Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Christopher Ratti. It appeared first on the Bloomberg Terminal.

Despite pledges by banks to cut financing to CO2-intensive industries including oil & gas, money continues to find its way to the sector, limiting the effectiveness of these efforts from a climate standpoint. Private credit deals have picked up some of the slack, but the companies have been able to increase bond issuance over the last 16 months, while loan issuance has decreased.

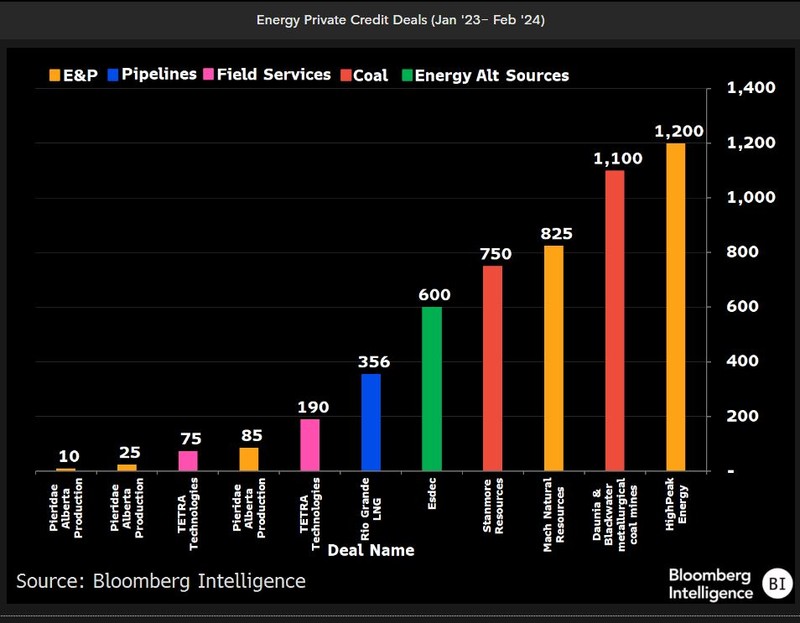

HighPeak Energy is largest oil & gas private credit deal in 2023

More than $5 billion in private credit deals have been written for oil & gas projects since the start of 2023. HighPeak’s $1.2 billion transaction provides financial flexibility and potential for the company to add a third drilling rig, increasing HighPeak’s oil production, which averaged 50,000 barrels of oil a day. Whitehaven’s $1.1 billion acquisition of the Daunia and Blackwater metallurgical (coking) coal mines adjusts their revenue mix to be 70% coking coal and 30% thermal. The IEA calculated that more methane is released from coking coal mining than from gas pipelines and LNG facilities combined, and is generally unaccounted for in steelmaking.

As banks step away from funding deals linked to high-emitting industries, the impact is limited, as direct lenders step in to finance CO2 intensive industries.

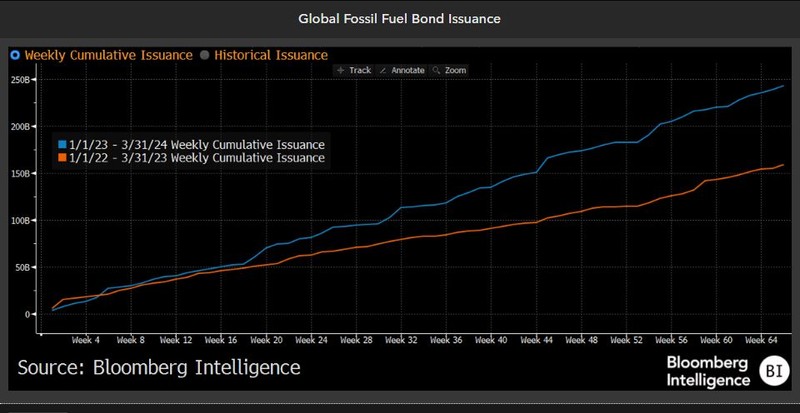

Bond issuance for fossil fuel companies up 62%

Bond issuance for fossil fuel companies was down in 2022, as banks targeted a reduction in financed emissions. Over the last 16 months, there was a 62% increase in issuance as banks de-emphasize targets. Enbridge Inc. had the second-largest deal over the period, a $2.3 billion sustainability-linked bond with sustainability performance target linked to a 35% reduction in GHG intensity by end-2030, a goal they reached as of end-2023, pointing to a weak target with limited impact as methane as a percentage of production volume was higher in 2022. Other issuers have seen increases in production, with ConocoPhillips up 63% since 2020, and Marathon up 31% since 2021.

Bond investors are still actively participating in financing through bond purchases.

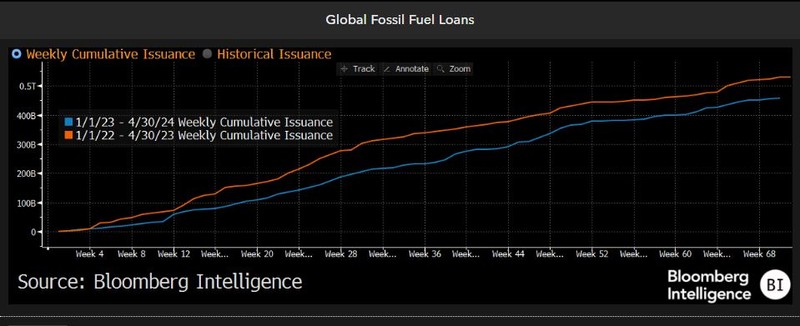

Loan issuance by fossil fuel companies down 13.2%

Banks pulling back from oil & gas companies can be seen in loan issuance, which is down 13.2% over the last 16 months. The decrease in loan issuance may be evidence that fossil fuel companies are in need of other financing as the banks announced reductions or halting of direct financing. Despite the decrease overall, large loans were completed for companies like Phillips 66 and The Williams Cos., both of which are trailing peers in Scope 1 & 2 emission intensity (measured in metric tons of CO2 equivalent/$million of revenue). Both companies also had absolute emissions that were higher in 2022 than in 2020. Our BI Carbon dataset shows Phillips 66 would need a further 9.1% reductions in emission intensity to reach 2030 IEA benchmark aligned target.

Banks rethinking lending, potential for more financed emissions

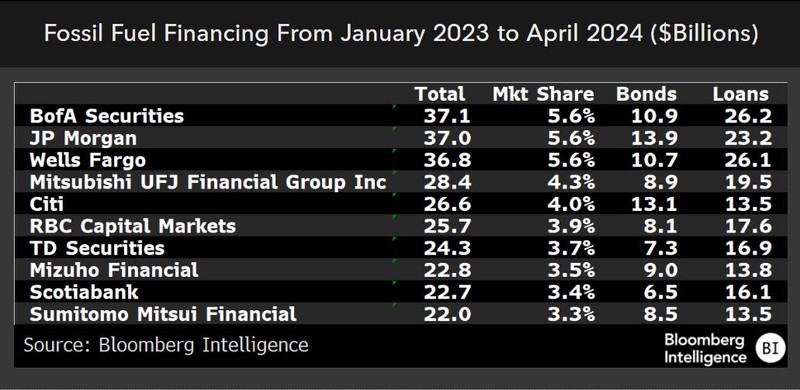

Corporate lending to the oil & gas sector was down about 32% on average from 2019-2022 for JPMorgan, Wells Fargo and Bank of America. BofA has backtracked on restrictions, and JPMorgan adjusted emissions targets, while Wells Fargo was the last big bank to set targets. These three accounted for 17% of fossil fuel financing over the past 16 months. Targets for financed emissions in the sector use 2019 as a base year, meaning even with increased lending year-over-year, the banks may still hit their goals in 2030.

Our BI Carbon forecasts show BofA has room to increase financed emissions intensity by 93% from 2022 levels and still meet the 2030 IEA benchmark aligned target of a 27% reduction from 2019 baseline, while JPMorgan’s could jump 77% and Wells Fargo’s 12%, as the financed emissions path won’t be linear.

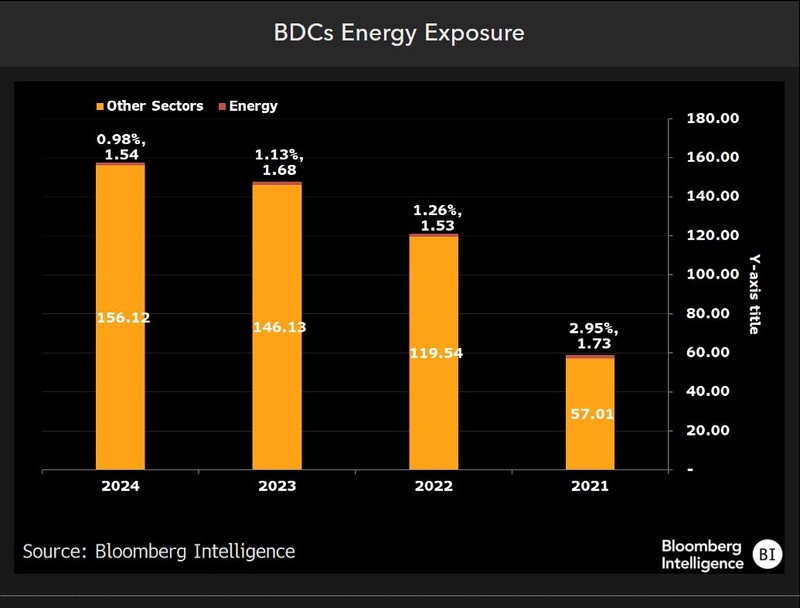

BDCs reducing exposure to energy sector

In addition to banks reducing financing to the energy sector, business-development companies (BDCs) have also reduced their exposure since 2021. BDCs, which typically invest in small to medium-size companies, have reduced their exposure to below 1% of their assets from nearly 3% in 2021, while increasing exposure to industrial and technology sectors by 5% and 7%, respectively. Blackstone’s energy strategies haven’t invested in oil & gas exploration and production since the beginning of 2022, and Ares Capital Corp. has allocated a majority of power generation investments to utility-scale and residential renewable energy projects.