November commodities: Early state of the turn? Commodities, risk assets vs. High rates

This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

Down about 12% and 6% in 2023 vs. the dollar, the falling yen and yuan may show wrecking-ball forces of 5%-plus US Treasuries, with implications for greenback-based commodities and risk assets. Effects from the most central banks in history still hiking rates in 3Q, along with 2022 energy spikes, might be early days, as evidenced by the almost 14% 2023 decline in the Bloomberg Industrial Metals Spot Subindex to Oct. 30. What’s most notable in 2H is that the stock market has started giving back 1H gains, following a path paved by copper and Bloomberg Economics outlook for a US recession to begin around the end the year.

What stops the downward momentum of what we see as early reversion stages of the 2022 commodity pump is the key question. What’s clearly different is the Federal Reserve is in no hurry to provide liquidity.

That WTI crude oil peaked at $95.03 a barrel before the Israel-Hamas war and 2023’s average price of $78 was first traded in 2007 could portend a broad commodity downward tilt into 2024. Gold is the opposite, as its 2023 average is the highest ever. Commodity momentum might be in an early-cycle lower stage, albeit with a notable headwind — the Federal Reserve Bank.

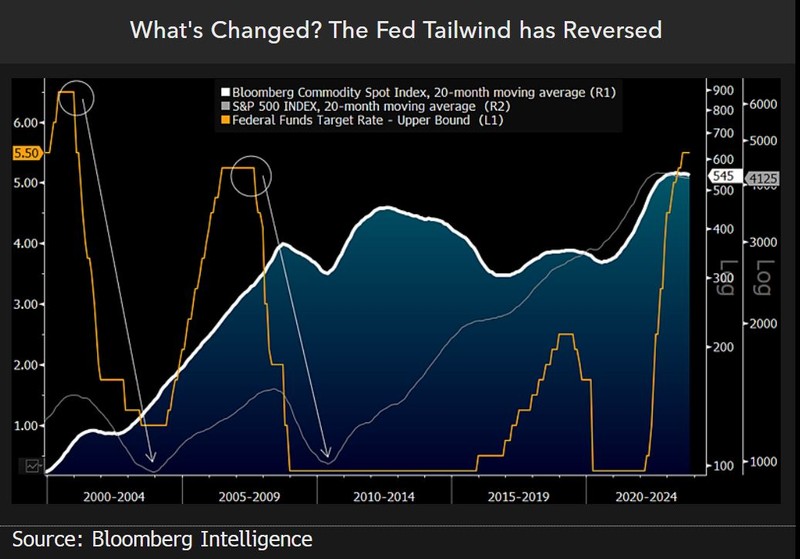

Commodities rolling over, rates are still rising

The trend is down, yet liquidity is still being removed. This may be all that matters for risk assets as projected by commodities, stocks and the Fed. Our graphic reveals the rules of sustaining trends with reason — the Bloomberg Commodity Spot Index and S&P 500 20-month moving averages are rolling over and the fed funds rate is still rising at its fastest pace from zero ever. It’s a question of what stops the risk assets’ trajectory. If the previous two significant bottoms since the 2000 internet bubble are a guide, it’s almost two years from the start of an easing cycle.

What’s different may be enduring lessons from the highest inflation in about 40 years due to excess liquidity. The potential for a soft landing appears quite low, given what may have changed: a propensity for the Fed to ease when the stock market falls.

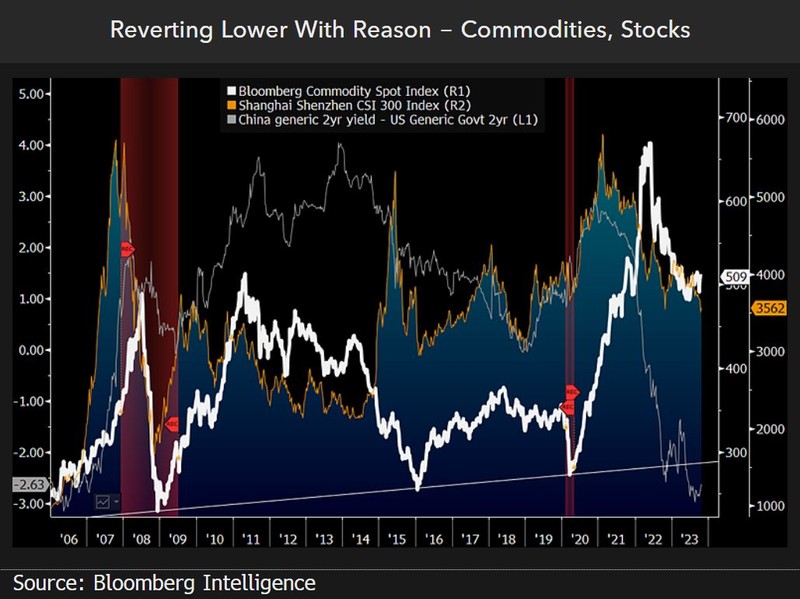

Baby bear markets? China stocks, commodities

The Bloomberg Commodity Spot Index (BCOM) and Shanghai Shenzhen CSI 300 may be in early lower-reversion days from 2021-22 peaks. Global economic-growth estimate revisions remain downward and a key issue for recovery could lack a long lag to central-bank easing. Our graphic shows the level of China monetary stimulus as indicated by the lowest two-year yield in Beijing vs. US Treasuries since 2006, but the wide disparity may augur a lose-lose for commodities.

Dollar strength is an offshoot of high relative US rates, which means headwinds for greenback-based commodities. The BCOM has a pattern of higher highs and lows since 2008, but if Bloomberg Economics is right about a US recession beginning at about year-end, the index could drop another third and still be above the lower-bound trend line.

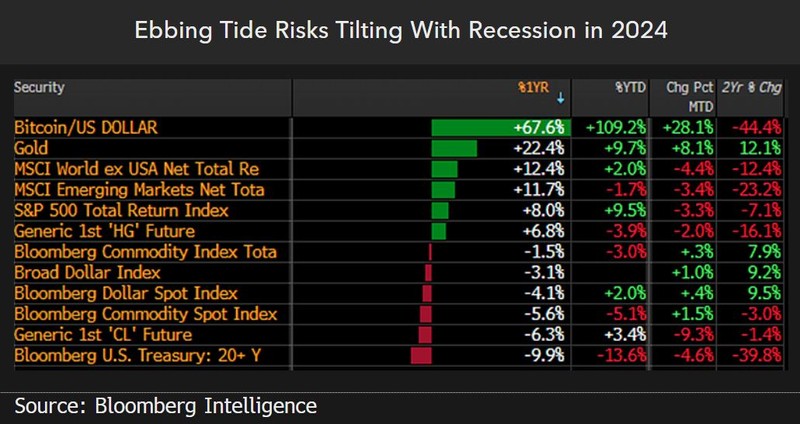

All that may matter if stocks keep falling

Weakening commodities and bond prices for most of 2023 have garnered companionship from the stock market in 4Q and there may be little to reverse the momentum. Our annual performance scorecard, with the Bloomberg US Treasury 20+ Total Return Index and crude oil on the bottom, and gold on the top, appears unsustainable. Treasury prices might pivot toward gold. Crude oil appears in early downward-reversion days within the pattern since 2008 after 2022’s spike.

Substantial US fiscal spending kept the economy buoyant, yet gold appears to be looking past the present to the future of what typically happens when rates rise rapidly preceding recessions. Our analysis, guided by Bloomberg Economic’s contraction outlook, is for the metal’s rally to continue, with potential fuel from declining crude and bond yields.

Energy deflation fueling advancing gold

That the gold bull market and energy sector bear gained momentum in October with the Israel-Hamas war may portend enduring trajectories into 2024. Our annual sector-performance scorecard, with gold at the top and industrial metals, grains and energy on the bottom, is a clear recession path. A key question is what stops the momentum in 2024? The most central banks in history still hiking in 3Q may be ample reason for commodities to show economic-contraction leanings, but more significant might be where they came from.

Russia’s invasion of Ukraine, on the back of the biggest liquidity pump in history, spiked most commodity prices to such extreme levels in 2022 that reciprocal supply-and-demand elasticity forces and recession may be in early days. We see commodities in an early downturn phase potentially akin to 1980’s peak.