Algeria proves key to Europe hitting 90% full gas storage

This analysis is by BloombergNEF Senior European Gas Associate Nnenna Amobi. It appeared first on the Bloomberg Terminal.

The European Union has met the Commission’s target for 90% full gas storage almost two-and-a-half months ahead of the Nov. 1 deadline. Supply from Algeria has been essential to meeting this goal, providing 10% of supply across the ‘Europe Perimeter’ – Northwest Europe, Italy and Austria – from April to August.

Despite heat waves and record-breaking temperatures across North Africa spurring a rise in gas demand for power at home, Algeria’s exports to the Europe Perimeter have increased during this summer restocking season.

Italy remains the largest buyer, purchasing both pipeline deliveries and liquefied natural gas cargoes. Total piped gas volumes received via the Mazara del Vallo entry point in Southern Italy have averaged 65.8 million cubic meters per day since the start of April, above the 56.2Mcm/d observed during the same period over the last two years.

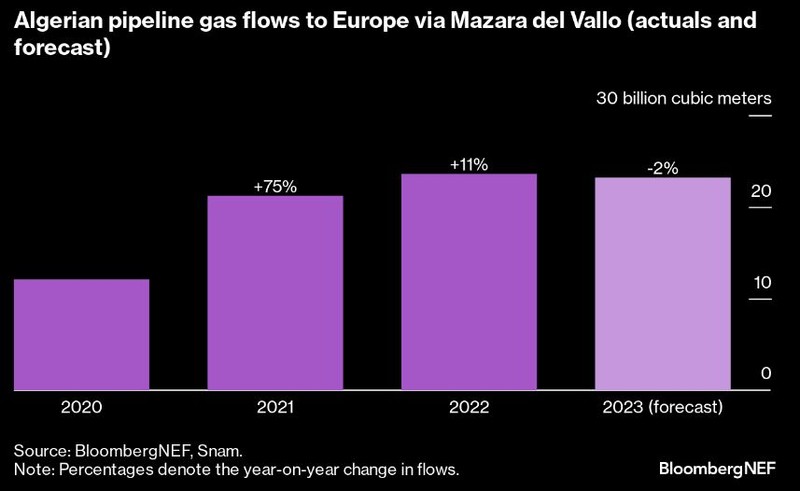

Overall pipeline imports from Algeria to Italy are expected to dip slightly this year, falling by 2% to 23 billion cubic meters on the back of softer Italian demand, higher storage levels and pricing dynamics. But this is still a high level, representing over a third of Italy’s total gas demand and an essential source of supply following the sharp drop in Russian piped flows. Prior to 2022, pipeline imports from Algeria hadn’t surpassed 22Bcm in more than a decade.

Flows from Algeria will be underpinned by several existing long-term pipeline contracts with Italian buyers – including a new agreement reached last year between Eni and Algeria’s Sonatrach for an extra 9Bcm of gas before 2023-24 – and supplemented by additional spot purchases.

Algeria’s drive to enhance domestic production and maintain high gas exports will require efforts to continue developing gas fields, similar to the Phase 3 Boosting project of Sonatrach’s Hassi R’mel field, which helped raise production levels above 100Bcm in 2021.

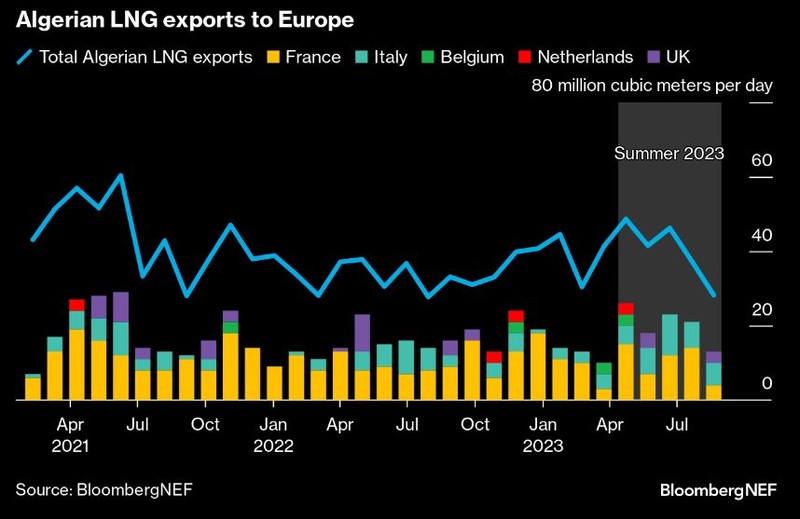

Europe laps up surge in Algeria’s LNG exports

BloombergNEF has observed a 25% year-on-year increase in Algerian LNG exports in the first seven months of 2023, to 8.8Bcm. Countries in the Europe Perimeter have benefitted from this growth, absorbing 3.7Bcm (18Mcm/d) of Algerian LNG, according to Bloomberg’s ship tracking data, up 14% from last year.

France has been the largest recipient, importing 2.2Bcm (10Mcm/d) during this period. An existing LNG contract between TotalEnergies and Sonatrach to deliver 2.7Bcm of LNG per year to France’s Fos Cavaou terminal was set to expire this year but has recently been extended to 2024, providing additional security of supply.

An essential component of Europe’s gas balance

While Europe has now reached 90% full gas inventories, a loss of volumes from Algeria could have slowed the region’s storage injection rate.

If even a quarter of the total volume from Algeria had not been provided in the summer to date (April to August), which closely aligns with the previous three-year average, BNEF estimates the Europe Perimeter’s average rate of injection into its inventories might have declined from 198Mcm/d to 176Mcm/d. The implications would have been stronger for Italy and France, as the latter’s storage is currently trending below the EU average at 86% full.

Lower volumes from Algeria would have delayed the point at which 90% full storage was reached unless additional gas was acquired to fill the gap. This would likely have come from spot LNG and pushed prices up.