ARTICLE

Visa, Mastercard spur gen-AI adoption among payment companies

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Diksha Gera. It appeared first on the Bloomberg Terminal.

Visa and Mastercard’s billions of dollars in AI investments will likely set the pace for other payment firms, with use cases in charge-back prevention, credit risk and fraud prevention, as well as hyper-personalized client services. Advanced predictive analytics can help streamline dispute resolution and allow preemptive infrastructure maintenance, reducing downtime and transaction costs.

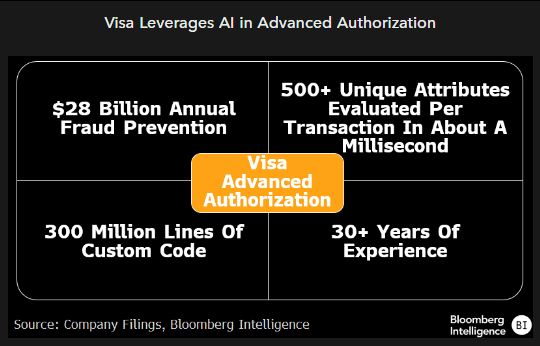

Visa’s $3 billion in AI spending, startup investments

Visa, having spent more than $3 Billion in the past 10 years on AI and data infrastructure, is leading the payments industry’s adoption of generative AI, along with peer Mastercard. To process nearly 280 billion transactions (fiscal 2023), Visa deploys several hundred large language models (LLMs) embedded in more than 100 different products. One of these real-time payment products, Visa Advanced Authorization, has helped prevent an estimated $28 billion in fraud annually. With over 76,000 transactions per second in over 200 countries, AI-driven fraud prevention has become imperative for Visa, which has also launched a $100 million venture fund for generative-AI startups in October.

The firm has been an early adopter of AI for over three decades, and launched a AI consulting service for its clients last year.

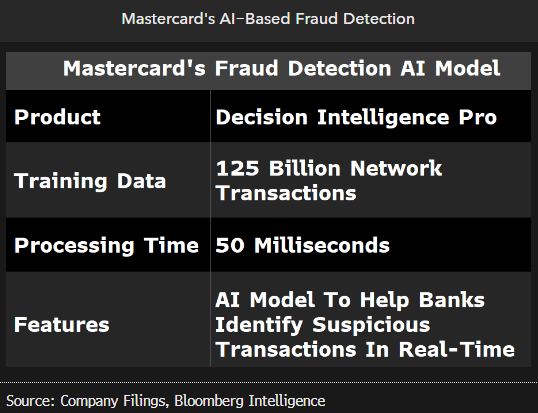

Mastercard’s $7 billion investment in AI, cybersecurity

Mastercard has been leveraging AI extensively in fraud detection for over a decade, with its Decision Intelligence solution the most prominent use case. One of its most successful large language models has been trained on the roughly 125 billion payment transactions Mastercard processes annually. The company claims it boosts detection by up to 300%, helping thousands of in-network banks, including some of the largest global institutions, detect and prevent fraud. Mastercard claims to have invested over $7 billion in cybersecurity and AI over the past five years.

US consumers lost $12.5 billion to internet scams in 2023, according to the FBI. That highlights the opportunity for Mastercard’s continued investment and partnerships in AI to enhance value-added offerings and provide revenue tailwinds.

Global payments’ fraud solution cuts losses by 50%

Global Payments uses AI for improving overall efficiency and fraud detection, where issuer-processing clients have reported a nearly 50% reduction in losses attributable to fraud. Other applications include credit-risk evaluation, charge-back prevention and enhancing customer experiences with personalized offers. The company has identified a governance framework for its deployment processes to ensure safe execution.

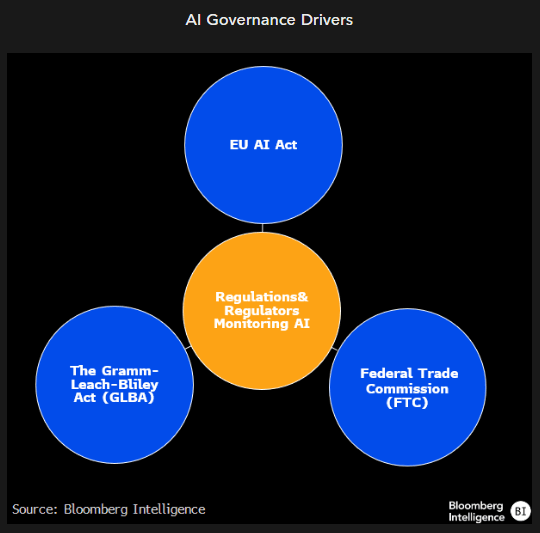

Still, fears of risk and uncertainty, including a changing regulatory landscape that may require costly and frequent adaption of internal systems, could slow Global Payments’ future investment in AI, according to its 2023 annual report.

WEX deploys AI for operating efficiency

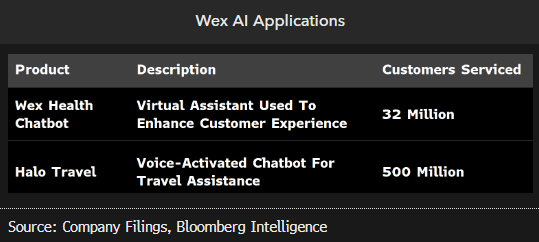

WEX, a competitor of Corpay in vehicle-related solutions, sees AI as an opportunity for cost savings. Another part of its business, WEX Health, deployed an AI-driven chatbot in August 2020, putting it ahead of the AI boom, which took off in 2022 when OpenAI launched ChatGPT. WEX’s chatbot is used to improve the experience for the 390,000 employers and more than 32 million consumers it services. Additionally, in a partnership with AI.io, WEX launched Halo Travel, a voice-activated chatbot for travel that’s accessible to more than 500 million people via Google Assistant.

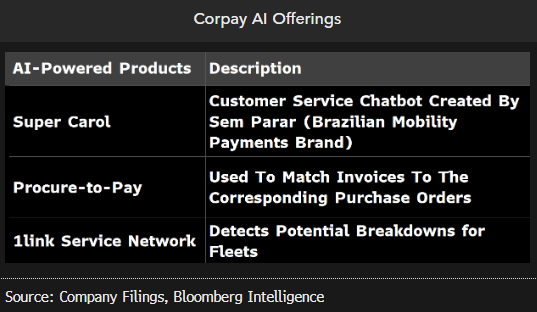

Corpay’s AI for invoice automation, credit underwriting

Corpay, a leader in automated solutions for vehicle-related expenses, has AI embedded in its purchase-order (PO) and invoice-automation offerings. Specifically, AI is used to to match invoices to the corresponding PO and to improve accuracy in data extraction for the invoices. Additional AI products include its Super Carol AI chatbot and its fleet maintenance platform called 1link Service Network, which uses AI to detect potential breakdowns. Corpay also uses machine-learning models as part of its credit underwriting process.