Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Commodity Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

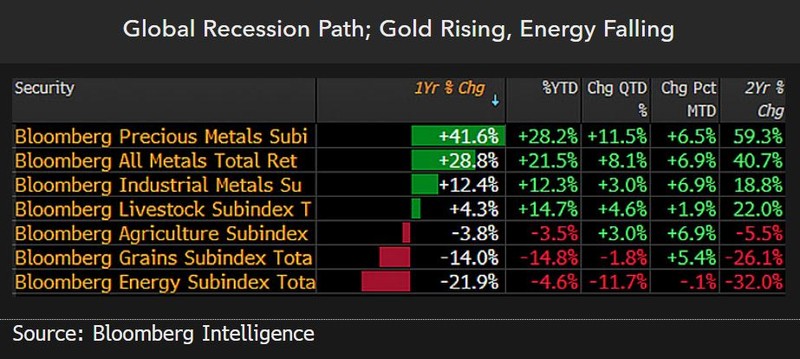

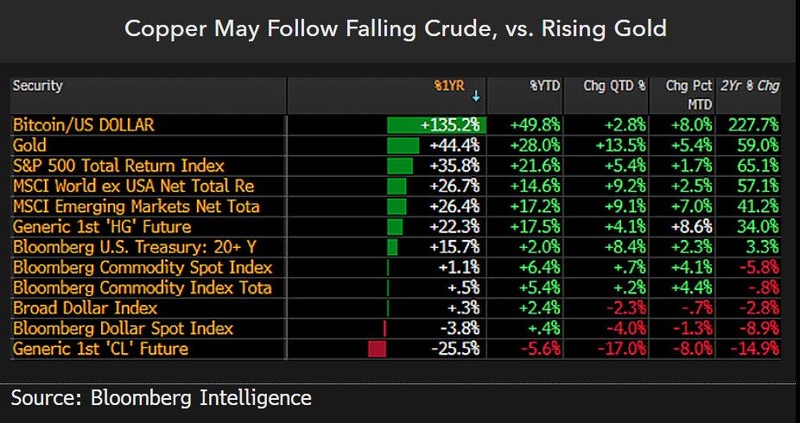

It’s normal for commodities to get relatively cheap after price pumps akin to 2022, but typical reversion of an emerging market that grew too fast might remain a top deflationary headwind. Fiscal and monetary stimulus in China, and the Federal Reserve and most central banks easing, aren’t happening because economic growth prospects look rosy. Bounces in risk assets, notably copper, should be expected at the onset of stimulus, but it’s broader cycles that matter and gold’s about 45% year-over-year gain to Sept. 30 vs. crude oil’s 25% decline is a global recessionary path.

Our bias is that crude’s track is likely toward $40 a barrel and gold’s $3,000 an ounce, with bumps in the road expected. Total returns of 36% year over year for the S&P 500 vs. 1% for the Bloomberg Commodity Index may augur risk of a bit of back up in beta.

The Chinese 30-year government bond at about 2.38% on Sept. 30 has been declining toward 2.08% in Japan, with deflationary implications. Fiscal and monetary stimulus is ramping up globally due to deteriorating economic outlooks. Bounces should be expected, but gold may continue outperforming most commodities in 2025, especially if the US stock market declines.

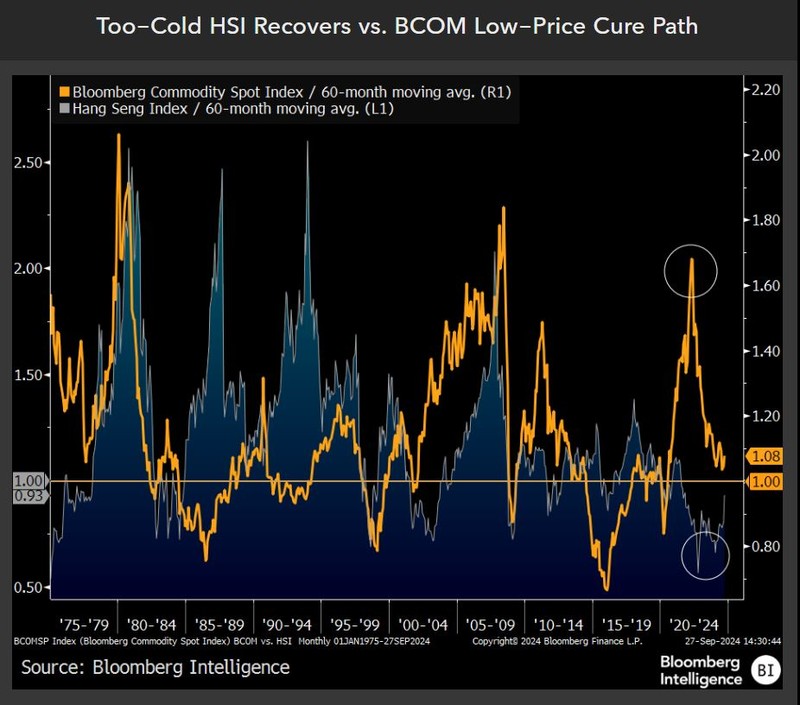

China may be following Japan’s reversion track

Japan has been stimulating its economy for decades and GDP at about $4 trillion is the same as 1992-93, with implications for China and commodities. The lessons of history and rapidly expanding emerging markets that revert may not be different. Our graphic shows the timeliness of Beijing ramping up purchases of ETFs tracking domestic equities, on the back of what Japan has been doing since 2010. The Hang Seng Index is recovering from reaching the steepest discount to its 60-month moving average since 1975 and the Bloomberg Commodity Spot Index appears on a typical low-price-cure track, after getting to expensive in 2022.

China may have plenty of firepower to stop its sliding stock market, but buttressing organic demand for commodities is less certain. Our bias is that it’s unlikely the BCOM nadir has been reached.

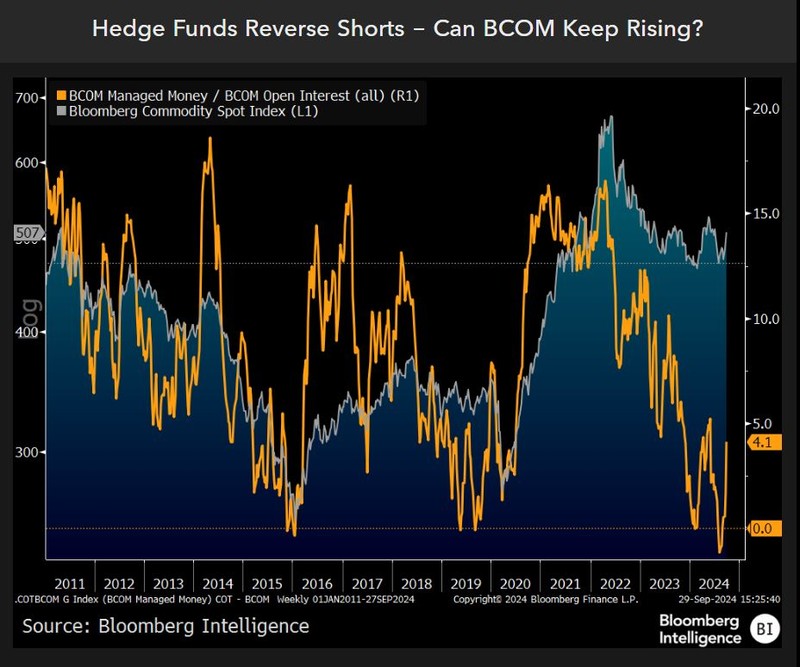

Dead-cat bounce or more enduring bottom?

Since its Aug. 5 nadir, the Bloomberg Commodity Spot Index (BCOM) has rallied 9% to Sept. 30 as managed money (hedge funds) reversed record net shorts. It’s a question of recovery duration, and the fact that the S&P 500 has bounced 11% may suggest a top risk to broad commodities: a backup in beta. At 4.1% of open interest to Sept. 30, our graphic shows net longs on the 19 major BCOM constituents recovering from 1% net short at the start of August — the most sold out in our 13 years of data. Short covering in the grains and buying gold, copper and sugar vs. selling crude oil have dominated speculator activity since Aug. 5.

Fed easing and China stimulus are ample reasons for commodities to rise, but global fiscal and monetary incentives may be part of a typical cycle toward deflation worthy of the inflation to the 2022 peak.

Commodity bounce vs. History’s overhang

Gold up almost 45% and crude oil down around 25% year over year to Sept. 30 isn’t a good trajectory for the global economy. It’s a question of performance a year from now, and our bias is that risks are leaning toward trend continuation, with copper a leading indicator. If the metal can sustain above its end-of-3Q price around $10,000 a ton, the signal would be positive for economic growth. It’s the potential for some normal copper reversion toward its five year average of $8,228, on the back of China in decline and recession risks in the US, that we find disconcerting.

That fiscal and monetary stimulus is expected when economies deteriorate may be what gold outperforming the S&P 500 by almost 10% year over year is sniffing out. Our bias is the burden on the US stock market to keep rising and lift all boats risks reversion.

Cold energy, hot gold and implications

In the history of the Bloomberg Energy Spot Subindex (1991), only at the onset of the pandemic in 2020 has the index been lower vs. gold, with macroeconomic implications. The 2025 year in commodities will likely be about what might reverse the path of deflating energy vs. inflating gold, and a top prerequisite could be an inordinate burden on the US stock market to remain resilient. If beta backs up for a potential recession, as indicated by the uninverting yield curve and rising unemployment, the deflationary dominoes led by US natural gas, grains, iron ore, crude oil and falling government bond yields may gain companions and momentum.

The Bloomberg Industrial Metals Subindex’s gain of 12% year over year is trailing gold’s roughly 45% and the S&P 500’s 36%. Unless beta keeps rising, base metals could risk falling.