This analysis is by Bloomberg Intelligence Senior Industry Analyst Henik Fung and Associate Analyst Chia Cheng Chen. It appeared first on the Bloomberg Terminal.

The energy equivalent of a Greek chorus is beating the drums for Japan to fire up its nuclear plants, with public support rising to 60% for the first time since Fukushima in 2011. Power shortages and soaring costs have policymakers dusting off the atomic reactors in the push for steady supply. Uranium demand can gain at coal and LNG’s expense.

Summer power trauma fast-tracks Reactors’ restart

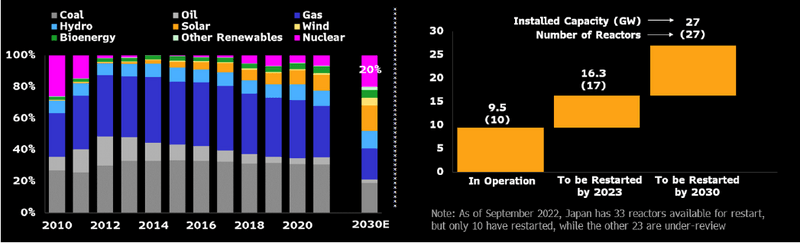

Japan is expediting the restart of seven idle nuclear reactors that have already met new safety standards as it scrambles to avert a repeat of this year’s power crunch. Public support in Japan for a nuclear kick-start has hit 60% for first time since the 2011 Fukushima mishap, according to one measure. Japan’s onerous summertime power crisis could fast-track more reactors into operation, putting the country within reach of its 2030 target of 20% power generation from nuclear.

Ten of Japan’s remaining 33 idle reactors have restarted since 2011. Another seven are set to fire up in 2023, bringing total operating nuclear capacity as high as 16.3 gigawatts (GW). Another eight to 10 reactors are under review for restart before 2030, which would boost total capacity to 27 GW.

Japan’s power generation mix, nuclear fleet

Uranium demand poised for leap on nuclear restart

Uranium miners stand to gain from the global drive to mobilize nuclear power generation. Japan has company in its push to restart more reactors, with other countries adding more nuclear capacity to bolster their energy security. Fifty-five nuclear reactors are under construction globally. China leads the way with 21 reactors, followed by eight in India and four in Turkey. European nations are also reconsidering their nuclear policies to wean themselves off Moscow’s gas supply. Berlin is mulling putting off shutdowns of its three remaining reactors while Paris plans to add 14 new ones.

Investors are becoming more bullish on uranium, evident in the 45% rise in the Global X Uranium ETF and the 48.7% jump in CGN Mining, both occurring between Jan. 1, 2021 and Sept. 1 2022.

Global X uranium ETF price ($)

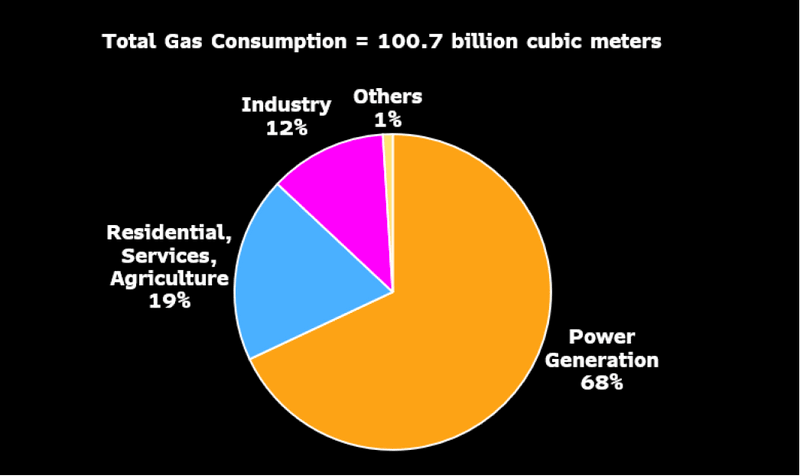

Restarting old reactors may curb LNG imports

Japan’s increased loyalty to nuclear power could cut its LNG imports, giving slight relief to the global gas supply crunch. Japan consumed 100.6 billion cubic meters of natural gas in 2021, 68% of which was used for power generation. Tokyo leaders’ plans to restart seven idle nuclear reactors by next year could generate around 47.7 terawatt hours (TWh) of power, equivalent to 13.9% of gas-fired generation. The country’s gas imports could drop as much as 9.5% if gas consumption in the industrial, residential, services and agricultural sectors remains unchanged.

Japan’s natural gas consumption breakdown (2021)

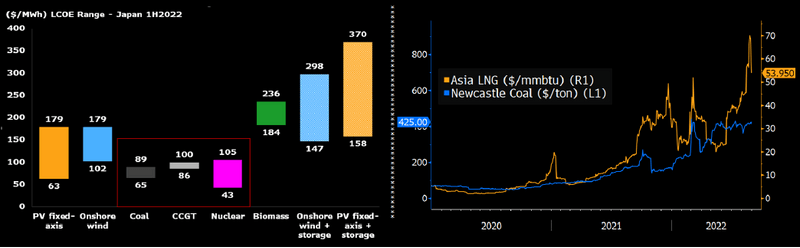

Nuclear wins favor as coal, gas get costly

Nuclear can win the upper hand in Japan and other fossil-fuel importing nations as they adjust their energy mixes on cost and security concerns. Prices for LNG and coal have surged due to sanctions against Russia and the global race to build inventory ahead of winter. That has raised the levelized cost of electricity for coal-fired and gas-fired power, threatening their competitiveness with nuclear. Policymakers may give nuclear the nod over fossil fuel energy for its security, affordability, and environmental advantages, though social acceptance still lags. A shift toward nuclear could come at LNG and coal’s expense.

Levelized cost of electricity, LNG and coal price

Japan’s nuclear prospects brighten as renewables dim

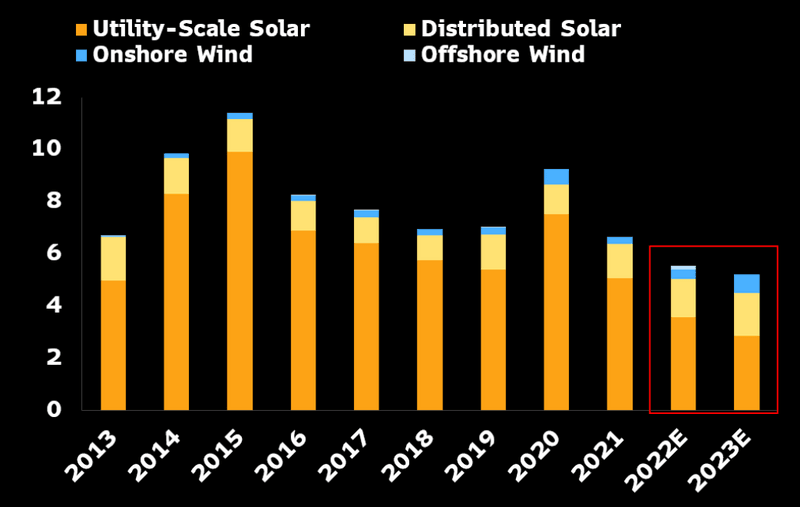

Japan’s renewable development is losing momentum, prompting policymakers to favor nuclear power. Renewable developers are facing growing challenges, including fading subsidies, rising equipment costs, and land constraints, all of which could cause new solar and wind capacity to fall 18% vs. last year, and even lower in 2023.

Slower project development could result in the nation missing its target of raising renewables’ share of the power mix to an average 37% by 2030. Getting there will mean Japan must install an additional 35 GW of solar and 15 GW of wind capacity within the next eight years, a tall order at a time when Japan’s solar sector is in decline, and the offshore wind sector is beset by stagnation. Nuclear power could steal some of renewables’ markets.

Japan’s annual solar, wind capacity additions (GW)