ARTICLE

Driven by AI, technology credit quality’s best days lie ahead

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Credit Analyst Robert Schiffman with contributing analysis by Alex C Reid. It appeared first on the Bloomberg Terminal.

Technology credit quality across hardware, semiconductors and software is on an improving trajectory, as a formerly depressed demand and limited supply cycle have mutated into an AI-driven global growth phenomenon. Enormous financial flexibility, supported by large cash hoards and billions of dollars in free cash flow, provide a near-to-intermediate term path of ratings stability.

Nvidia, Broadcom Ride AI semi boom with supercycle aspirations

Explosive growth for artificial intelligence is likely to extend over the next 24 months, improving fundamentals for chipmakers despite pockets of supply/demand challenges. The iShares Semiconductor ETF has rallied nearly 300% since early 2020, with standout Nvidia surpassing a $3.5 trillion equity value. Credit quality across semiconductors tends to range from strong to stronger rather than bad to good. Capital-light models at Nvidia, Broadcom, AMD and others are likely to generate considerably better near-term cash flow than foundry business counterparts Intel and Micron.

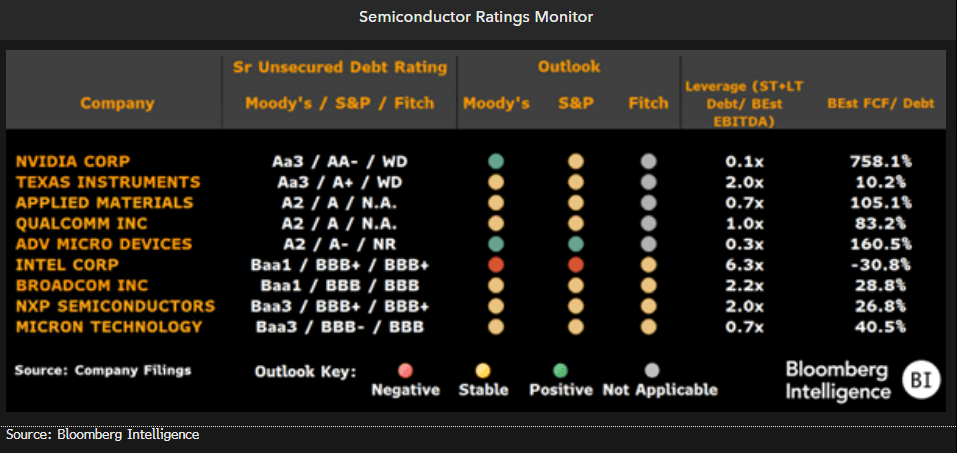

Nvidia and AMD still have positive rating outlooks, even after numerous upgrades. Intel is the only issuer in our coverage universe with ratings lowered in the past year, driven by negative free cash flow trends.

Semi revolution just starting, so Nvidia’s success isn’t the end

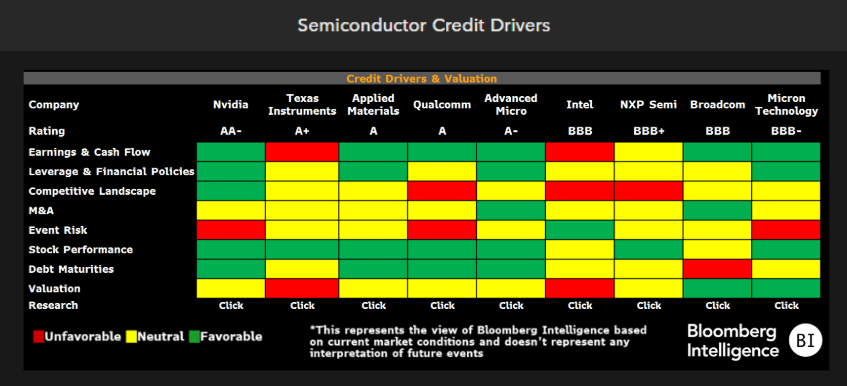

As in other technology subsectors, semiconductor designers and manufacturers aren’t homogeneous. With different products, some are clearly better positioned to take advantage of pockets of extraordinary growth, while others benefit in less dramatic increments. Their fundamental prospects, top-line growth and cash generation can vary widely, yet credit risks for the vast majority are small, as AI demand is likely to generate a larger pie of revenue for all. Those best positioned — Nvidia, AMD and Broadcom — are already reaping stock-price gains and climbing credit ratings.

Even though Intel is among those still facing mild downward pressure, the semiconductor subsector in aggregate is poised for improving financial flexibility over the next few years.

Semiconductor credit profiles show resilience

The semiconductor sector’s defensive credit characteristics have mitigated industry and macroeconomic headwinds, with overwhelmingly stable-to-positive rater outlooks. Flexibility is supported at most bond issuers by robust free cash flow and financial policies oriented toward solid investment grade ratings. A wide swath of ratings upgrades across the sector since 2022, including AMD, Nvidia, Broadcom and NXP Semiconductors appear near their cyclical peak, but remain more positively biased.

Year-to-date, the iShares Semiconductor ETF is up 13% after rising 67% in 2023 (vs. negative 35% the prior year), indicating lower concerns about fundamentals and valuations. Nvidia’s equity price is up dramatically vs. peers, lifting its market capitalization to over $3.5 trillion, highlighting expectations of sizable future demand.

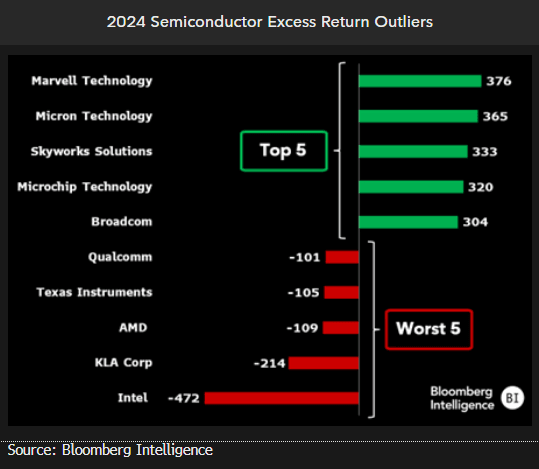

Growth doesn’t lead to better returns

Semiconductors have underperformed their high-quality corporate peers year-to-date in both spreads and total returns. With spreads for the subsector starting 2024 25% tighter than the broad index, semiconductors have widened by 1 bp as the index tightened by 23 bps. The gap is primarily attributable to the underperformance of Intel’s credit curve. The sector’s immense cash pile, robust free cash flow and low leverage mitigate volatility, yet tight relative spreads still limit outperformance potential.

From a total-return perspective, Marvell Technology (3.76%) and Micron (3.65%) are among the leading performers this year. Intel has been the worst, with 2024 total returns of negative 4.72%.

AI to reap, and require, billions but ratings can absorb outlays

Amazon.com, Microsoft, Alphabet and Meta are on course for peak revenue and Ebitda with rising artificial-intelligence demand, but the climb will require hundreds of billions in capital spending cumulatively over the next few years. Even as investment spending likely far exceeds historical highs, a variety of megacap tech leaders should be able to manage these outlays without jeopardizing the highest credit ratings within the corporate debt-issuing universe. Scale efficiencies enable rising free cash flow, which supports credit quality further down the rating spectrum for a host of issuers, including Uber.

BI’s market-sizing model suggests generative-AI demand can rise to $1.6 trillion in revenue by 2032, representing 13-15% of total tech spending.

Amazon, Alphabet, Meta, Microsoft growth won’t disturb ratings

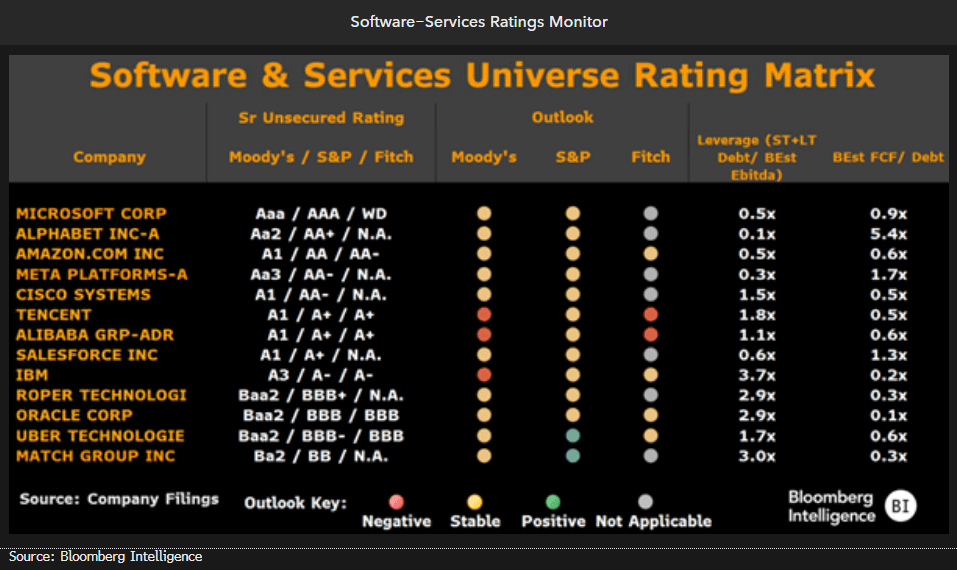

Credit metrics and ratings for software-services debt issuers are expected to continue on a stable-to-improving trajectory, as rising demand, excess liquidity and resilient cash flow mitigate broader macroeconomic uncertainty and post-election tariff concerns. Even with shareholder returns rapidly climbing at the subsector’s highest-rated issuers, substantial liquidity suggests minimal rating risk. Lower down the rating curve, positive outlooks for Uber and Match indicate upgrade potential through the end of 2025.

After a change to China’s sovereign rating in late 2023, Moody’s lowered its outlooks on Alibaba and Tencent to negative, and Fitch then followed. Despite the outlook changes, spreads on China’s largest US dollar issuers have tightened considerably over the past 12 months.

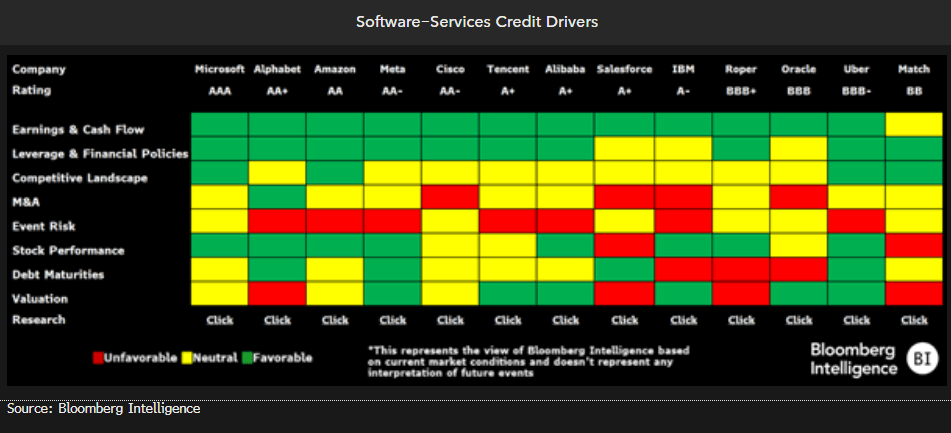

Potential to generate considerable cash flow

The BI software-services credit-drivers matrix is mixed heading into 2025, but has transitioned toward a more positive bias relative to the start of 2024. A challenging macroeconomic backdrop has slowed growth for the subsector, yet low leverage and cash-rich balance sheets provide protection for most constituents. High quality issuers including Alphabet, Microsoft, Amazon.com and Meta are each expected to generate free cash flow exceeding $50 billion in 2025, further fortifying strong balance sheets. After rising from junk, Uber (Baa2/BBB-) is expected to continue expanding annual cash generation.

Despite Moody’s negative outlook for IBM, it has ample flexibility to maintain its single A rating profile with its commitment to balance-sheet strength the key determining factor.

Tech-hardware issuers may take on Apple-like polish as AI shines

Weakness in 2024 for the highly diversified technology-hardware group appears to be at a turning point, as growth returns, leverage declines and ratings stabilize for most issuers. As the subsector verges on a rebound, credit quality in 2025 may begin to resemble that of Apple, the group’s exemplar of cash flow and defensive characteristics.

Breadth of AI windfall to widen for tech hardware in 2025

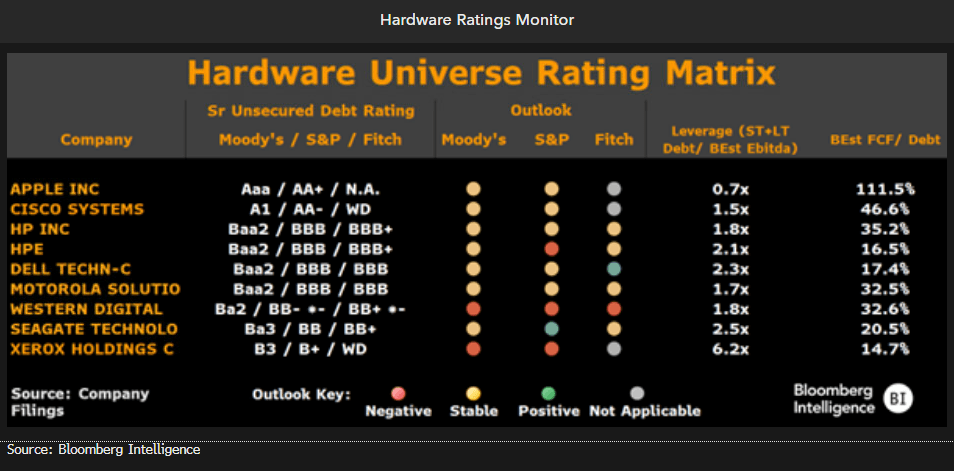

The largest technology-hardware providers, suffering low-to-negative 2024 top-line growth, appear poised to make considerable progress over the next 12 months as artificial-intelligence growth benefits an expanding range of businesses. The subsector isn’t homogeneous, yet there’s a bias toward stable ratings for most debt issuers, particularly on an absolute-dollar basis, given that fortified balance sheets and resilient cash flows limit credit-quality volatility. Seagate and Hewlett Packard Enterprise, both with negative rater outlooks, could rapidly deleverage over the next few quarters, stabilizing their credit profiles.

Apple’s (Aaa/AA+) ratings stand out as the most steady among peers, given its massive liquidity, negative net leverage and $100-plus billion of annual free cash flow.

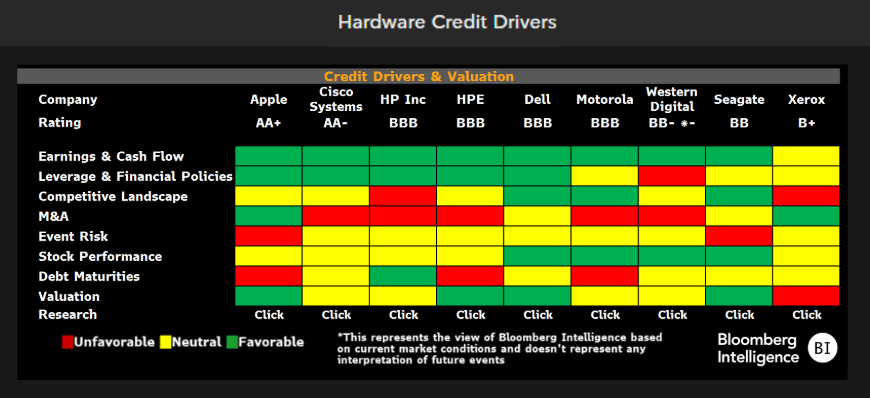

Mixed credit-driver matrix now improving

The BI credit-driver matrix monitor remains mixed, but is transitioning to more positive into year-end as an inflection point may be at hand, with 2025 consensus fundamentals for tech-hardware issuers rapidly improving. From a credit perspective, excess liquidity and consistent cash generation at HP, Motorola, Dell, Cisco and others provide intermediate-term ratings stability, if not mild upside.

After modest bond widening relative to peers, potential value has emerged across high grade and high yield hardware debt issuers. This year and 2023 may ultimately prove to be a trough for fundamentals, though balance-sheet repair and ratings recovery are unlikely to substantially appear until 2H25.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.