Four trends shaping the momentum in sustainable finance

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

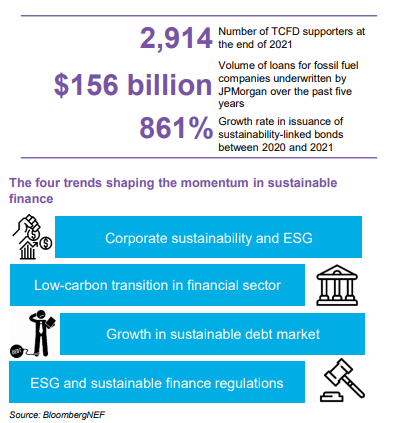

The low-carbon transition is underpinning a surge in sustainable finance activity. Investors are redirecting trillions of dollars towards sustainable activities, resulting in innovative financial products and an ever-expanding regulatory landscape. Corporations are also responding, refining the way they collect and communicate pertinent environmental, social and governance (ESG) data and ratcheting up their climate goals. Nearly all of the key growth indicators in sustainable finance hit new watermarks in 2021, suggesting we are only scraping the surface of how big this market could become.

• Momentum in ESG investing is growing and companies are responding. Flows into ESG exchange-traded funds (ETFs) reached an all-time high of $128.6 billion in 2021. These funds are expanding to take advantage of a growing pool of sustainable companies. Over 1,400 new companies set an emissions target aligned with the goals of the Paris Agreement last year and hundreds of others set net-zero goals.

• The finance industry is undergoing a low-carbon transition as entities reduce their exposure to climate risk. Over 71 thermal coal exclusion policies have been rolled out by banks around the world, on top of more than 1,300 fossil fuel divestment pledges. There is room for more growth, however, as banks are still lending hundreds of billions of dollars to fossil fuel companies and projects annually.

• Sustainable debt issuance surged to $1.6 trillion in 2021 and new products are being created. While green bonds are still the industry darling, with $625 billion-worth being issued last year, debt issued for social and broader sustainable purposes surpassed $400 billion. Sustainability-linked debt also advanced in a big way, holding companies accountable for their low carbon transition efforts.

• We have seen a turning point for sustainable finance regulation, as many countries have decided to develop stronger policy agendas. Mandatory ESG reporting for companies is either in force, planned or under discussion in over 10 countries globally, complementing a growing suite of ‘Taxomania’ around the world and putting a definition of ‘sustainable’ into law.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.