LNG contract-expiration wave an opportunity for traders, buyers

This analysis is by Bloomberg Intelligence Industry Analyst Talon Custer. It appeared first on the Bloomberg Terminal.

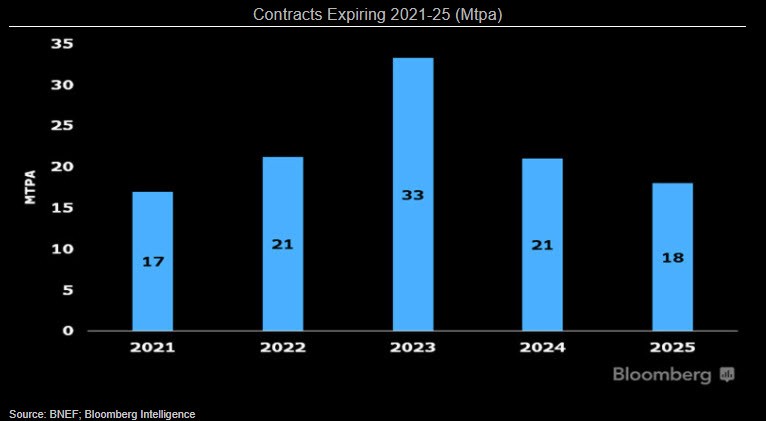

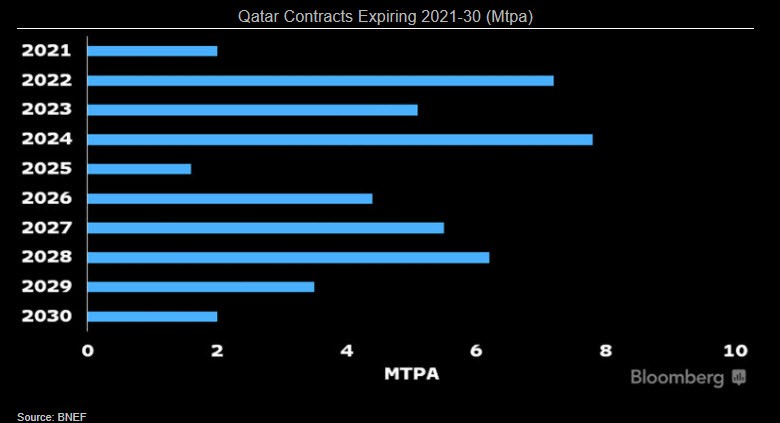

Contracts covering about 30% of global LNG demand are expiring through 2025, according to our analysis of BNEF data, and could contribute to the commoditization of the market, providing an opportunity for importers to re-contract under better terms and shore up margin, as well as bolster profit prospects of portfolio players. About 110 million tons a year, worth a possible $35-$45 billion, are affected.

Buyers may obtain better LNG pricing

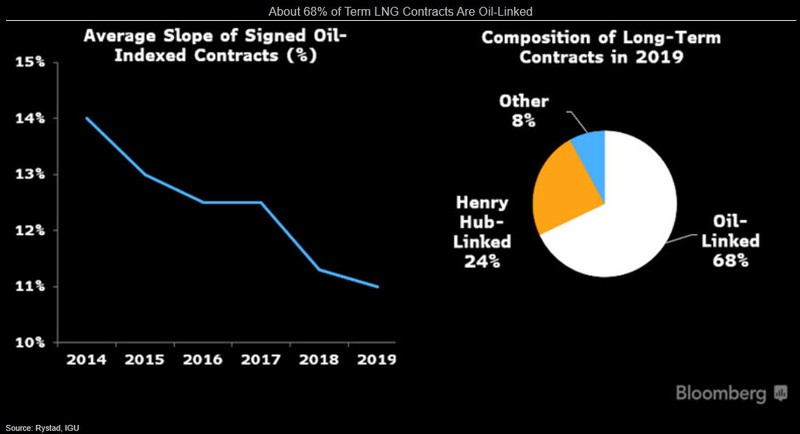

Expiring LNG contracts offer opportunities for buyers such as gas suppliers and utilities to re-sign volume under more favorable terms and prices, and improve margin. We expect a gradual shift away from pricing tied to oil and toward more gas-linked and hybrid deals. Yet those contracts that are oil-linked could get re-signed with a lower slope (level of indexation of gas price to oil) of about 11% vs. 13-15%. For example, assuming a 1 million ton per year agreement at 14% of Brent at $60 a barrel, re-signed at 11%, could save about $85 million a year, based on our calculations.

Kogas may be renegotiating its deal with Qatargas, while JERA, a joint venture of a TEPCO subsidiary and Chubu, continues to push for more contract flexibility. Naturgy and Chugoku Electric are some other companies with expiring contracts.

Portfolio players can capitalize on volatility

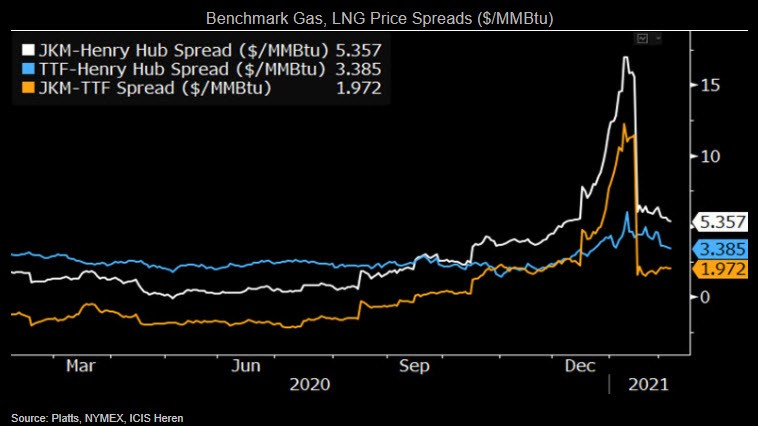

Trading houses such as Vitol, as well as companies with LNG portfolios (oil majors), may seek to renew contracts and snatch up added volume from expiring agreements to fuel trading revenue. We expect LNG spot-price volatility to persist, driven in part by market dislocation, gradual tightening, a lack of gas storage in Asia and swings in power prices, as illustrated in Japan this winter. There is risk, but portfolio players should be better positioned to capitalize on volatility with flexible supply, enabling them to exploit arbitrage opportunities to boost profit.

Recent months also stressed that unprepared buyers can suffer from price swings. Portfolio contracts don’t specify the source or destination, so buyer and seller can choose locations that maximize profit. Shell, Total and BP each have sizable LNG portfolios.

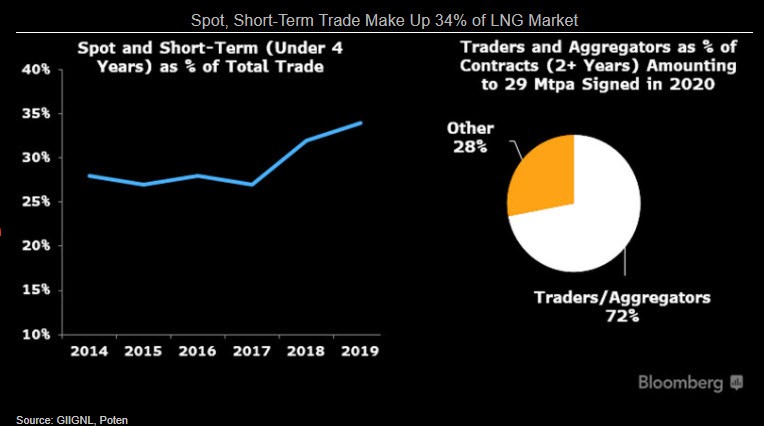

LNG market to evolve in 2020s as contracts expire

Significant LNG contract expirations could lead to more flexibility and accelerate spot expansion, which would be a net positive for the market, in our view. Some volume may not be re-signed, boosting the spot market. This could increase liquidity, and allow smaller participants to enter the market or expand as 20-year contracts and exceptional credit are no longer required, driving demand growth and aiding suppliers. Contracts that are re-signed will likely be for shorter durations of 5-10 years, or less, and have more flexible terms such as no destination restrictions.

Legacy contracts mainly had specified destinations. By adding flexibility, like in U.S. export contracts, portfolio players can direct cargoes where netbacks are highest, and buyers can divert cargoes depending on price and domestic demand.

Suppliers can secure cash flow or take on more risk

From an LNG supplier perspective, expiring contracts could be a challenge and an opportunity. We expect a sizable amount of the volume coming up for renewal will be recontracted, but prices for exporters are unlikely to be as lucrative as the first round. Still, given that most agreements are expiring for older projects that are amortized, even deals at reduced prices should secure a healthy margin and cash flow. Moreover, a lack of new supply coming online through 2024 should tighten the market, which may drive some suppliers to take on additional risk and allocate more spot capacity.

Qatargas, Petronas, Woodside and Santos are some companies that operate projects with contracts expiring soon. Qatargas has already launched a trading arm, QP Trading, signaling an increased spot market role in the coming years.

Gradual shift from oil linkage, yet role remains

Oil-linked pricing for LNG makes less sense given the decoupling of crude and natural gas pricing. Yet these types of contracts should maintain a large role due to limited alternatives — just at a lower oil slope. Still, sales and purchase agreements (SPA) with pricing linked to gas (Henry Hub in the U.S. or TTF in Europe) or LNG (JKM in Asia) may gradually become more prevalent, as well as hybrid pricing that incorporates both oil and gas. With no contract standardization, diversity of supply and price exposure is critical for buyers’ LNG portfolios.

Mitsubishi signed an SPA with Santos that will be linked to JKM, while an example of a TTF-linked SPA in Europe is Total’s deal with Cheniere. Hybrid, gas or LNG-linked pricing would better reflect supply-demand dynamics as opposed to oil.