Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Global Head of Metals & Mining Grant Sporre and Senior Analyst Rob Barnett. It appeared first on the Bloomberg Terminal.

Global copper consumption is likely to be 2 million tons higher by 2030, with over half from the US, as power-hungry AI fuels data-center capacity growth. Powering data centers via copper-intensive renewables and reshored manufacturing is set to spur US needs (stagnant for a decade), lifting worldwide demand to above-trend 2.7-3% annual growth.

AI, data center demand may boost copper demand by 3%

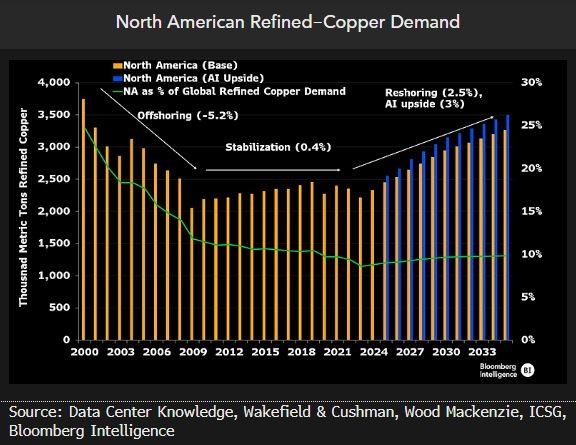

Rapid growth in generative AI spending — driving the build-out of data centers — could spur a 3% annual increase in North American copper growth to 2035, based on analysis by BI’s telecoms, utilities and global technology teams. Investment in manufacturing, as part of reshoring and upgrade to aging infrastructure, has the scope to lift US and North American demand 2-2.5%, with further upside of 0.5% from AI capacity development. Consumption is likely to significantly outpace 2010-20’s anemic 0.4% compound annual growth, and 5%-plus decline over 2000-10.

North America’s copper demand fell by over 5% a year in 2000-10 as manufacturing capacity was relocated to China and other low-cost countries. We expect this to reverse to a certain extent over the next decade, amid increasing tariffs and trade friction.

Data-Center copper use may be 1.1 million tons by 2030

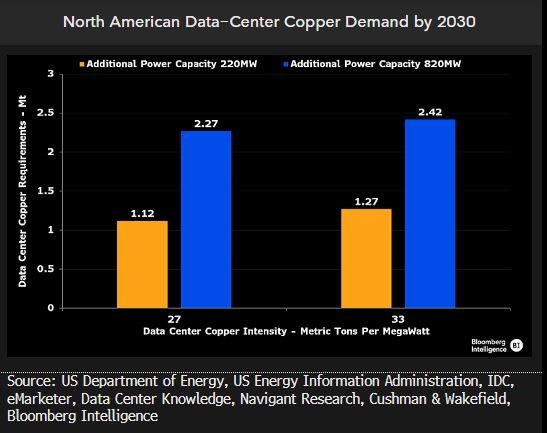

North American copper demand from the build-out of data centers could increase by 1.1-2.4 million tons as of 2030, according to our calculations that use data-center copper intensity of 27-33 tons per megawatt (MW) of applied power, a 150% increase in data-center capacity and a similar gain in renewable-power capacity. Our energy team’s analysis nevertheless suggests there’s further scope.

A study based on Microsoft’s $500 million data center in Chicago puts the copper intensity of a 1 MW facility at 27 metric tons. Yet as AI demands mount, so too will server-rack power density and cooling needs, potentially pushing up copper intensity too. An earlier study by Schneider Electric derived copper intensity of 66 tons a MW, yet this was based over a 10-year life cycle, with subsequent refit demand likely to be met by recycling.

US demand AI growth doesn’t have to be zero-sum game

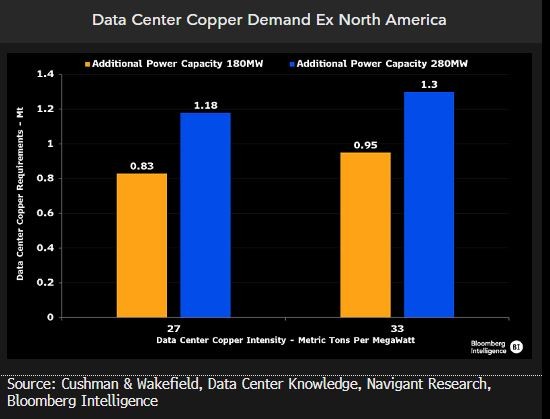

The build-out of US and North American manufacturing via reshoring and increasing trade barriers could dent copper demand in other regions — such as South-east Asia and China — just as US demand was hit in the 2000s by the inverse happening. Yet data-center capacity expansion is likely to be global, with room for rapid growth across many regions outside the US where power may be less constrained and security concerns dictate a domestic location.

The increase in US capacity is likely to outpace that in the rest of the world, yet nearly 20 gigawatts (GW) could still be built in the APAC region (13.3 GW) and EMEA (6.6 GW), translating into an additional 800,000 to 1.3 million metric tons of copper demand by 2030. That’s equivalent to the output of 4-5 midsized copper mines.

Cloud, generative AI fueling investment boom

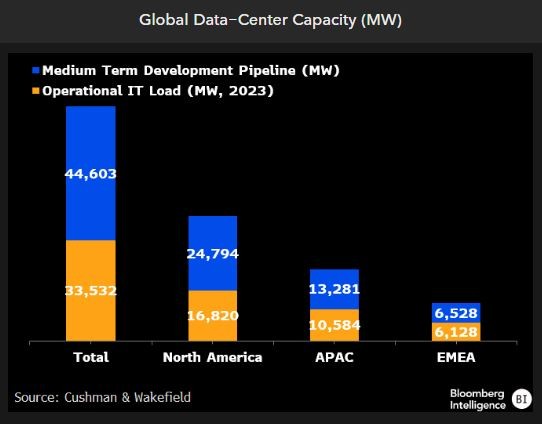

Global data-center capacity may more than double to almost 80 gigawatts (GW) over the medium term, according to Cushman & Wakefield’s analysis of the development pipeline. That’s enough power to supply over 50 million homes. Demand is being fueled primarily by the transition toward cloud-based services and generative AI applications, both of which involve power-intensive servers and processing.

North America — already the largest data-center market in the world — is set to add almost 25 GW (147%) of capacity. The Asia Pacific development pipeline includes 13.3 GW (125%), while in EMEA it’s about 6.5 GW (107%). The modular nature of modern data-center facilities means service providers can bring new supply online in phases to match client demand, minimizing the risk of stranded capital.