ARTICLE

Energy sector wades into uncertain waters as demand ebbs

Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Industry Analyst Vincent G Piazza and Associate Analyst Matthew Demarino. It appeared first on the Bloomberg Terminal.

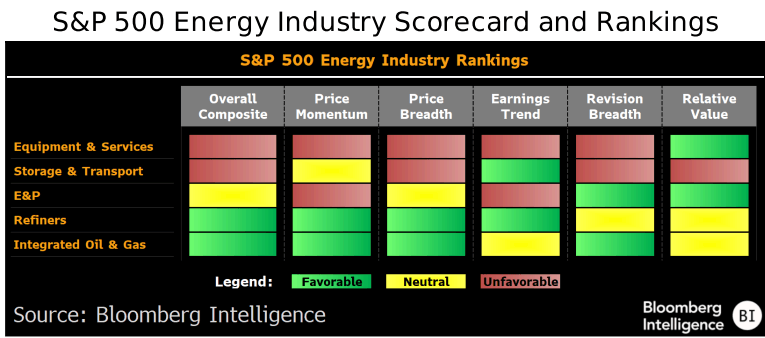

Refiners and integrateds appear the best positioned heading into the peak of 2Q earnings season amid a clouded near-term backdrop for oil and gas prices. Positive structural trends could be suppressed by geopolitical risks as demand concerns dilute benchmarks. The global economy’s path remains uncertain, and the OPEC+ grip on production could tighten as quotas boost volume above expectations.

Metrics change with economic, political landscape

Our energy-sector metrics remain fairly divided, with upstream, the sector’s second-heaviest S&P 500 weighting, likely reporting more mixed profitability in 2Q. Improvement is probable this coming winter as gas balances look tighter due to higher seasonal demand and lower storage volume. Geopolitical risk premiums are eroding, which may limit activity in the broader sector. M&A remains key to sentiment, yet most consolidation appears on hiatus until tariffs are more concrete.

Integrateds’ diversified base offers multiple levers of protection, while refiners may have benefited from cheaper inputs during the driving season. Capped production follows potential oversupply, and upstream operators have shifted to more cost-effective strategies to preserve shareholder returns.

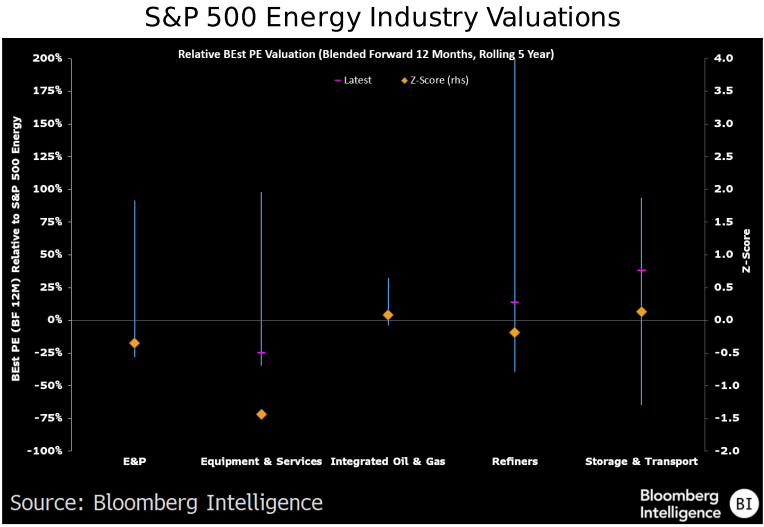

Premium accorded to downstream, midstream

Midstream, along with refining and integrateds, have higher forward P/E multiples, while equipment and services, and upstream (E&P) are the cheapest vs. peers. Yet sector-wide sentiment remains unstable, with energy fundamentals clouded by oil uncertainty, the economic backdrop and softer benchmark prices across US hubs. At 20.5x, midstream has the highest premium to the S&P 500 energy sector, thanks to greater earnings visibility from long-cycle contracts. Improved balance sheets, throughput increases and M&A could support midstream companies despite limited organic growth opportunities and a challenging regulatory backdrop.

Refining (16.9x forward P/E) trades at a premium to the sector, but downstream product demand is a concern amid a heightened awareness of recession trends.

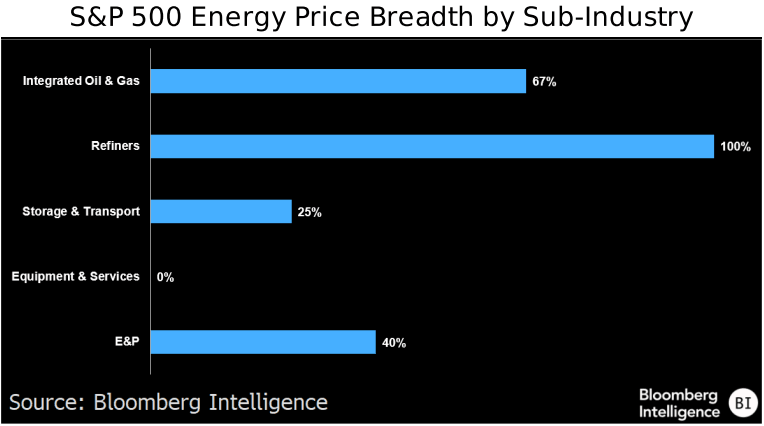

Technicals help rank top and bottom performers

Price breadth, the percentage of companies trading above their 50- and 200-day moving averages, supports refiners and integrateds, while storage and transport, upstream and equipment and services are muted. WTI, hovering around $69 a barrel, may remain subdued as the risk premium from the war in Ukraine fades and short-lived rallies from the Iran conflict were shaved off with further escalations unlikely. OPEC+ hikes continue, diluting commodity prices. Though geopolitics injects persistent volatility, softer demand remains a broader threat. Natural gas benchmarks could give some respite, with power-generation demand and EU storage encouraging offtake irrespective of cyclical weather demand.

Price momentum, defined as trailing six-month performance minus the past two weeks, supports refiners amid lowering input costs.

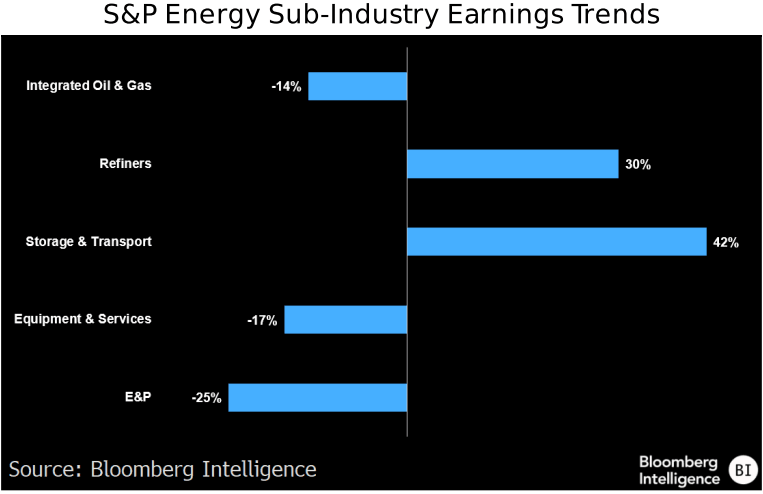

Trade frictions, geopolitics undermine energy earnings

Our earnings-momentum score, ranking industries on the average of the forward four quarters minus the past four, shows midstream and refiners outperforming, with weakness among upstream, integrateds and equipment. Commodity-price pressure has persisted amid renewed tariff disputes, fueling trade uncertainty. China’s sluggish recovery may not deliver the energy demand many were expecting last year, with sanctions curbing imports and the last US LNG cargo delivered back in February. OPEC+ supply hikes, part of a one-two punch alongside tariffs, contributed to crude’s sharp decline in 1Q and is likely to further loosen global balances as quotas amount.

Midstream accounts for the smallest weighting in the energy sector, with integrated and upstream the largest components, driving EPS volatility.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.