This analysis is by Bloomberg Intelligence Industry Analyst Talon Custer. It appeared first on the Bloomberg Terminal.

While weather and Nord Stream 2 are key determinants, we believe the liquefied natural gas (LNG) backdrop will remain positive for exporters in 2022 as hardy Asia demand, led by China, persists and European importers seek to refill low inventories. The market should stay tight, keeping prices high and fueling netbacks. This may temper demand a bit, but LNG trade could still rise 5% next year. The global gas crunch underscores LNG’s role in the energy transition, restoring long-term contract discussions that may lead to multiple new project investment decisions in the next 12 months.

LNG trade momentum to carry into 2022 as Asia propels growth

Voracious liquefied natural gas demand in Asia, particularly China, and low European inventories entering peak season are primary drivers of our expectation for mid-single-digit LNG trade growth in 2022. While the severity of winter weather and start date of Russia’s Nord Stream 2 gas pipeline are wild cards, we believe LNG market fundamentals will remain strong into 2023.

LNG trade poised for mid-single-digit gains

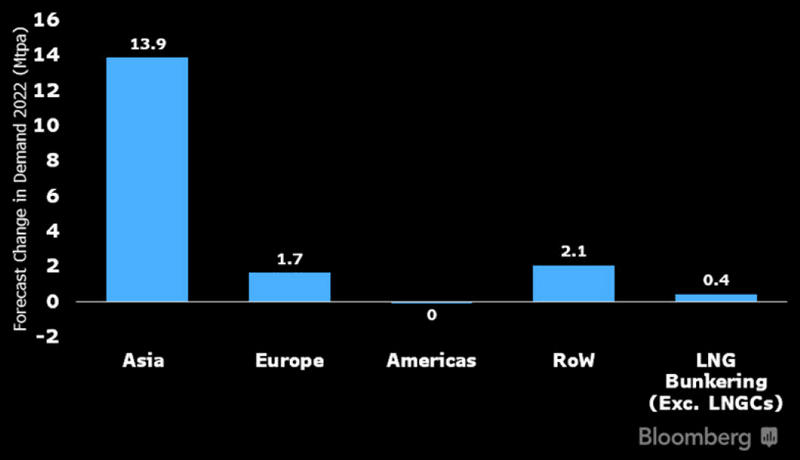

LNG demand may rise 5% in 2022 to about 399 million tons, based on our analysis, following a projected 6% gain in 2021. Weather severity and the magnitude of expansion in 4Q are key factors, but we are slightly more bullish than Clarksons and Wood Mackenzie, which project 4% growth in 2022. We expect almost 14 Mtpa in Asia growth, propelled by countries such as China, India and Bangladesh. The need to replenish natural gas inventories in Europe could spur modest growth, while Kuwait spurs a gain among remaining countries as it starts a 3 million ton-a-year contract with Qatargas.

Americas demand may be little changed due in part to challenging comparisons to immense growth this year amid a drought and weak hydropower. Strong global demand growth aids exporters’ such as Cheniere, Sempra, Novatek, Total, Shell and BP.

Projected change in LNG demand 2022 (Mtpa)

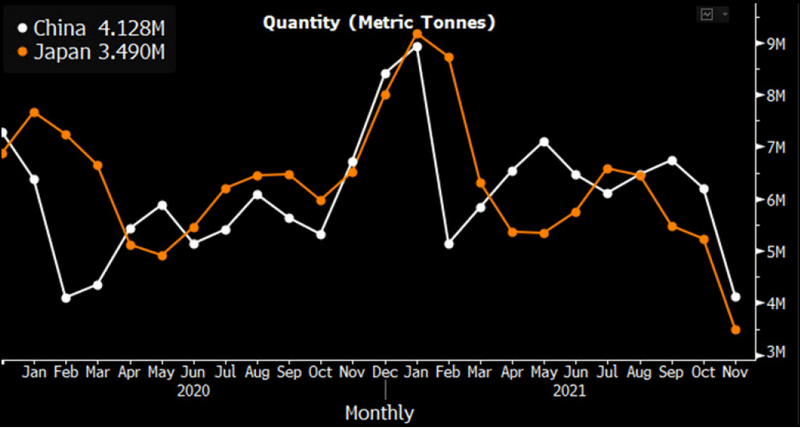

China to extend lead as largest importer

Asian LNG demand could increase 5% in 2022, our analysis suggests. China’s LNG imports may finish the year about 18% higher and grow 10% in 2022, driven by economic recovery, sizable regasification capacity growth and a push for coal-to-gas switching to improve air quality. We expect the benchmark JKM LNG price to stay elevated, but for demand in countries that are typically more price-sensitive, such as Bangladesh and Thailand, to remain resilient given energy supply pressure. Bangladesh could see robust growth as domestic gas output slips and it continues a switch from oil and coal.

Indian LNG imports have slid in 2021, but could rebound with high-single-digit growth in 2022. Strong Asia demand bodes well for exporters like Exxon, Woodside, Santos and Petronas. China surpassed Japan as the largest LNG importer this year.

China takes LNG import lead from Japan (Mtpa)

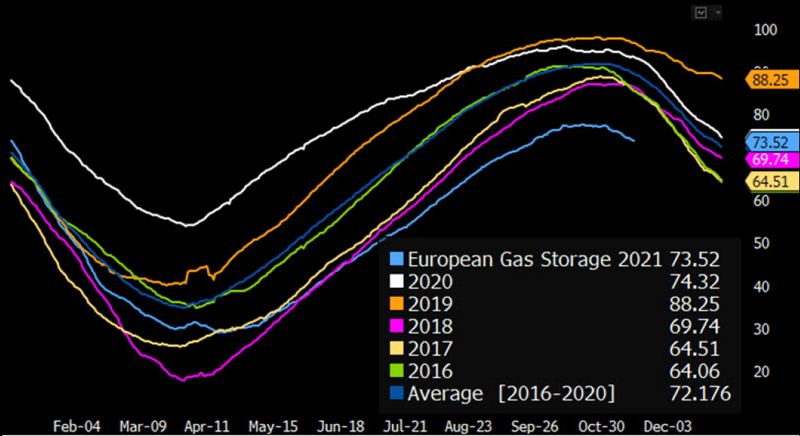

Europe must refill gas inventories

European LNG imports may rise 2% in 2022, based on our analysis, after falling in 2020 and 2021. Importing nations such as the U.K. will need to restock inventories that are likely to be significantly depleted after entering this winter well below average. At just 73% of capacity, European gas storage is 16 percentage points below the five-year average, according to GIE data. Turkey LNG imports could modestly rebound next year after tumbling in 2021 amid higher spot prices and rising pipeline volume, while Spain may rely more on LNG after the closure of the Maghreb-Europe pipeline.

High carbon prices, the planned partial shutdown of the Groningen gas field and possible delayed start of Russia’s Nord Stream 2 to 2Q should sustain LNG needs. Offtakers such as Naturgy, EDF, Centrica and PGNiG have long-term LNG contracts.

Europe natural gas storage (% Full)

U.S. Leads 2022 LNG Supply Growth That Should Easily Be Absorbed

LNG supply growth in 2022 should remain strong, expanding by about 20 million tons (mtpa), based on our calculations. Almost 25 mtpa of liquefaction capacity is expected to start operations, led by the U.S., but projects in Indonesia and Mozambique are unlikely until later in the year. Disruptions or supply issues at certain global plants could cap LNG growth and help keep the market tight.

U.S. makes up bulk of supply growth

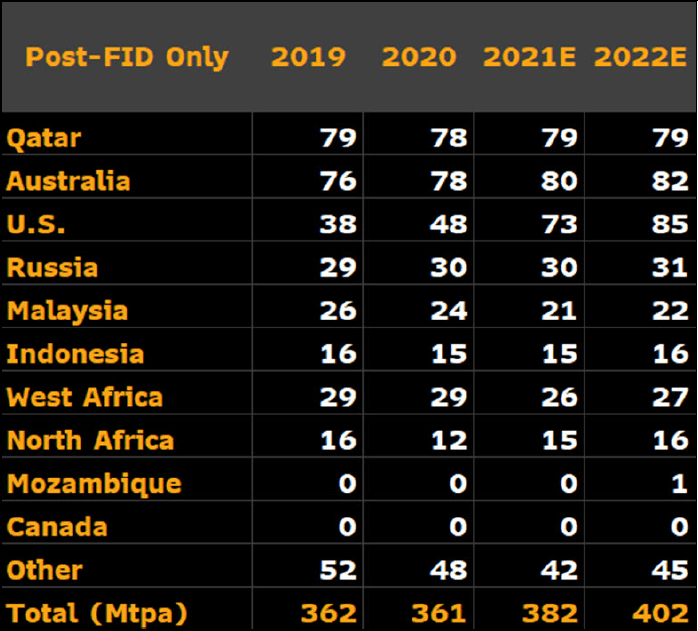

Global LNG supply may rise about 5.4% in 2022 to 402 million tons (mtpa), our analysis shows, modestly outpacing demand growth. Supply expansion will again be driven by the U.S., which may comprise close to 60% of the 20 mtpa gain. The sixth train at Cheniere’s Sabine Pass and Venture Global’s new Calcasieu Pass facility could start in December and ramp through 2022. Other projects that could start in 2H22 include BP’s Tangguh train 3 in Indonesia and Eni’s Coral South floating LNG off the coast of Mozambique. Gazprom’s Portovaya (1.5 mtpa) project may start soon, or be delayed to 2022.

U.S. LNG exports may increase about 50% this year. Our expectation for 2022 growth of 16%, to about 85 million tons a year, is slightly lower than the EIA’s 17% projection. U.S. growth is supported by increasing trade with China.

Forecast LNG supply by region (Mtpa)

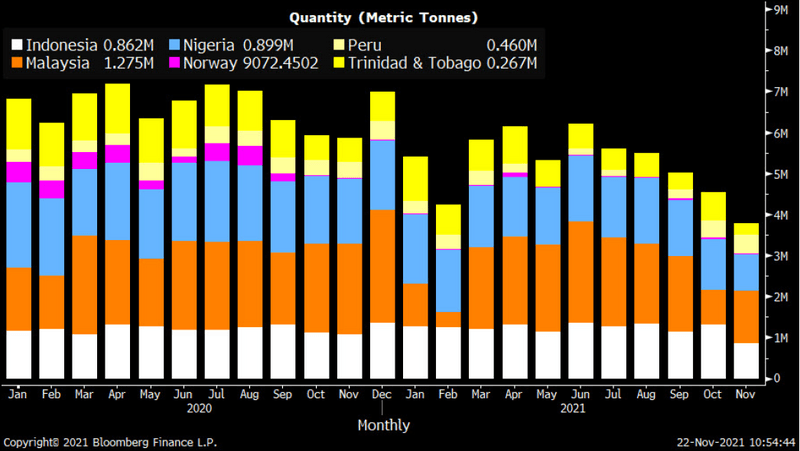

Disruptions periodically affect LNG supply

Unplanned LNG export outages contributed to market tightness in 2021, and this could continue as some providers still have issues to resolve. Equinor’s Hammerfest facility in Norway (4.2 mtpa) has been offline since September 2020 due to a fire, and may not return until 2Q. We expect utilization at Atlantic LNG in Trinidad and Tobago to stay pressured, with higher output hinging on successful restructuring negotiations and execution on gas backfill projects. LNG export growth at Pertamina’s Bontang LNG in Indonesia and Petronas’ Bintulu project in Malaysia could be hindered by upstream constraints into 1Q.

Golar’s Hilli FLNG off the Cameroon coast is modestly boosting utilization next year. Overall, our analysis suggests global liquefaction capacity utilization of about 86% in 2022, just above the prior year.

Monthly LNG exports of select countries (Mtpa)