ARTICLE

AI data centers fuel quicker growth in power demand

BloombergNEF

This article was written by Helen Kou, BloombergNEF analyst covering decentralized energy and utility strategy. It appeared first on the Bloomberg Terminal.

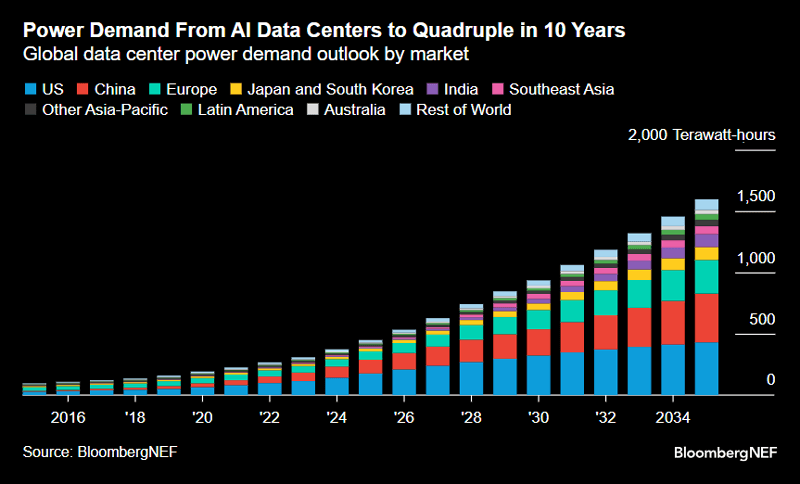

The surge of Artificial Intelligence (AI) is turning data centers into giant energy users. Electricity demand from AI training and services is set to quadruple within a decade, making data centers one of the fastest-growing electricity users on the planet.

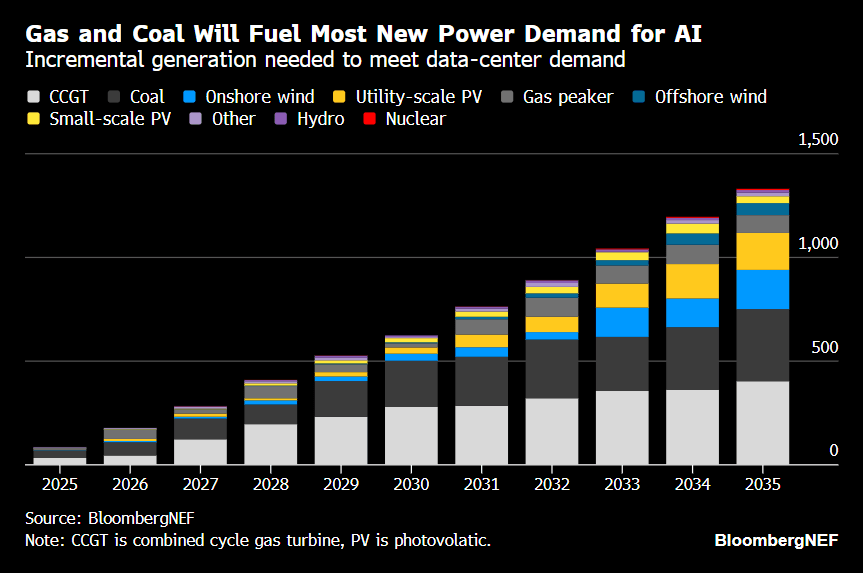

Fossil fuels are likely to fill the gap in the short term. But clean energy could be the long-term winner as operators face pressure from policy makers, net zero targets and even their own customers to grow without damaging the environment.

Data centers could consume 1,600 terawatt-hours by 2035 – about 4.4% of global electricity. If they were a country, they’d rank fourth in electricity use, just behind China, the US and India.

Nowhere is the shift more dramatic than in the United States, which is expected to remain the world’s largest data center market through the decade. In key US markets, data centers are out-pacing electric vehicles, hydrogen and other emerging technologies in electricity demand growth.

Why is AI causing a demand boom

The infrastructure behind AI is no longer behind the scenes. It has become a defining feature of the energy landscape. Data centers are scaling up to match.

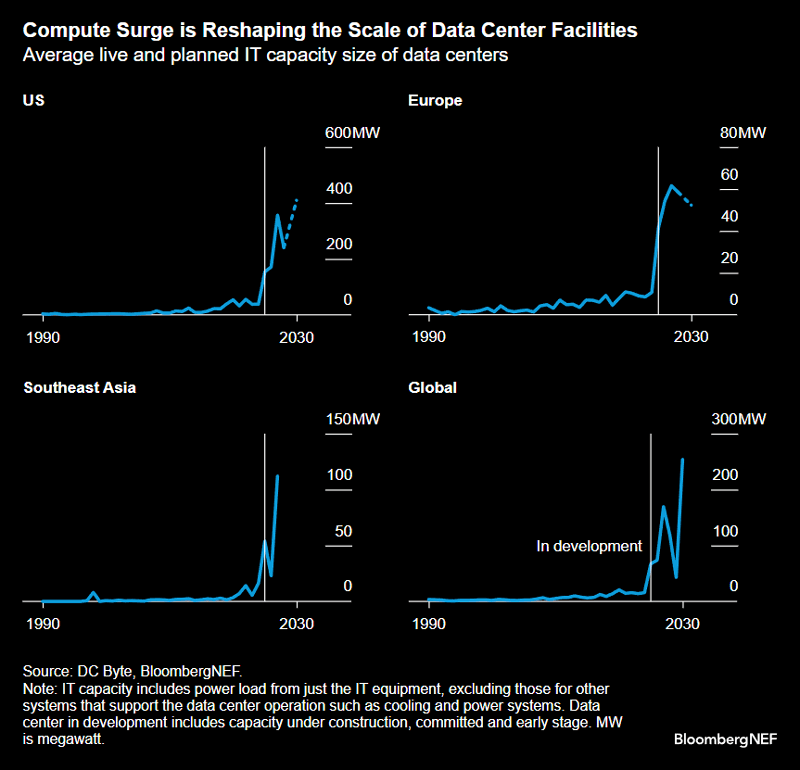

As recently as 2010, more than half of all data centers operated on less than 5 megawatts of electricity. Today, developers routinely plan for hundreds of megawatts – and a few are reaching for the gigawatt scale.

Two forces driven by AI are dramatically increasing power consumption. First is the energy intensity of computation increases with AI, and the scale of AI’s data processing needs are many times higher than for traditional systems.

Efficiency is improving. The average power usage effectiveness (PUE) is expected to fall from 1.4 to 1.2 by 2030. But the growth in demand for computing power is outrunning those gains. What were once anonymous tech warehouses are becoming massive engines of electricity demand, built for heat, scale, and nonstop processing.

Training large-scale models now requires such concentrated computing that a new class of data center is emerging – one that is reshaping not just the cloud, but the grid itself.

How do we supply rising demand

The AI boom is no longer just a computing challenge – it’s an energy race. For frontier model developers, electricity access is existential. Companies are building fast — often before revenue materializes — prioritizing sites with quick access to power, permits, and land. In the US, traditional hubs like Virginia, Oregon, Texas and Ohio still lead. But new regions are emerging. Speed sometimes can matter more than proximity to users.

Meeting this demand means leaning on existing energy systems — along with new ones. In the short term, natural gas is carrying the additional load. With abundant supply and flexible generation, gas-fired plants are underpinning much of the new data center build-out in the US, especially in regions already reliant on the fuel.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.