This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

BloombergNEF is bearish on oil prices for the week ahead, with Brent May-23 trading at $81.95/bbl and WTI Apr-23 trading at $75.61/bbl at the time of writing.

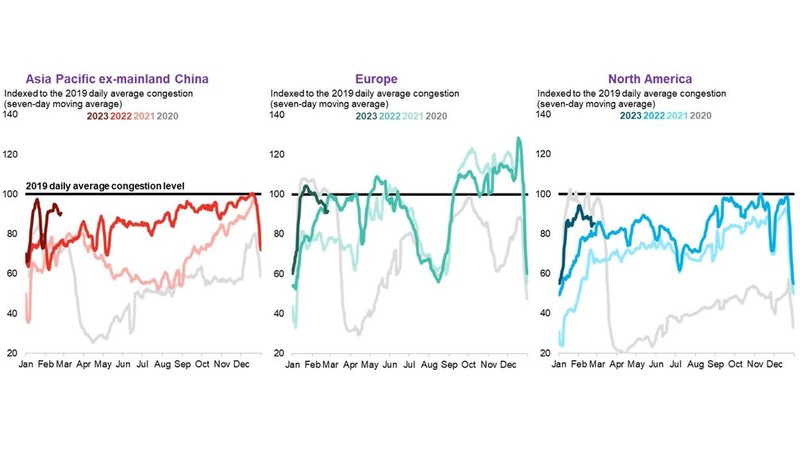

Global mobility faces headwinds, as key regions saw traffic levels weaken on a week-on-week basis and against the same week last year. Europe is the only tracked region to see traffic fall below the same week in 2022. Road congestion levels in China fell slightly following several weeks of strong growth, and currently stands above 2022-highs.

Meanwhile, global jet fuel demand is expected to continue growing in the week ahead based on the current flight schedule. The US TSA passenger throughput and flights in the Eurocontrol area saw a weekly increase in traffic levels versus the same week in 2019, but still remained below their respective seasonal highs.

Oil inventories saw a net bearish move over the past week.

- Global refinery margins were slightly higher over the past week.

- In the week ending February 17, land crude-oil storage levels in BloombergNEF’s tracked regions (the US, Japan and the Amsterdam-Rotterdam-Antwerp oil trading hub [ARA]) grew by 2.4% to 598.2 million barrels (m bbl). The stockpile deficit against the five-year average (2016-19 and 2022) of 2.7m bbl flipped to a surplus of 10.9m bbl. Including global floating crude stockpiles from the same week, total crude oil inventories increased 1.5% to 674.3m bbl, while the stockpile surplus widened from 21.5m bbl to 33.4m bbl.

- In the week ending February 17, gasoline and light distillate stockpiles in BNEF’s tracked regions (the US, ARA, Singapore, Japan and Fujairah) fell 1% week-on-week to 287m bbl, with the stockpile deficit against the four-year average (2017-19 and 2022) widening from 6.9m bbl to 8.8m bbl. Gasoil and middle distillate stockpiles in BNEF’s tracked regions were up 2.6% to 159.4m bbl, with the stockpile deficit against the four-year average narrowing from 27.9m bbl to 21.5m bbl.

- Oil product stockpiles in tracked regions grew by 0.1% to 955.2m bbl, with the stockpile against the four-year seasonal average flipping from a deficit of 6.6m bbl to a surplus of 2.8m bbl. Altogether, crude and product stockpiles increased 0.7% to 1,629.5m bbl, with the stockpile surplus widening from 14.9m bbl to 36.1m bbl.

- In the week to March 6, global jet fuel demand from commercial passenger flights is set to rise 0.4% to 5.57m b/d (million barrels per day). Jet fuel consumption by international passenger flight departures is on course to grow 19,600 barrels per day (or +0.6%) week-on-week, while consumption by domestic passenger flight departures will increase 4,300 barrels per day (or +0.2%). In the week to February 25, flights in the Eurocontrol area grew to 88.3% of the equivalent week in 2019, up from 87.6% in the previous week. The four-week moving average rose to 87.2%, up from 86.1% in the prior week. Meanwhile, in the same week, US TSA passenger throughput grew to 103% of the average week in 2019, up from 97% last week. The four-week moving average however fell to 101.2%, down from 101.9% in the previous week.

- In the week to February 25, congestion levels showed declines in Asia Pacific excluding mainland China (-3.3%), Europe (-3.8%) and North America (-2.7%). On a four-week moving average basis, Europe (-2.3%) and North America (-1.2%) fell, while APAC ex-China (+4.7%) posted a gain. Against the same week last year, all three regions registered declines – Asia Pacific ex-mainland China dropped 7.6 percentage points to 117.9% of the same week last year, Europe fell 12.5 percentage points to 92.3%, while North America slipped 3.4 percentage points to 106.3%. In the week to February 26, road congestion in China’s 15 key cities dropped by 10 percentage points to 153% of January 2021 levels, according to BNEF’s calculation based on Baidu data. Month-to-date, traffic congestion in China’s 15 key cities was 46% higher than January 2021 levels.

- Weather in several cities across Western Europe became colder over the past week.

- The dollar index averaged 104.5 in the week to February 24, and was up 0.8% from the week prior. The Flash US Manufacturing PMI rose to 47.8 in February 2023, up from 46.9 in January. The Flash Eurozone Manufacturing PMI however slipped to 48.5 from 48.8 in the same time period.

- In the week to February 21, Managed Money net positioning in ICE Brent fell by 23.4m bbl (or -7.8%) week-on-week to 276.6m bbl, and stood in the 57th percentile of the past five years. Brent and WTI 1M volatility fell over the past week. There was a significant increase in open interest for Brent $85/bbl calls across various maturities to Jun-24. There was also a notable drop in open interest for WTI Jun-23 $75/bbl put.

- Disclaimer: Please note that BNEF does not offer investment advice. Clients must decide for themselves whether current market prices fully reflect the issues discussed in this note.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.