UMR phases 5 & 6: Margin rules to alter derivatives market

This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Robert Mackenzie Smith. It appeared first on the Bloomberg Terminal.

The number of counterparties set to be hit by extra trading costs will hit an all-time high on Sept. 1 as the next phase of the initial margin (IM) rules for non-cleared derivatives, commonly referred to as “UMR,” takes effect. After a one-year delay due to Covid-19, any entity that traded non-cleared derivatives exceeding an average notional value of $50 billion in March-May and has an IM transfer threshold of above $50 million will be subject to the rules.

UMR might change derivatives trading

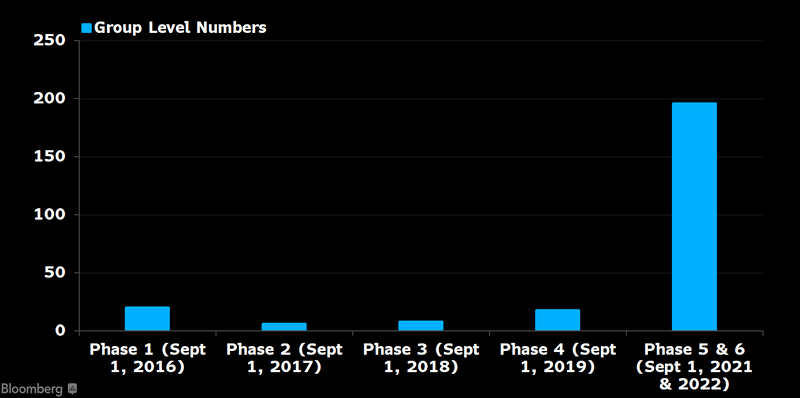

The next phase of the initial margin rules for non-cleared swaps, “Phase 5,” will affect the largest number of firms to date. According to the International Swaps and Derivatives Association (ISDA), about 314 counterparties will start exchanging IM starting Sept. 1, with another 775 complying 12 months later in Phase 6.

From a group level, both phases will see 196 firms begin exchanging IM vs. 52 in the four previous phases, which predominantly brought banks under UMR. This is the biggest change yet to the landscape of non-cleared derivatives trading and places additional operational burdens onto buy-side firms. Primarily hedge funds and insurance firms will come into scope in Phase 5, and they may alter trading styles to reduce costs.

Number of firms hit by UMR

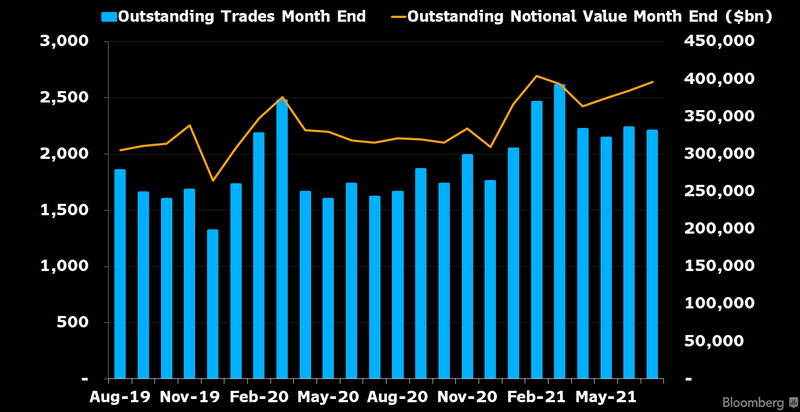

NDFs, options could face biggest change

A wide range of over-the-counter derivatives are in scope for UMR, but some asset classes already see a majority of trades centrally cleared. According to ISDA data, 76% and 79%, respectively, of interest rate and credit derivatives were centrally cleared in 2Q.

The FX market could see the biggest jump of centrally cleared activity. Weekly swaps reports published by the Commodity Futures Trading Commission reveal that just over 2% of the FX derivatives market is centrally cleared, meaning it’s the area with most room to grow. Products like options and non-deliverable forwards are already cleared at major clearing houses and have seen volume increase.

Cleared FX at ForexClear grows

SEC rules come too late for Archegos

In the wake of the meltdown of Archegos Capital Management, attention has turned to the opaque bank margining practices of non-cleared security-based swaps. Derivatives such as total return swaps, which helped take down Archegos, are covered by UMR under the U.S. Securities and Exchange Commission’s version of the rules, which were due to come into effect on Oct. 6.

But lobbying from ISDA and the Securities Industry and Financial Markets Association has delayed this adoption until Sept. 1, 2022 in order to align with Phase 6 adoption from other regulators. This relief will help firms focus on UMR for other instruments, such as FX and interest rates, but will keep the opaque margining practices at large for security-based swaps at large until Phase 6, estimated to affect 4,352 counterparties.

Excerpt of SEC letter to ISDA on Aug. 5