ARTICLE

Global insight: Who innovates, who benefits? Gauging the AI race

Bloomberg Economics

This article was written by Michael Deng, Geoeconomics Technology Analyst at Bloomberg Economics and Sarah Zheng, Geoeconomics Analyst at Bloomberg Economics. It appeared first on the Bloomberg Terminal.

The US and China are locked in a race to be the first to achieve artificial general intelligence. The winner will benefit from faster economic growth, a more lethal military and a powerful new tool of economic statecraft. Right now, the US is in the lead — but China is close on its heels.

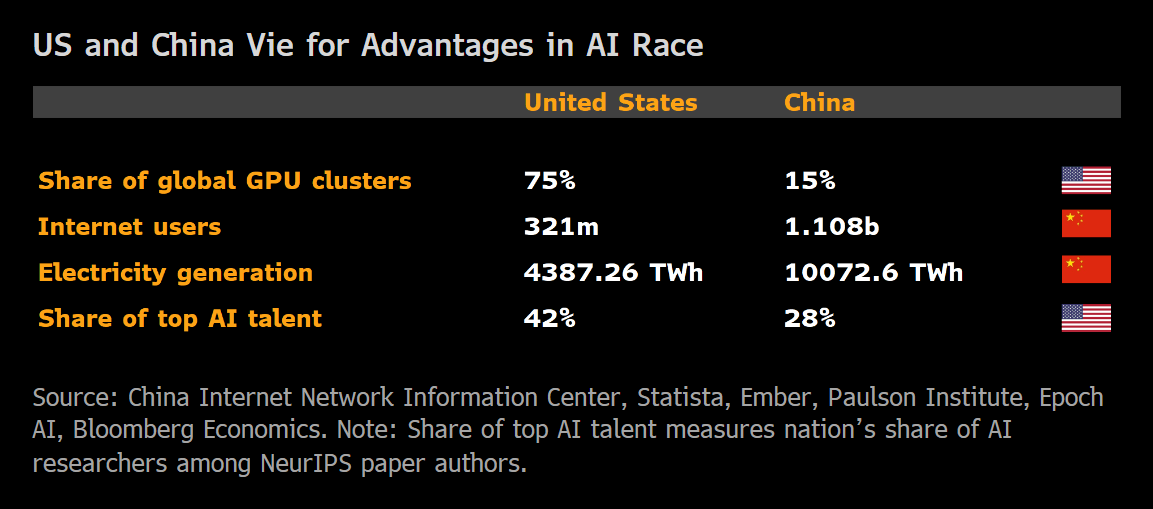

Four factors will be critical in determining the outcome. The US is ahead in two, computational power and elite talent, with China close behind. In the other two, data volume and power infrastructure, China has significant advantages. The US is betting it can stay ahead by running faster. In other technological races, that hasn’t proved to be a winning strategy.

Compute

Computational power sets the pace of training, tuning and deploying AI. The US has a decisive edge for producing superior models.

- The US contains about 75% of global GPU cluster performance, with China in second place at 15%. Western semiconductor fabs are also at least three generations ahead of China in manufacturing the advanced semiconductors needed for the most powerful AI models.

- US export controls limit China to using weaker chips such as Nvidia’s H20. Huawei is reportedly limited to producing just 200,000 AI chips yearly. Nvidia, in contrast, shipped 3.76 million AI chips in 2023.

- China has attempted to innovate around these restrictions. On hardware, Huawei’s AI chips, while still limited in quantity, are becoming increasingly competitive in terms of capability. Companies like DeepSeek have achieved competitive results with weaker GPUs through algorithmic improvements.

Data

China is unmatched in the volume of raw data needed to train AI models. The US retains an edge in data quality and accessibility.

- With over a billion Internet users, China is a data superpower, generating an estimated 28% of all global data in 2024, up from 9.5% in 2019. Meanwhile, the US share of global data is projected to decline to 17.5% this year from 21% in 2018.

- OpenAI and other US companies gained early dominance by scraping freely accessible internet data. Major websites are now erecting technical barriers. Well-funded Western companies can still secure access through licensing agreements, but Chinese companies will face greater challenges accessing this high-quality data.

- China also faces challenges because of strict censorship and closed ecosystems on platforms like WeChat, limiting the variety and accessibility of data for AI training there.

Power

China’s clear advantage in electricity infrastructure enables rapid AI deployment at scale. The US power grid is struggling to keep pace with an AI-driven demand shock.

- China has more than double the electricity generation capacity of the US. This abundance of low-cost electricity (as low as $0.05/kWh in some provinces) partially enables Chinese data centers to offset hardware inferiority by deploying larger quantities of less efficient chips.

- Data centers could consume up to 8.6% of all US electricity by 2035. With multi-year wait times for new grid connections, this infrastructure bottleneck threatens the pace of American AI deployment.

- The US also faces an inconsistent energy policy. The Trump administration is pushing for permitting reform to accelerate energy for AI while rolling back tax credits for clean energy, which accounted for 93% of new US power capacity growth last year.

Talent

The US maintains an advantage in elite AI talent, though it’s being eroded by stricter immigration policies and China’s large cohorts of STEM graduates and active recruitment.

- China is the world’s largest producer of top-tier AI talent, originating nearly half of all elite researchers globally. For now, the US remains their primary destination, employing 42% of global researchers and 60% of the “most elite” top 2% of global talent.

- However, the Trump administration’s broader attacks on universities, scientific funding cuts and restrictive immigration policies could undermine this US advantage.

- China has had some success through its “Thousand Talents” and other talent recruitment programs, with scientists of Chinese descent increasingly leaving the US for China. The US still offers higher wages and more open research environments.

Both countries hold pieces of the AGI puzzle. Neither has everything required to realize its full potential. Unlocking AGI’s transformative benefits demands both solving technical challenges to build leading models and having the infrastructure to deploy them across the economy.

Our bet: The US edge on computing and elite talent might enable it to achieve AGI first. China’s fast-follower superpower, advantage on power and data and proven ability to deploy at scale means it won’t be far behind, and it could be the first to realize economy-wide benefits.