming most commodities is a key question for 2025. Our bias is it’s likely, but natural gas having dipped below its US break-even cost and crude oil and grains getting close may suggest nadirs are near, on the back of the pump to the 2022 peaks. That gold is up about 30% year over year to Nov. 27, while more-volatile and higher-beta silver has gained only about 20%, could show global deflationary leanings and waning demand for industrial metals, with China at the epicenter.

Reversion may be near for the wide disparity between 10-year government-bond yields at 2.05% in the country with the largest commodity demand and goods exports vs. about 4.25% in US, the top goods importer and a net exporter of energy and grains. Our bias is US yields more likely slip toward China’s.