Will commodities be spared from the Great Reversion of 2022?

This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

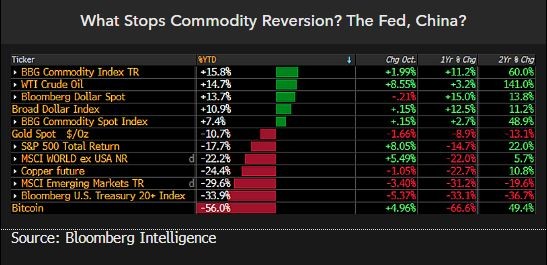

Commodities face pressure as the Federal Reserve intensifies its tightening in the world’s largest economy despite deflating financial markets, while an increasingly autocratic leadership threatens growth in China. Though the Bloomberg Commodity Index Total Return was up about 15% in 2022 to the end of October, it may be at greater risk of following a 20% decline by the S&P 500 and copper. It’s a question of what might stop the typical process of commodities being their own worst enemy when they spike and strain global GDP, and add incentives for the most central banks in history tightening in a bid to reduce inflation.

In times of stress, commodities often revert toward their costs of production and in the world’s largest producer of crude oil and corn — the US — that’s about $40 a barrel and $4 a bushel.

Don’t fight the Fed, fading global GDP may not spare commodities

The risk of some form of nuclear attack in the Russia-Ukraine war and related supply disruptions are catalysts for grain prices, but central banks intensifying tightening despite the world tilting toward recession is a top headwind for broad commodities. Material prices typically get too cold and help reset economies, but they remain quite warm at the end of October.

Bottom for commodities, China equities elusive

An increasingly autocratic Chinese leadership shifting focus away from growth that had been the greatest demand driver for commodities over two decades is a problem for prices. Add to the mix the most central banks in history hiking rates as stocks, bond markets and global GDP decline, and it’s clear commodity-price resistance is becoming more entrenched. Our graphic shows what could augur a bottom: a trough in the MSCI China Index. The Bloomberg Commodity Spot Subindex appears relatively elevated at the end of October vs. slumping equity prices in China (on an auto-scale basis since 2000).

China’s sinking equities have joined downward trajectories in the yuan and interest rates, on the back of pandemic-driven lockdowns and a potentially extended property crisis.

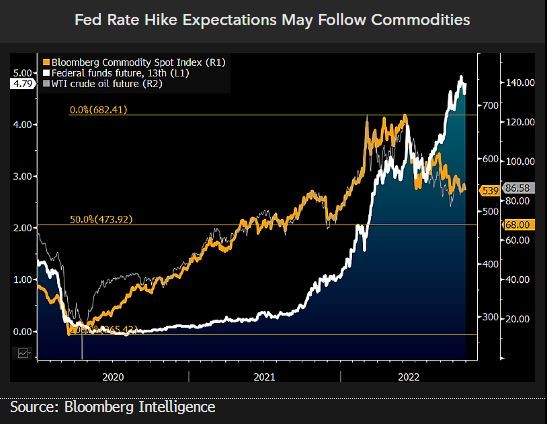

What stops commodity price reversion? Not the Fed

There may be little to stop broad commodity prices from reverting lower, especially as Federal Reserve rate-hike expectations continue to rise. The spike in commodities in 1H accelerated the pace of rate hikes, and our graphic shows the recent disparity of the declining Bloomberg Commodity Spot Index (BCOM) vs. the still-rising one-year federal funds future (FF13). About the halfway mark from the 2020 low to 2022 peak may be gaining force as target support as declining stocks, copper and industrial metals weigh on the BCOM. For WTI, an equivalent level may be the 2021 average price of about $68 a barrel vs. about $86 at the end of October.

The key question may be what stops downward reversion in most risk assets, notably commodities, and we see a plateau low enough to mute inflation forces and stop central-bank rate hikes.

Reverting commodities may help bottom bonds

If the lone major asset class to rally in 1H — commodities — doesn’t continue to revert lower along with the stock market, central-bank tightening may intensify as the world tilts toward recession. This is the state of play at the end of October and we see greater potential for the Bloomberg Commodity Index, at the top of the 2022 scorecard, to trade places with the Bloomberg US Treasury 20+ Index near the bottom. Declining commodities into 2023 may fit better with the Bloomberg Economics recession-probability model at 100% during President Joe Biden’s administration and that US yields may have peaked.

Were one to look back at the performance a year from now, commodities might appear as the sore-thumb asset class, which if it didn’t drop would suggest the world is more likely to enter an enduring recession.

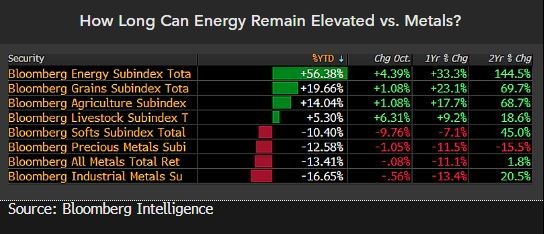

The energy sector risks following industrial metals

Up about 100% in 2022 at its peak in June, the current gain of 60% in the Bloomberg Energy Subindex Total Return may be at greater risk of following industrial metals down closer to 17% to the end of October. The lose-lose for broad commodities is if the energy sector doesn’t drop and help relieve global economic and inflation stress, the most central banks in history intensifying tightening are more likely to stay that course. What’s typical is energy and commodities tend to drop with global GDP and help the reset process.

Our key question at the start of November, is what stops this process? Not the Fed. Not the fact that the cost of production in the US, the world’s largest producer of crude and corn, is almost double the price. Additional commodity headwinds come from China’s increasingly autocratic leadership.