February commodities: Enduring gold bull and crude oil bear markets

This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

What’s typical in commodities –enduring periods of low prices following spikes akin to 2022 — may be early days. That the rabbits of the rally — US natural gas and lumber — have plunged to levels first traded in the 1990s may portend a resumption of broad commodity deflation, with implications for US Treasury bond yields. Russia’s invasion of Ukraine has parallels to the “great grain robbery” that pumped corn to $4 a bushel in 1974 and Iraq’s invasion of Kuwait that peaked crude oil near $40 a barrel in 1990. Reciprocal supply and demand elasticity as well as global recession risks may pressure markets toward those levels.

Commodities proved their diversification value in 2022, but using the insurance analogy, the claim may have been paid if history is a guide. We see gold as the potential shining star this year.

Too hot in 2022 vs. Enduring hangover risks – Commodities 2023

Most risk assets, particularly commodities, decline in recessions and central bank actions act with a lag. That the Federal funds rate a year ago was zero, is above 4% at the end of January and still rising may represent the early days of what we see as a severe global economic reset. The enduring gold bull and crude-oil bear markets may be energizing.

Will numerous never-before’s make it different?

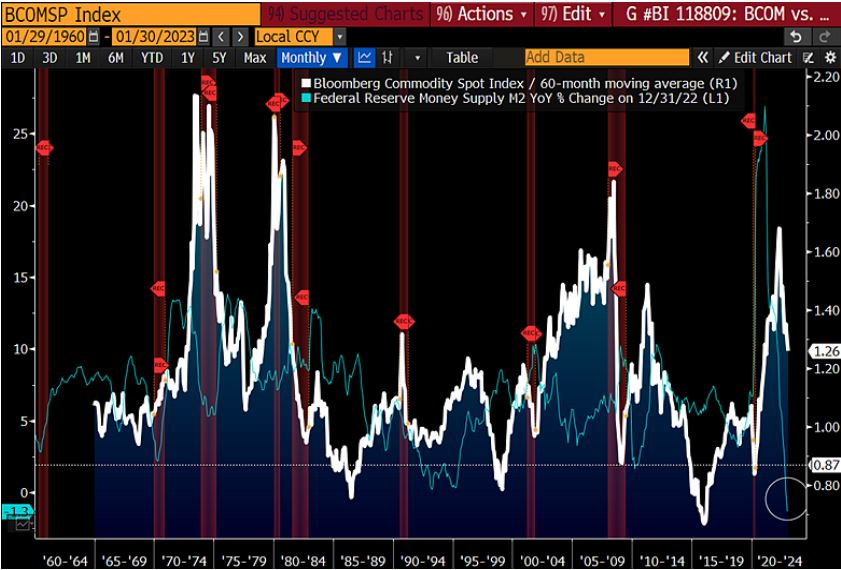

That the Bloomberg Commodity Spot Index has never spiked at a similar velocity as in 2022 without an ensuing US recession and enduring low price hangover may set the stage for 2023. It’s the unprecedented backdrop for the commodity pump — extreme fiscal and monetary stimulus, and Russia’s invasion of Ukraine — that may portend a reciprocal dump. In addition to the fact that this is the typical cyclical nature of commodities, the most central banks in history still tightening as the world leans toward recession adds headwinds.

Commodity, inflation reversion may be early days

Never before has US year-over-year money supply spiked to the extreme of 2021 and to minus now in our database since 1960. An organic recovery in global demand pull forces and from China appears unlikely vs. the risks of normal reversion toward a lower plateau for commodity prices.

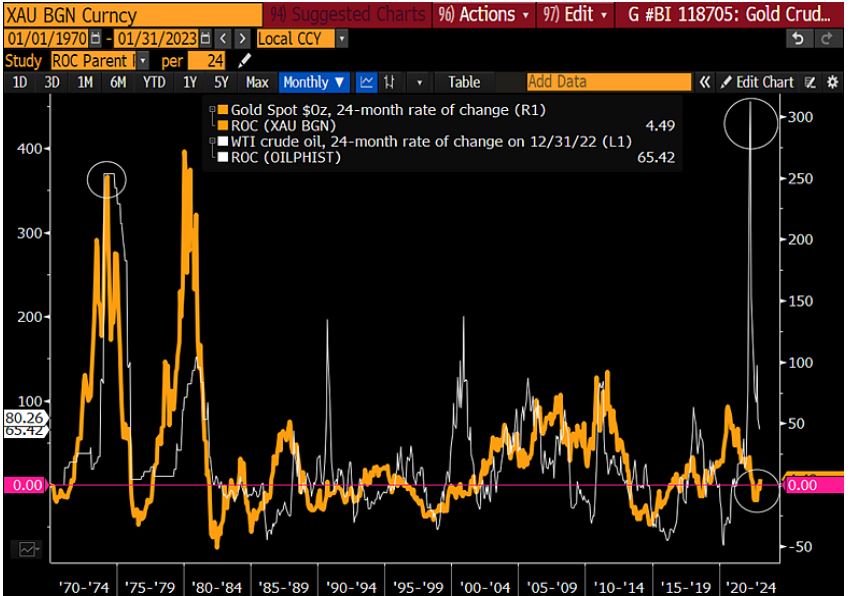

Reverting crude may pave gold foundation

Crude oil’s high-velocity rally to the peak in 2022 may have solidified a foundation for gold. The metal appears to be bottoming from the steepest 24-month drawdown since 2015. It’s the repercussions from the greatest two-year rally in WTI crude history (since 1899) and unprecedented pace of central bank tightening that we expect may be equally significant, and in early days. What’s notable from the graphic is crude’s enduring autocorrelation since the 1973-74 energy crisis to almost 50% declines. The 2022 price spike may have set the new standard, with implications for commodity deflation and gold buoyancy.

Extreme crude oil high vs. Gold bottom

The metal is on the cusp of breaching $2,000 an ounce resistance when it sniffs out an inevitable Fed pivot, in our view. Gold has been on an upward trajectory vs. crude oil since the 2008 financial crisis nadir.

Back to trend? Gold up, crude oil down

Gold appears to be recovering from good support within an elongated bull market, and crude oil may be doing the opposite. The predominant global economic paths at the start of 2023 — diminishing growth and central-bank tightening — are reflected in our graphic showing the metal on the cusp of a

new high above $2,000 an ounce and WTI crude oil peaking last year below the 2008 high. Bear-market resumption is our bias for crude. Spiking energy in 2022 proved its own worst enemy; global GDP is more likely to continue contracting — and central banks tightening — if crude prices don’t decline.

A 2022 blip in the crude bear, gold bull trends?

Since 2007, gold is up about 130% vs. a decline of about 20% for WTI. What stops these trajectories is a key question as the possibility of a recession looms in 2023, and our bias is tilted against fossil fuels, favoring the metal.

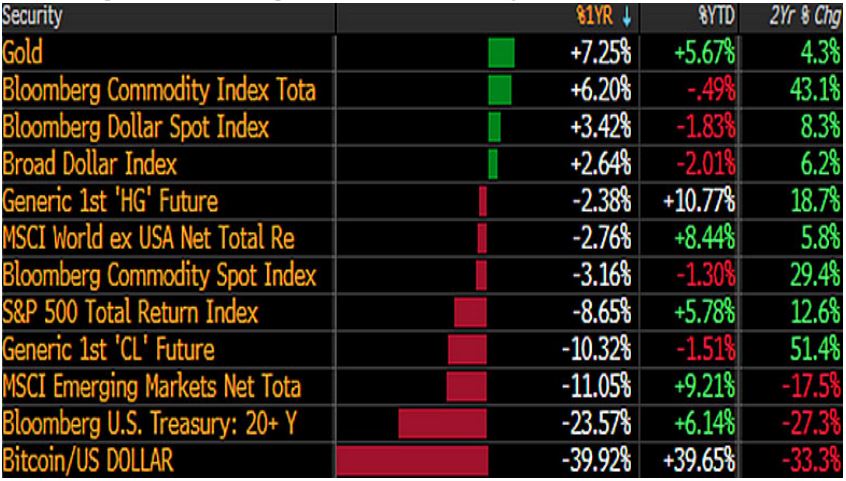

Dropping commodities, inflation, bond yields

In a scenario that China reopening demand is swift and strong and the world has a soft landing, commodities may remain buoyant with Treasury bond yields and risk assets. Our base

case for a global recession worthy of the unprecedented liquidity rug-pull from central bank tightening, war in Europe and 2022 spike in commodity prices may be more likely to buoy gold and pressure copper, crude oil and the stock market in 2023. The scorecard featuring one-year percentage returns shows that trajectory. What might stop it?

Gold up, crude, equities down may be 2023 path

Some combination of organic demand pull forces, central bank easing led by the Federal Reserve and remarkable recovery in heavily export-dependent China may be required for broad commodity buoyancy. Typically, commodities bottom over a year after the first Fed ease, and they are still tightening in February.

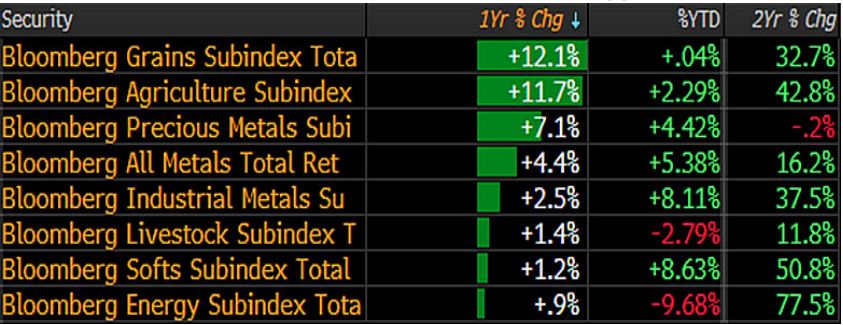

Grains/Agriculture may be too hot vs. Gold

Lofty grain/agriculture prices at the start of 2023 appear unsustainable absent a poor weather year. Ample producer profits that mean more supply, a waning war premium and plunging natural gas are some of the headwinds that may pressure the agriculture benchmark, corn, from the end of January price near $6.90 a bushel toward $5 or lower. We see little to dispute the corn future for December delivery at about $5.90 on Jan. 30. At the top of our commodity sector scorecard on a one-year basis, we see the grains at risk of following the softs toward the bottom. Precious metals appear more likely to continue migrating upward.

Tilt toward recession – base metals, energy risks

In a world leaning into recession and most central banks tightening, energy and industrial metals appear at greater risk of declining in 2023, in our view.