ARTICLE

The AI value chain: Understanding the engines of growth

Bloomberg Professional Services

How can investors assess exposure across the expanding AI value chain? Through the Bloomberg AI Value Chain Index, this article explores how indices map the ecosystem and how equal weighting and diversified exposure across semiconductors, hardware, and cloud highlight the underlying drivers of AI’s growth.

This article was written by Sean Murphy, Multi-Asset Index Product Manager at Bloomberg Index Services (BISL).

From chatbots writing poetry to algorithms helping doctors read scans, the headlines make it feel like a revolution is unfolding. But for market observers, the question isn’t whether AI matters, but rather, how to analyze exposure across AI’s expanding ecosystem.

In our previous article in this series on how AI is reshaping the investment landscape, we examined how AI adoption in hardware is driving structural economic change, influencing portfolio construction, and redefining market leadership through inference.

But while it is tempting to focus on the companies building the AI models that dominate the news, the history shows that when new technologies take off, the long-term beneficiaries may often include the enabling companies that support innovation across the supply chain. In this article, using the Bloomberg AI Value Chain Index as an example, we examine how indices can help to observe companies building the foundations of AI.

PRODUCT MENTIONS

Why does an index approach matter in assessing AI investments?

AI is less a single product and more an ecosystem. AI models require substantial infrastructure (data centers, advanced semiconductors, and reliable storage systems) to function. Each layer is complex and capital intensive and has its own essential contributors.

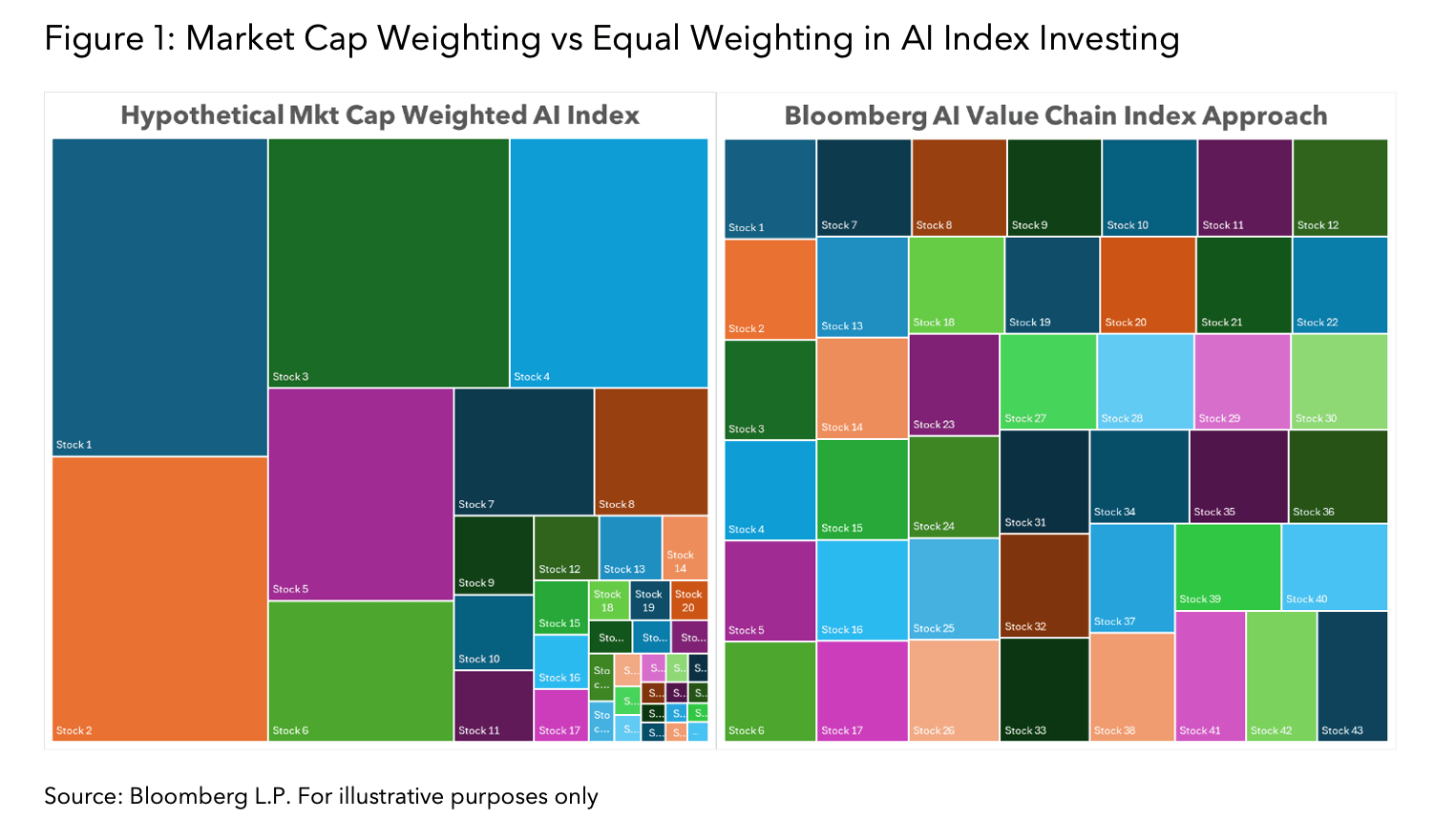

Focusing on a narrow set of AI stocks may lead to concentration or exposure gaps. From an index design perspective, two structural risks arise: high weighting to a few large-cap constituents, and underrepresentation of companies providing critical but less conspicuous contributions to AI innovation.

Think of AI as a skyscraper. The model developers are the architects celebrated on magazine covers, but without the steelmakers, electricians, and elevator manufacturers, the building will never be completed. Indices, such as the Bloomberg AI Value Chain Index aims to capture all of these roles.

Built using a rules-based approach informed by Bloomberg Intelligence (BI) research, the index maps the AI value chain and identifies companies with significant involvement in each link of the AI infrastructure. Numerous business models fit within this theme, from cloud computing platforms to semiconductors to hardware infrastructure.

Only firms that have clear, material exposure to AI, as identified in BI research, are eligible for inclusion into the index. Once the eligible universe is set, the selection process groups companies into three categories: cloud, AI hardware, and AI semiconductors. From these, the 15 largest companies in each group, ranked by free-float market capitalization, are selected.

The power of equal weighting in AI index investing

Some investors may question the need for a dedicated AI sleeve in portfolios. After all, many of the largest constituents in market cap weighted indices are active in this growing area. A simple market cap weighted approach, however, may not reflect the diversity of AI-related business models. To avoid large cap names from dominating the index, here, the selected securities are instead equally weighted. Such an approach also increases the exposure to names that are smaller in market capitalization and whose price may not yet reflect the magnitude of their involvement this early in their development cycle.

Additionally, taking an Equal-weighted approach may increase the representation of companies involved in AI-related M&A activity. By giving smaller and mid-sized firms greater footing, the index may highlight potential targets more fully.

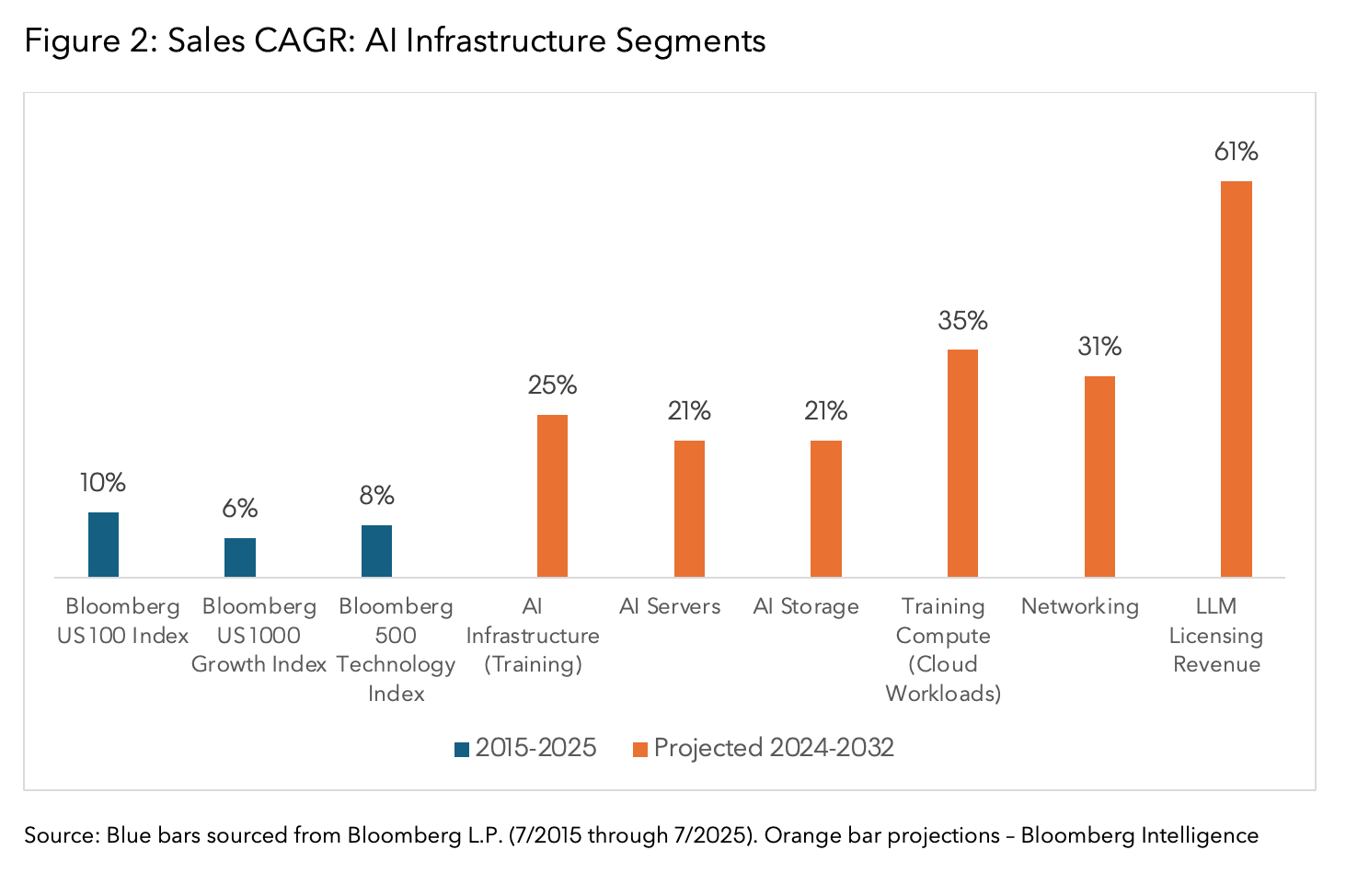

Traditional equity indices may underrepresent how AI is reshaping market growth. While broad benchmarks capture companies that are already benefiting from digital transformation, they often reflect today’s market composition rather than tomorrow’s growth drivers.

Even indices that focus on technology (such as the Bloomberg 500 Tech and Bloomberg 100 Indices) do not fully capture the growth of the AI ecosystem as acceleration may be happening beneath the surface. The following chart illustrates this gap, showing that the broader indices underrepresent the scale of projected sales growth across AI-related segments over the coming decade.

Selected companies illustrating the approach employed by the Bloomberg AI Value Chain Index

Western Digital: AI’s expanding library

AI runs on data, and every image analyzed, every prompt answered, every recommendation generated requires vast storage. Western Digital (WDC US) has developed a framework called the AI Data Cycle, mapping the six key stages of AI workflows from raw data storage to new data generation. At some stages, you need “sports cars” (SSDs) to move critical goods quickly. At others, you need “cargo ships” (HDDs) to carry massive loads efficiently. Western Digital builds both, and it designs them to work together as a complete logistics system for AI data.

What makes this significant is that Western Digital isn’t competing to build AI models themselves. Instead, it’s building the infrastructure backbone that is intended to support AI models with the appropriate storage options across workflow stages. The company’s strong year-to-date performance (+167.2% through September) may be attributed to some market participants increased attention to storage infrastructure’s role in AI workflows.

Credo: Highways for AI data

Technology provided by Credo (CRDO US) ensures information moves between GPUs, storage systems, and networking gear. The firm holds a leading position in the Active Electrical Cable market and has deep partnerships with hyperscalers like Amazon, Microsoft, and Meta. Credo essentially gives AI data centers the ability to add lanes to the data highways within.

One of the biggest challenges in scaling AI today is energy consumption. Training and running large AI models requires connecting thousands of GPUs in data centers, which in turn means moving vast amounts of data at extremely high speeds. Every time that data moves, energy is consumed. This is where Credo’s technology comes in. Their products are specifically designed to move data quickly while using less power per bit transferred. That means hyperscale data centers can train and deploy AI models without their energy bills spiraling out of control. Credo’s revenue growth and stock performance in 2025 (+117% YTD through September) may suggest a growing interest in energy-efficient solutions for AI infrastructure.

Hon Hai: Factories of the future

For decades, Hon Hai Precision Industry (2317 TT), or Foxconn, was synonymous with high-volume electronics assembly, particularly smartphones. Recently, however, Foxconn redirected its enormous manufacturing muscle toward AI infrastructure. This move has paid off, with revenue from its AI and cloud/server division now surpasses that of smartphone sales.

Today, it co-designs servers with NVIDIA and assembles forty percent of the world’s AI servers. The company’s pivot to AI servers coincided with record revenues in 2024 and 2025, and its year-to-date stock performance (+21.6% through September) may reflect increased investor focus on AI infrastructure.

Measuring the growth of AI infrastructure

AI adoption is accelerating across industries from healthcare to finance to entertainment. Each advance increases demand for chips, storage, servers, and faster data connections. The Bloomberg AI Value Chain Index is designed to capture this continuous change in demand. By focusing on the enabling infrastructure rather than any single model or application, the index seeks to capture relevant new technologies and players.

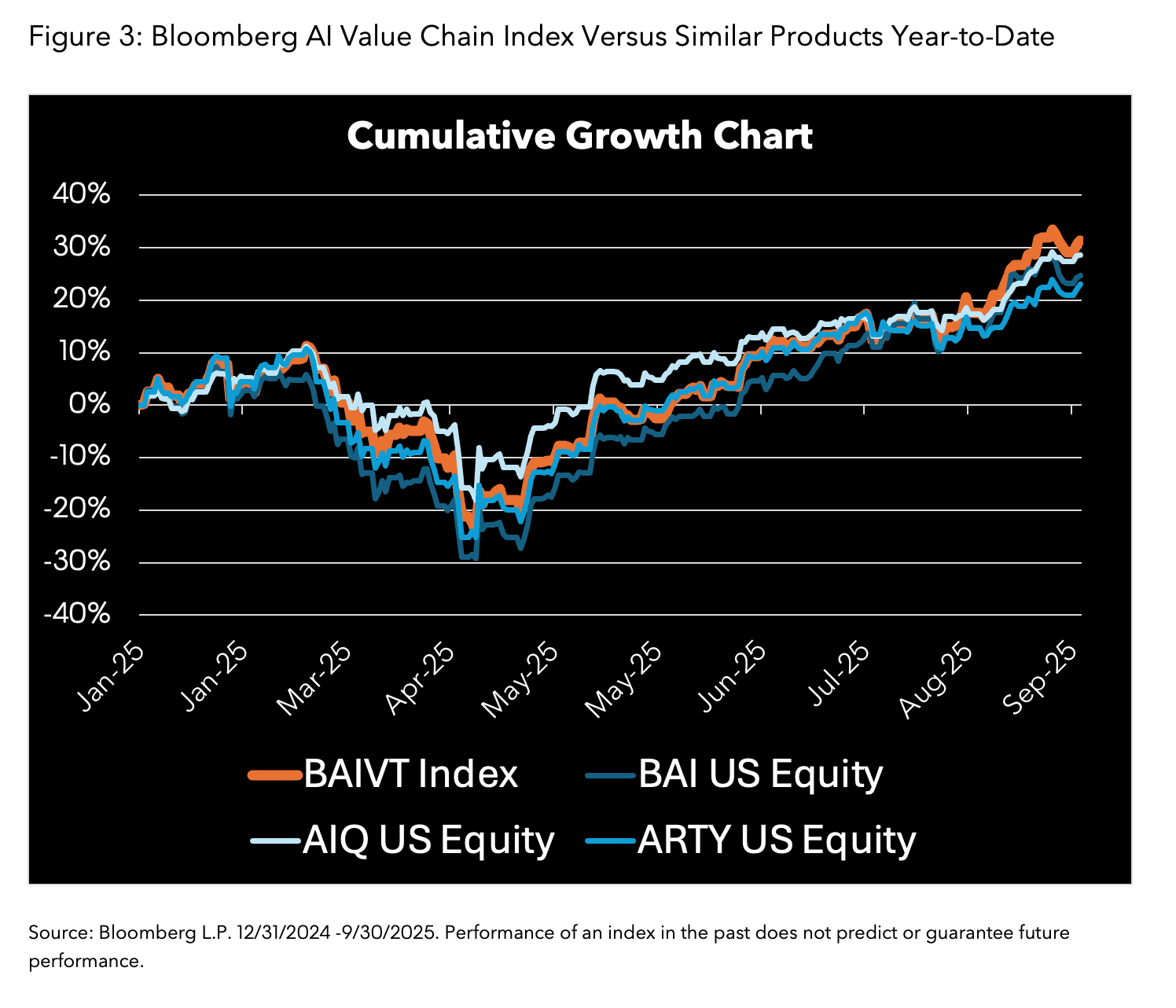

By equal weighting forty-five firms across cloud, semiconductors, and hardware, it offers a diversified, transparent way to track AI’s growth. In a year where AI is at the forefront of many investors’ minds, the index has delivered results that have been in line with or exceeded many of the more popular AI ETFs available on the market. If AI is the gold rush of our time, the index can be seen as a map to the companies selling the picks, shovels, and railroads.

Looking to further explore how AI is transforming markets, and how Bloomberg Indices measure exposure to this theme? In part three of our series, we focus on AI Thematics, examining how a rules-based approach, supported by Bloomberg Intelligence, identifies companies materially engaged in AI development and deployment.

To learn more about Bloomberg Indices, click here.

Amplify has licensed the Bloomberg AI Value Chain Index for their ETF ticker AIVC.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorized and regulated by the Financial Conduct Authority as a benchmark administrator. © 2025 Bloomberg. All rights reserved.