ARTICLE

Dell, HPE, Lenovo look to AI in $252 billion server market

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Industry Analyst Woo Jin Ho. It appeared first on the Bloomberg Terminal.

Dell, HPE and Lenovo aim for a bigger slice of an AI-server market set to grow 55% in 2025, reaching $252 billion, estimates show. Hyperscale cloud may drive the bulk of the gain, yet tier-2 providers like Tesla and Coreweave are taking a greater role. Though gross margin might remain a drag, we believe it’ll reach the midteens amid better GPU availability and demand.

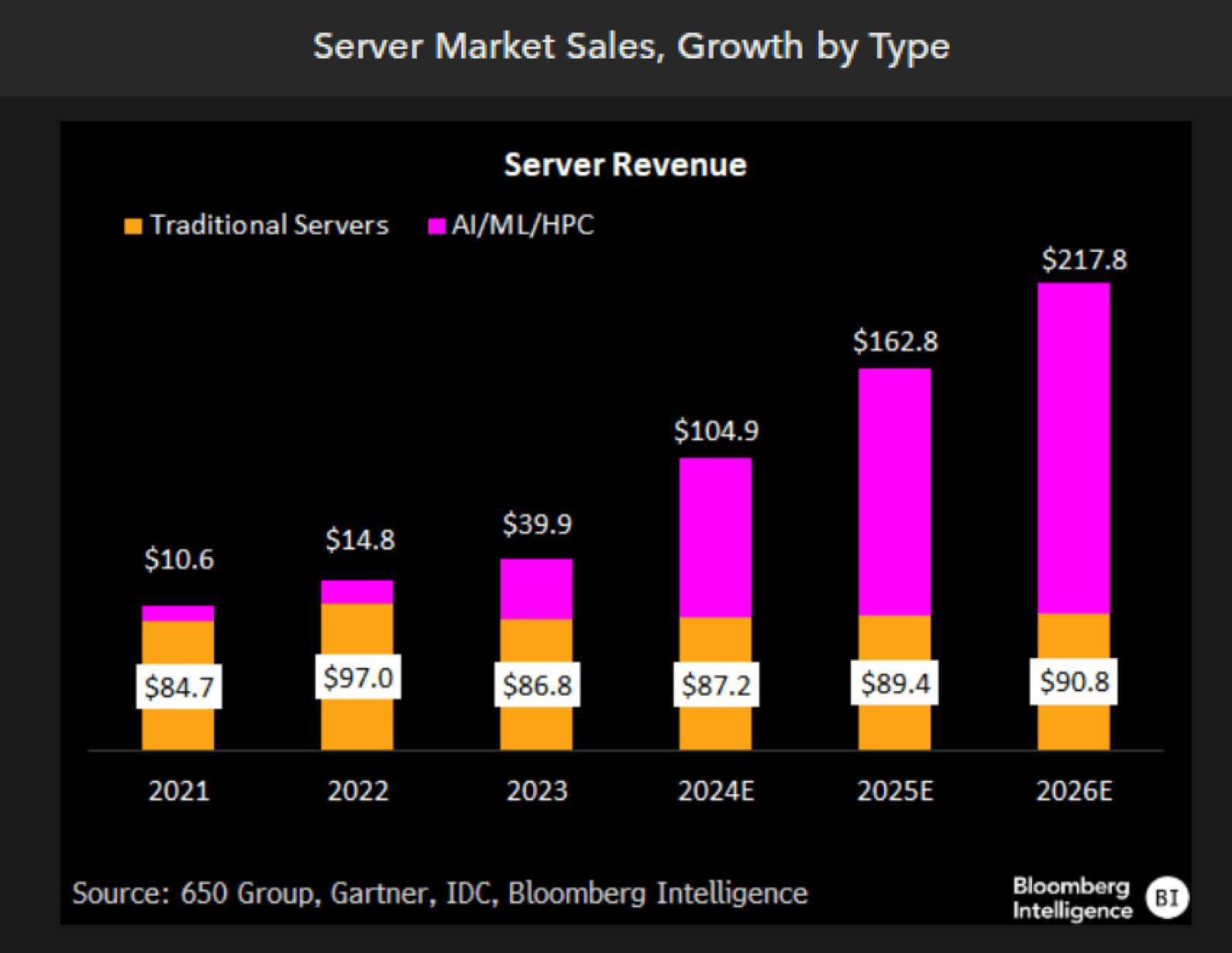

AI’s 55% sales-growth foundation for server renaissance

Dell, HPE and Lenovo are among the providers seeking a bigger share of the server market that’s poised to widen 31%, based on our analysis and estimates from 650 Group and IDC. Robust uptake in AI servers is fueling market gains — 55% to $162 billion. Sustaining this momentum is the buildout of bigger server clusters that could approach 200,000 GPU, suppporting larger-scale language models that can reach several trillions of parameters.

The strength in AI eclipses the 3% growth to $89 billion in the more mature traditional server markets, which is recovering amid the need to modernize fleets to complement the AI-server rollout.

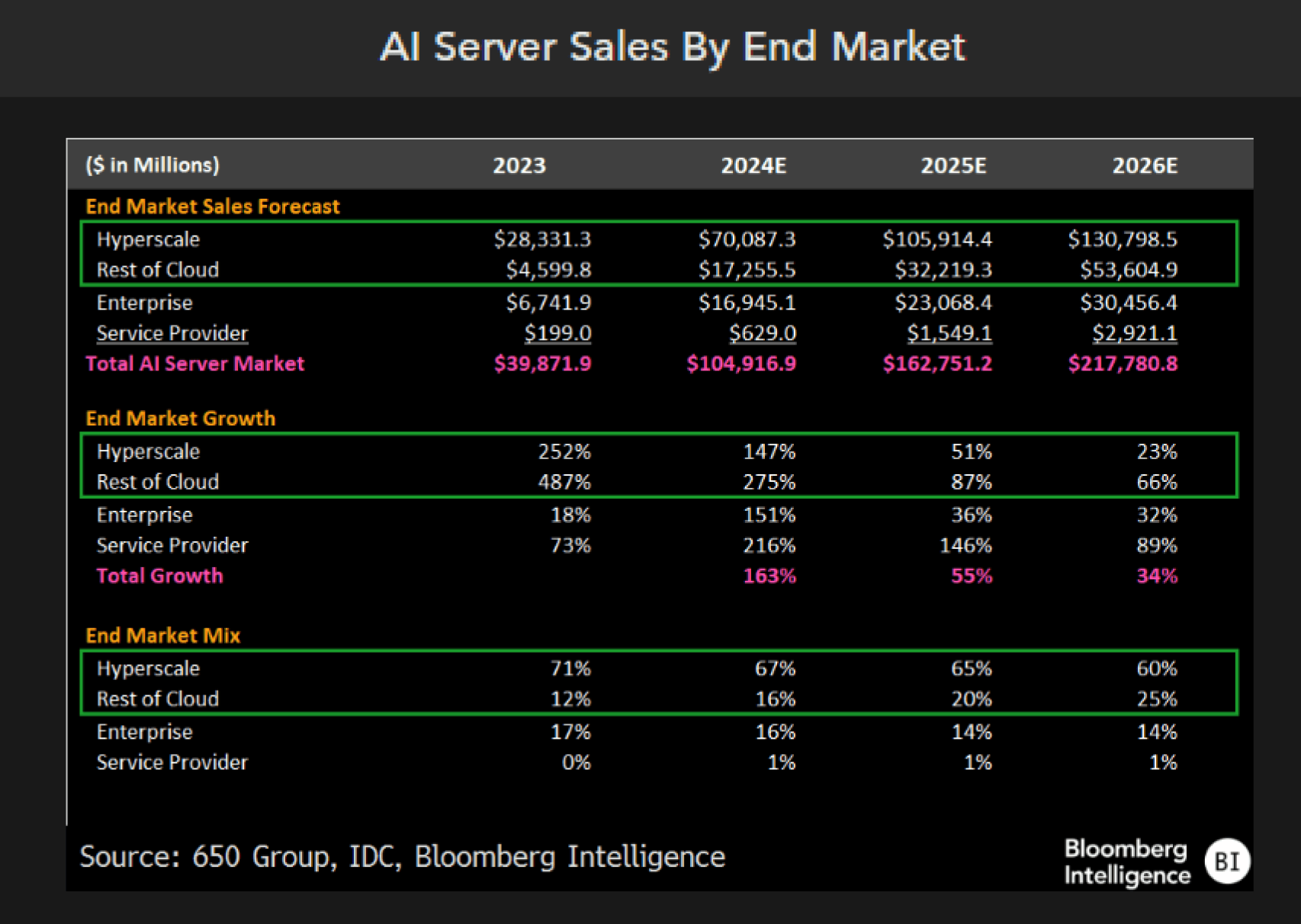

Bigger models, larger clusters fuel AI-server growth

The race to build larger foundational models by hyperscale and tier-2 cloud and sovereigns is fueling sustained AI-server sales momentum into 2025, which is set to grow 55% to $163 million, according to 650 Group. Nvidia’s Blackwell product cycle is a sales tailwind, leading to server racks valued at up to $3-$4 million apiece vs. $1.5-$3 million for fully loaded racks in the Hopper cycle. Hyperscale and tier-2 cloud providers could begin deploying AI-server clusters with as many as 100,000 GPUs, with some reaching 200,000. This could lead to more and bigger deals.

Enterprise customers may start adding to growth as they roll out and ramp up in-house AI. Enterprise is likely to make up 36% of industry sales ($23 billion) in 2025, 650 Group estimates show.

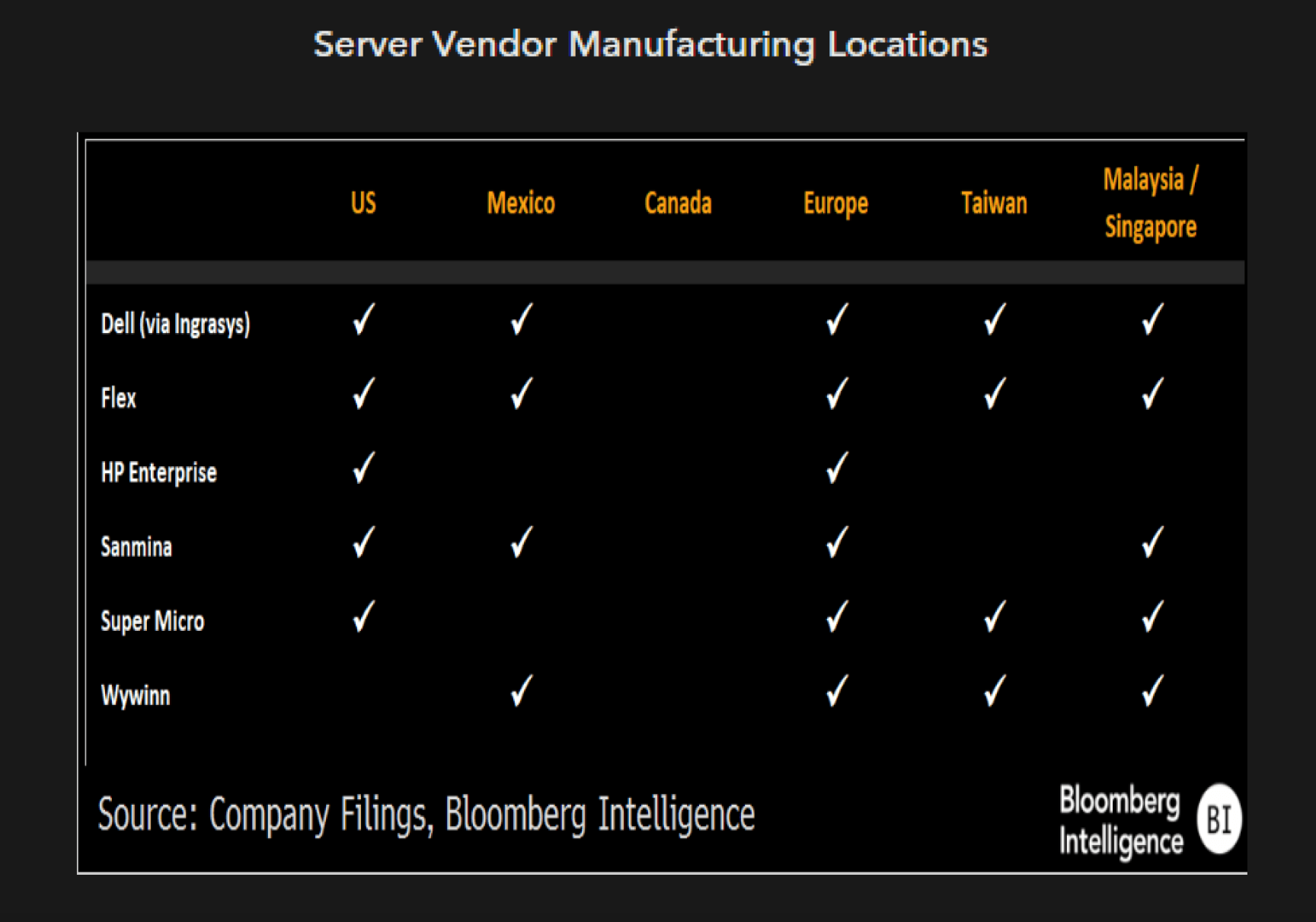

AI supply chain appears set for Trump-trade stance

The regional nature of the AI-server manufacturing supply chain could mitigate heightened trade concerns and China tensions in president-elect Donald Trump’s second term. Most key AI-server components — GPUs, CPUs and high-bandwidth memory — are designed and made outside of China and won’t be affected. Other aspects, like high-speed optics, largely moved their manufacturing out of China in Trump’s first term.

Server assemblers and manufacturers are already regionally aligned, aided by 2018’s supply-chain adjustments. Yet security and data sovereignty sensitivities related to cloud computing has led to regional manufacturing, which has extended into AI servers.

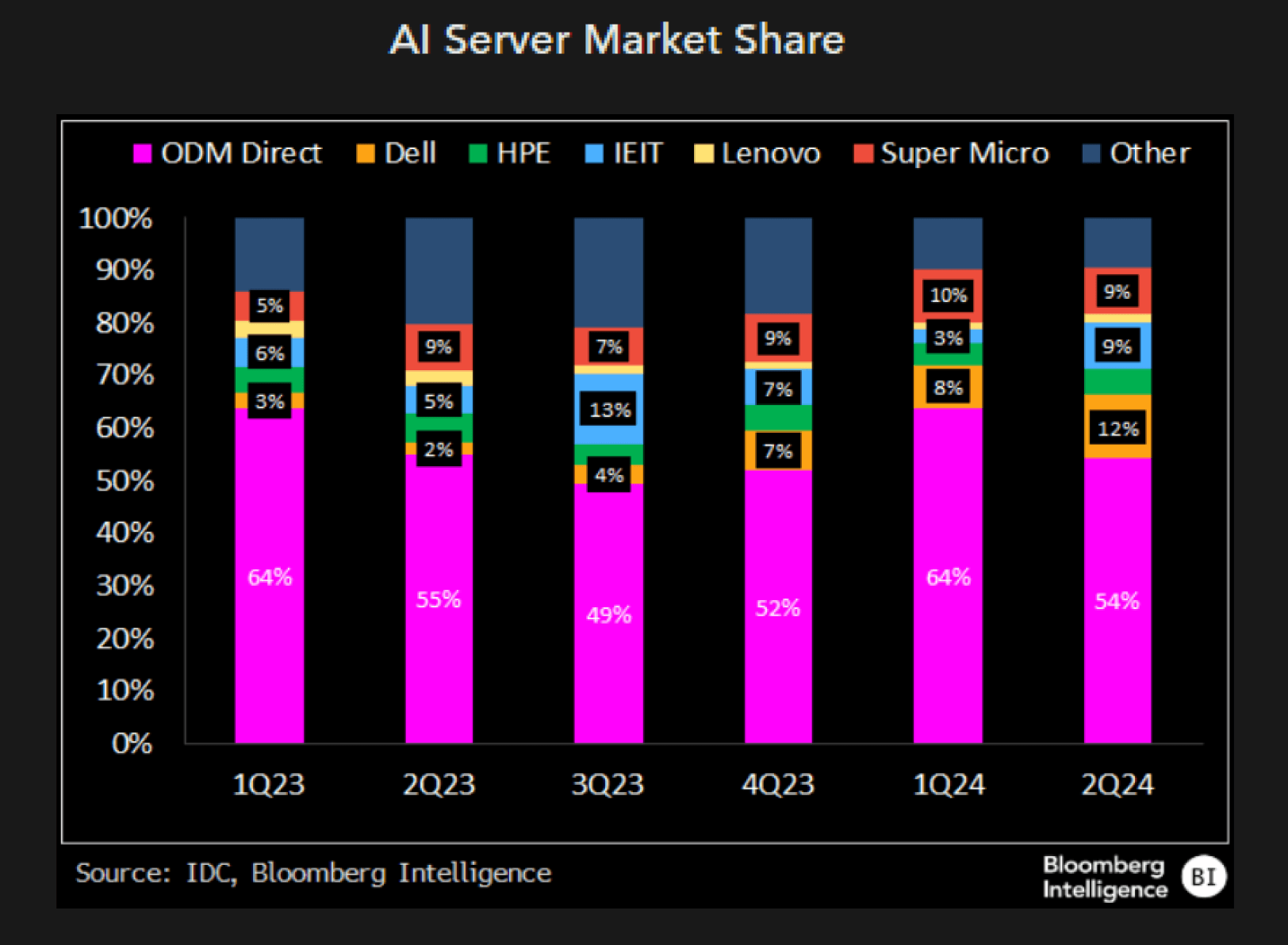

Dell, Lenovo part of a bigger competitive landscape

The AI-server competitive landscape will intensify in 2025 as more traditional electronic manufacturer-service (EMS) providers build at scale. Pegatron, Foxconn, Sanmina and Wywinn are among the hardware makers set to expand their roles in the Blackwell GPU product cycle, competing with Dell and Super Micro for hyperscale, tier-2 cloud and enterprise customers. The AI-server market should be able to support a large number of vendors, given its size.

Market share may be determined by GPU allocation and availability, regional and global manufacturing footprint and customer exposure. Liquid-cooling capabilities could prove to be a differentiator for HPE and others in larger, clustered deals.

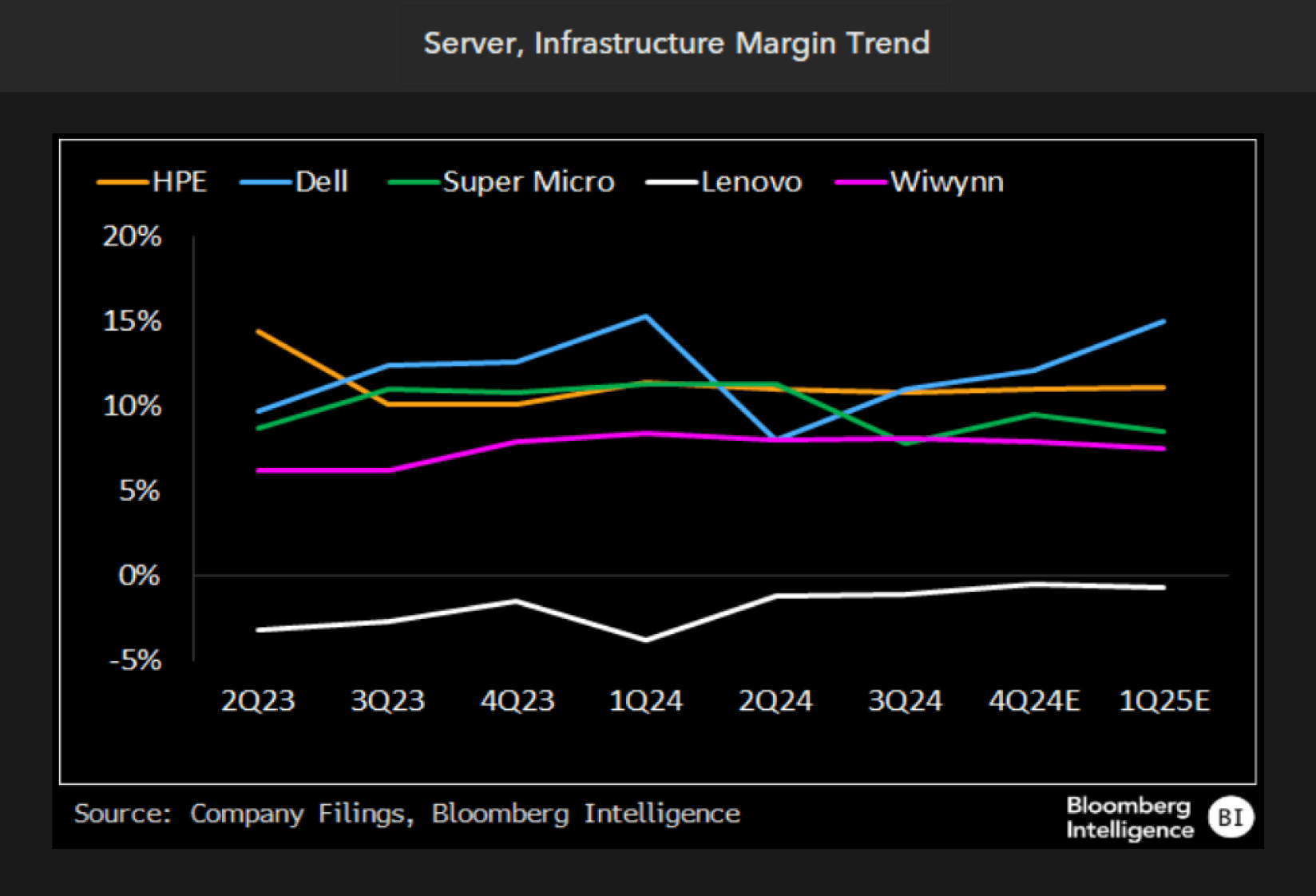

AI-Server margin less of a drag in 2025

AI-server margin could be less of drag on earnings growth in 2025 vs. 2024, with the competitive landscape likely keeping gross margin below 20-22% for traditional servers. Yet that might improve to the midteens vs. 2024’s low teens, aided by evolving supplier and market dynamics. That’s as GPU competition by AMD and Nvidia may boost component pricing. We expect broader demand from smaller-sized enterprises and sovereign entities that might lead to fewer price concessions, favoring bellwether server providers Dell, HPE and Lenovo.

Dell and HPE have pared costs to mitigate lower AI server margin. This should aid profit-margin dollars, but we see it as a temporary fix. until AI-server margin improves.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.