This analysis is by Bloomberg Intelligence senior analysts Will Hares and Eric Kane. It appeared first on the Bloomberg Terminal.

BP’s ESG performance and outlook are bolstered by an ambitious net-zero emissions target from its operated upstream production by 2050, complemented by a tenfold surge in green spending, 50 gigawatts of renewable-power generation by 2030 and a 40% decline in oil and gas volume. Ecological metrics are favorable, with significant improvement in the 10 years since the Deepwater Horizon disaster, as BP’s safety and spill records are in-line with or above peer averages. BP’s board is among the most gender-diverse, and it has an investor-friendly governance structure and best-in-class ESG disclosures.

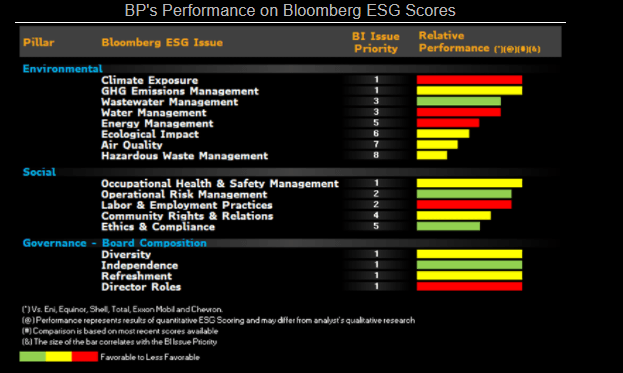

BP’s ESG scores reflect mixed performance on key issues

Total carbon embedded in reserves and an increase in fatality rates result in BP trailing peers on climate exposure and occupational health and safety, two of the most impactful environmental and social issues, in our view. Average scoring on management of greenhouse gas emissions reflects incomplete disclosure. BP continues to show uneven performance on key aspects of board composition.

Embedded carbon in reserves weighs heavily

BP and its integrated oil and gas peers face a range of significant environmental, social and governance issues. Those related to climate change and occupational health and safety are the most important, in our view. BP’s performance on climate exposure is negatively affected by higher-than-average embedded carbon in total reserves and a lack of direct disclosure on total investment in renewable energy. The company performs well on key metrics of greenhouse gas emissions, including gas flaring, but doesn’t disclose information on fugitive or process emissions. The company’s overall occupational health and safety score decreased from 2018 to 2019, due to a higher fatality rate. BP achieved leading scores on board independence but showed mixed results on other key board-composition metrics.

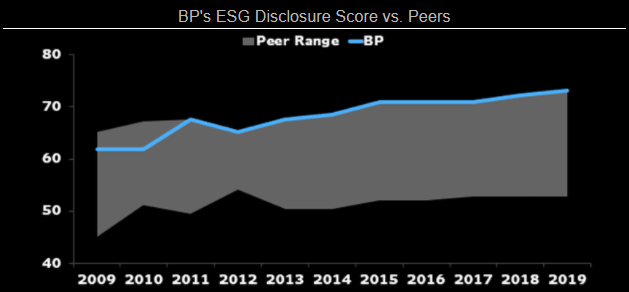

ESG reporting leads peers, but gaps persist

BP has the highest Bloomberg ESG disclosure score among global oil majors. The company provides good overall transparency on key issues related to greenhouse gas emissions, but doesn’t disclose all relevant metrics. BP reports a central case cost of carbon of $40 per tonne, and describes efforts undertaken to understand the physical risks associated with climate change. However, it doesn’t disclose total investment in renewable energy, another key aspect of climate exposure.

Similar to peers, the company doesn’t disclose the number or duration of technical delays, which is an important measure of performance on community rights and relations. Information on delays can provide investors with key insights, as opposition continues to mount vs. new oil and gas projects, contributing to higher costs.

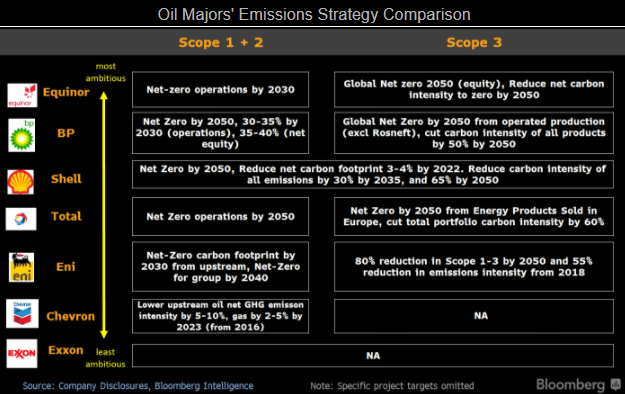

BP’s comprehensive energy-transition strategy and aggressive emissions ambitions, including its interim targets and net-zero greenhouse-gas goal by 2050, place it among the top global oil majors on environmental and climate strategy, we believe. The company also generally outperforms peers on spills, a critical component of ecological impact.

Net-zero carbon strategy comprehensive, ambitious

BP’s reimagined greenhouse-gas emissions transition strategy is among the most comprehensive and ambitious of global oil majors, in our view, with only Equinor more aggressive on its intensity target. By 2050, BP plans to achieve net-zero emissions from all operations and upstream production, and to halve the unit carbon intensity of its products. BP’s 2030 goals also stand out, as a plan for dramatic growth in renewable-power generation to 50 gigawatts leads peers. The latter is driven by a tenfold increase in green-energy spending to $5 billion a year.BP’s targets include a significant reduction of 1 million barrels a day, or about 40% of production, by 2030, the clearest sign yet from an oil major that the transition will force a major portfolio overhaul.

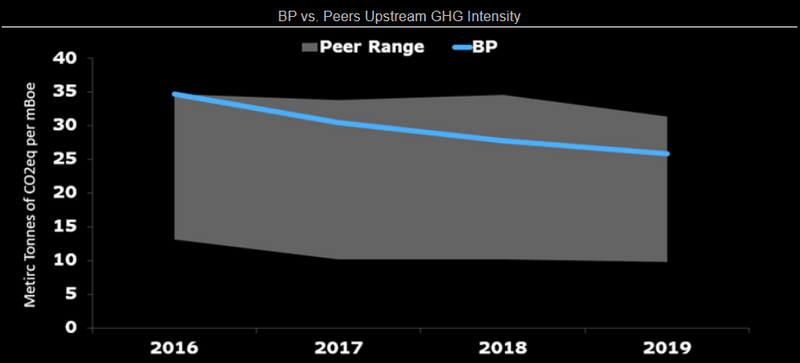

BP’s upstream greenhouse gas (GHG) emissions intensity in metric tons of carbon per 1,000 barrels of oil equivalent is down about 25% in the past four years. It remains well-above the peer average, but has an aggressive target for a 50% reduction in GHG intensity by 2050, with 15% the goal by 2030. To further reduce upstream GHG intensity, the company aims to install measurement devices at all of its major oil- and gas-processing sites by 2023, and decrease methane intensity by 50%.Methane is 7% of BP’s Scope 1 GHG emissions profile. Reducing that gas is a key climate-change consideration, given its warming effect is 21x higher than an equivalent amount of carbon.