Carbon neutral LNG: Suppliers focus on optionality, transparency and CCS

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

Growing concerns over natural gas’ role in climate change and its place in the energy transition are pushing LNG suppliers to compete not just on price, but on their ‘low-carbon’ branding. While not mainstream yet, trends are emerging regarding how LNG producers position their supply offerings for buyers.

- LNG producers and portfolio suppliers have started to offer customers two options: carbon offsets optionality or emissions transparency. The former encompasses the growing trade of ‘carbon neutral’ LNG cargoes, and involves suppliers purchasing offsets for the estimated carbon footprint of a standard cargo–potentially differing from actual emissions. The latter option proposes to detail related emissions per cargo, in spite of a lack of industry consensus on a measurement framework. Both options seem to appeal to LNG buyers presently.

- Greenhouse gas emissions vary significantly between LNG production facilities based on numerous factors. Suppliers are under increased pressure from investors and buyers to show tangible efforts in managing their carbon footprints. For LNG producers, their focus is on reducing and measuring emissions from upstream production to customer delivery point. The biggest share of emissions, however, comes from the downstream combustion of natural gas.

- Other options to reduce emissions are to have carbon capture and storage(CCS) facilities, power the LNG plant with renewable energy and install boil-off gas recovery units. These are not new technologies or solutions, but CCS in particular is seeing renewed supplier interest.

- Looking forward, industry collaboration will be required to address the key challenges ahead. Deciding on the standard for measuring, assessing and offsetting emissions is the first big step. Who pays the ‘green premium’ and how best to tackle downstream decarbonization also needs consensus. More research is needed on quantifying and identifying sources of emissions to improve any low-carbon LNG solutions. Industry players on both sides of the value chain will work together to explore more solutions that may even involve hydrogen.

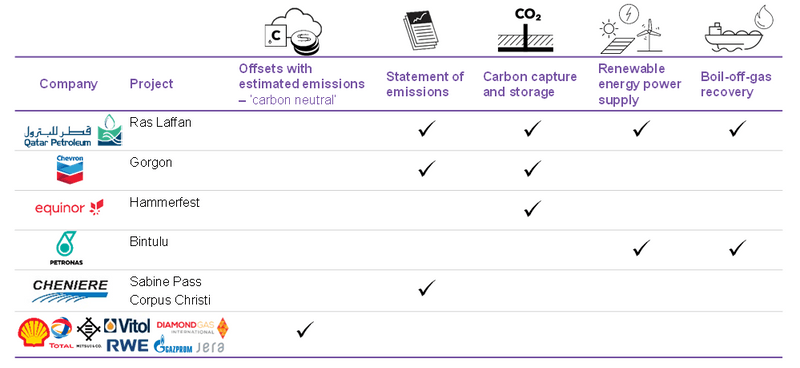

Comparison of key low-carbon LNG solutions by suppliers

Source: BloombergNEF, company websites. Note: LNG projects with ongoing work or plans for carbon capture and storage are not shown. List of solutions is not exclusive.

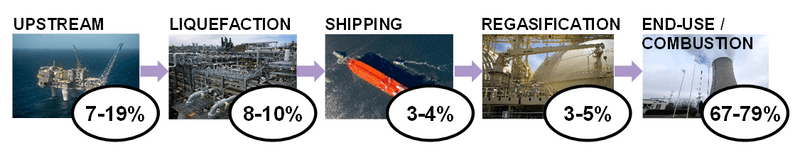

LNG value chain emissions

Emissions throughout the LNG value chain consist primarily of methane, carbon dioxide(CO2)and nitrous oxide –three greenhouse gases. Emissions occur along the whole value chain and product lifecycle. Methane emissions, or methane slips, are of particular concern as it is28 times more potent than CO2, according to the Intergovernmental Panel on Climate Change (IPCC). Greenhouse gas emissions associated with LNG can generally be categorized into five bucket types: combustion-related, vented emissions, fugitive emissions, transportation-related and non-routine emissions. Emissions can also be segmented operationally along the LNG value chain: upstream supply, liquefaction and production, shipping, regasification and downstream use. The biggest share of emissions comes from the actual use and combustion of natural gas, accounting for at least two-thirds of total lifecycle emissions. Transportation distances also impact the level of potential fugitive methane emissions. This could be the distance from upstream field to LNG plant, from LNG loading port to destination port or from receiving terminal to end-user

Emissions ranges along the LNG value chain

Source: BloombergNEF assumptions.

Primary area to tackle for LNG suppliers: Upstream production

As far as most LNG suppliers are concerned, the emissions within their control are up to LNG delivery point, which could potentially account for one-third of total lifecycle emissions. Assuming the LNG supplier is also the LNG producer, the largest area to tackle with regard to emissions reduction is upstream gas production and the liquefaction process.

Carbon dioxide emissions concerns begin with the natural gas composition in the hydrocarbon reservoirs. The percent of CO2 in the gas stream directly relates to how much ends up getting emitted or vented. Many of the major remaining, untapped natural gas resources in the world remain financially and technically challenging to develop because of their high CO2 content. Gas fields cancontainCO2 content levels anywhere from near-zero to as high as 70% percent –the latter currently not viable to develop. Currently there are fields in Malaysia and the United Arab Emirates being developed with 30-40% CO2 levels. Much of the CO2 in the natural gas stream is removed prior to, or in some cases during, the liquefaction process. Separated CO2 and other inert gases, such as nitrogen, are usually vented to the atmosphere. Carbon capture and storage technology can help address emissions from the upstream and production portion of the LNG value chain. Some LNG production plants currently have CCS projects associated with it, but many projects are trying to tag on a CCS unit to projects in order to make them more sustainable.

Other considerations for the carbon footprint of LNG projects have to do with their overall efficiency. Ambient temperatures play a part in this. Plants that operate in colder environments tend to use less energy to cool the gas down to liquid form, for example at Equinor’s Hammerfest LNG. Different liquefaction technologies, acid removal processes and power generation options will produce different emissions profiles based on the energy efficiency of the process as well. Natural gas combustion accounts for at least two-thirds of lifecycle emissions.

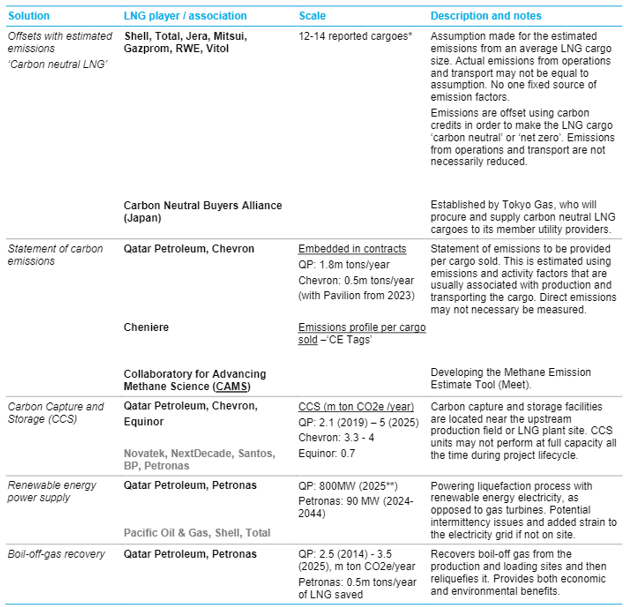

Current suppliers’ strategies for low-carbon LNG

With mounting pressure from investors, stakeholders and even LNG buyers themselves to manage the emissions profile of LNG, producers and portfolio suppliers are looking for ways to offer customers ‘low-carbon’ LNG options. In some cases what is on offer is a ‘carbon neutral’ or ‘netzero’ LNG option. BloombergNEF has identified five key strategies LNG suppliers are currently adopting in order to reduce the emissions footprint of their LNG production and supply.

Current and potential solutions adopted by LNG suppliers

Source: BloombergNEF. Note: Suppliers in gray have projects that are under construction or have only announced plans for it. *As of April 9, 2021, but reports vary. ***Assumed to be in line with when the first train from Qatar’s North Field East is expected.

Carbon offsets with average estimated emissions

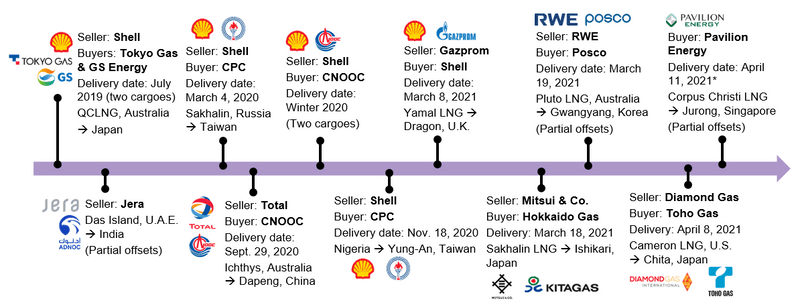

Since it emerged in mid-2019, the trade in ‘carbon neutral’ LNG cargoes has steadily risen. Reports vary, but anywhere between 12 to 14 carbon neutral spot cargoes have been transacted to date. ‘Carbon neutral LNG’ or ‘net zero LNG’ –both terms coined by the industry –does not mean there are no carbon emissions associated with the cargo. It is deemed as such as sellers have countered cargo emissions with purchased offsets. The offsets, or carbon credits, compensate for the carbon dioxide equivalent emissions associated with the LNG cargo, from production, liquefaction, shipping, regasification to final consumption by end-user. Some of the recent transactions used nature-based carbon credits and verified carbon standard certificates.

- As the trade continues to gain interest and make headlines, BNEF expects there to be no less than a dozen of these announced this year. So far this year at least four have been reported. See BNEF’s Gas & LNG Market: 10 Things to Watch in 2021.

- See BloombergNEF’s new Carbon Neutral LNG Cargoes Database (web) or via Terminal (NI BNEFLNG ‘Carbon Neutral’ <GO>)

The reported Shell carbon neutral cargoes used the average emissions per standard size LNG cargo, based on the U.K.’s DEFRA (Department for Environment, Food and Rural Affairs) calculation. This assumes an average LNG cargo of about 70,000 tons would emit approximately 240,000 tons of CO2 equivalent (CO2e) over the entire lifecycle – from ‘well to wheel’ as it is being coined. This is, however, a generic calculation and in reality would vary tremendously depending on different upstream, midstream and downstream aspects that would be unique per LNG plant and per cargo. What buyers will increasingly be conscious about is that offsets do little to actually reducing the emissions related to the production and sale of the LNG.

Trading house Vitol launched a ‘green LNG’ product for its customers, where they would be able to opt for converting LNG cargoes to ‘green LNG’ through offsets. Emissions associated with the cargo, from wellhead to delivery point, will be offset through the cancellation of Verified Emissions Reductions. Emissions will be estimated using the Wood Mackenzie LNG Emissions Tool, which is based on the estimated emissions profile from various LNG production plants. Vitol’s offering is different from the ones offered by Shell and Total in that Vitol will calculate LNG emissions up to delivery point, while Shell and Total have offered to offset the entire lifecycle emissions.

Carbon neutral LNG deals

Source: BloombergNEF, Bloomberg News, company websites. Note: BNEF assumes a source and delivery date based on AHOY vessel tracking, if not in press release. As of April 20, 2021.