This article was written by Jigna Gibb, Head of Commodities and Crypto Product Management at Bloomberg.

During the market turmoil of 2022 when bonds and equities failed to perform and inflation stayed at elevated levels, commodities were one of the few asset classes to generate positive returns. This scenario propelled commodities as an asset class back into the spotlight for both portfolio diversification purposes and as an effective inflation hedge. In addition, the key factors of geopolitical turbulence, adverse weather conditions and the uncertain path of inflation have contributed to higher commodities levels.

The Bloomberg Enhanced Roll Yield (BERY) index is an enhanced roll and carry long-only commodity index that was launched in June 2021. In this blog, we explain the construction of BERY strategy. The index is a dynamically weighted strategy that has similar characteristics to the Bloomberg Commodity Index (BCOM) with the following features:

- Typically allocates up to the first four futures contracts where liquidity is deepest (harvesting curve premium)

- Provides greater exposure to commodities that trade in backwardation as opposed to contango (capturing carry premium) by measuring Slope Scores

- Offers a wider eligible universe of commodities including the current BCOM components plus Feeder Cattle and Tin

BERY diminishes the traditional trade-off between liquidity and performance, and ultimately seeks to provide high capacity and mitigate the impact of negative carry and reduce roll congestion, using four equal-weighted contracts for each commodity, excluding gold and silver which use three contracts.

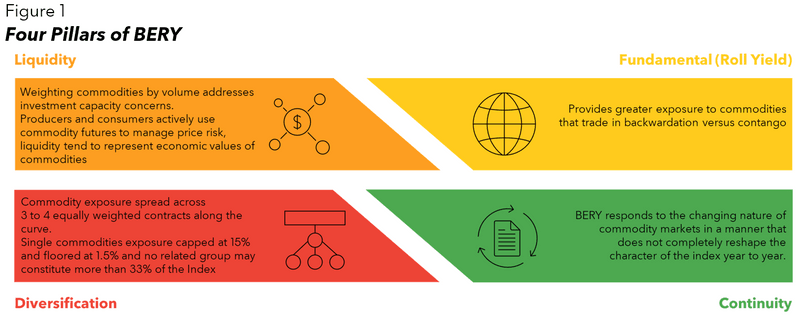

The BERY Index is a broad-based, long-only commodity benchmark that incorporates aspects of risk-premia strategies. When it comes to understanding how BERY has performed it is important to consider the components aligned to the four pillars below.

The BERY index combines four key aspects in its construction:

- Liquidity based weights (US dollar volume traded)

- Diversification via Curve Premium (allocation to deferred contracts) (commodity and sector caps to exploit correlation structures)

- Fundamental (Roll Yield) via Carry premium (tilting of individual commodities weights based on slope differentials “Slope Score”)

- Continuity from annually rebalanced weights

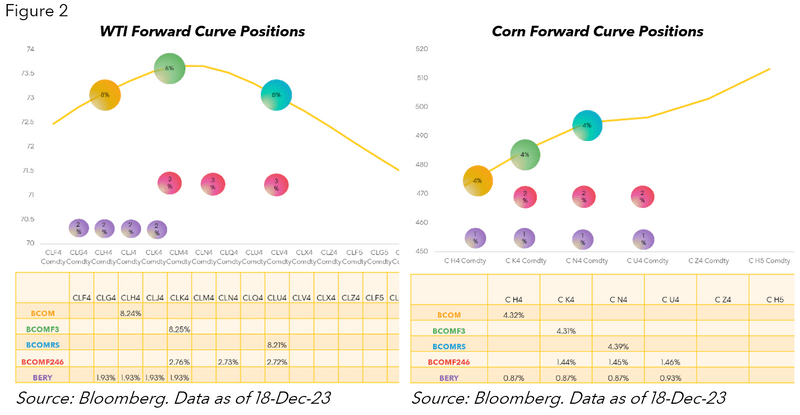

The family of Bloomberg Commodities indices are positioned in various contracts and weights along the forward curves. BERY would be compared against other enhanced roll peers such as Bloomberg Commodity Index 3 Month Forward (BCOMF3) and Bloomberg Roll Select Commodity Index (BCOMRS). We show examples of WTI and Corn forward curves in the chart below, where the orange bubbles represent BCOM futures position and BERY positions are highlighted in purple.

At the first step in constructing BERY, commodity liquidity percentages are determined per individual commodity. These are calculated by taking a three-year average of daily trading volumes. These weights are then subjected to diversification criteria with individual commodities weights bound between a weight of 1.5% and 15% and commodity groups capped at 33%.

In the BERY construction for carry tilting, “Slope Scores” are determined for each commodity by taking the three-year daily average of front month to 1 year gradient, standardised by dividing the maximum absolute gradient of all commodities. The score is then scaled with the degree of backwardation relative to the other commodities. The scores are scaled between 0 and 1 where the commodity with maximum absolute gradient has the score of 1 if the slope is positive and 0 if negative.

More details on the profile and construction of BERY are available in the index methodology and the paper “Commodities Indices: Enhancing Roll Yield: A More Liquid & Diversified Index.”

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.