This analysis is by Bloomberg Intelligence Senior Analysts Edmond Christou and Lea El-Hage. It appeared first on the Bloomberg Terminal.

A slowing global economy and elevated interest rates could test the Dubai property market’s resilience to external shocks. The Gulf region’s biggest gains since the pandemic’s peak came from the United Arab Emirates’ property markets — and Dubai in particular — after reforms that boosted its worldwide connectivity and safe-haven status, attracting foreign-money inflows. Developers are betting on a new wave of interest from investors in the mid-segment, while rescheduling 2023 housing-unit deliveries to keep supply-demand imbalances. Commercial demand may remain resilient due to limited availability of high-quality and green offices.

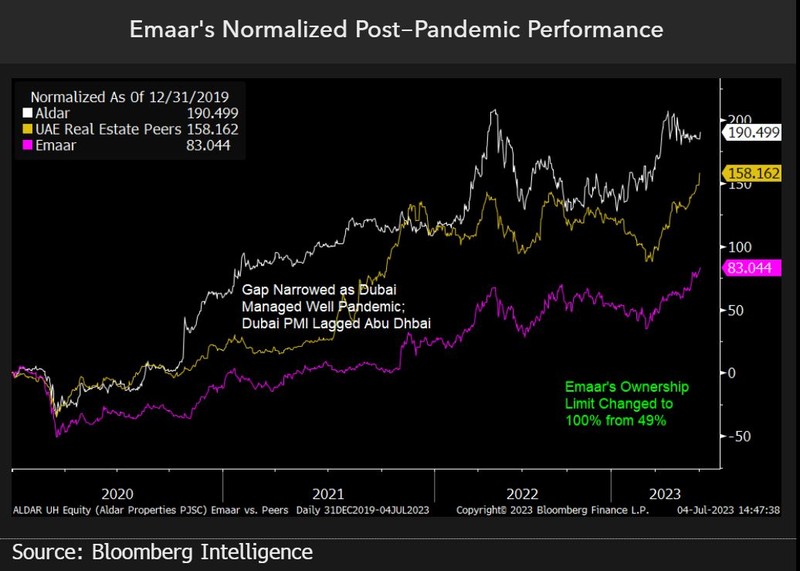

UAE developer valuations and solid share-price gains since 2021 have relied on Dubai’s property boom and their ESG ratings. Aldar Properties has surged 191% since 2019 vs. 83% for Emaar Properties, which trails peers performance of 158%. Emaar trades at a discount to net asset value, while more ESG funds hold Aldar due to its strong rating.

Still work ahead to close underperforming Emaar discount gap

Emaar Properties raised its foreign-ownership limit to 100% on Oct. 25 (49% prior) yet the share price continued to underperform UAE real estate peers. Emaar’s performance gap to Aldar has nevertheless narrowed since 2021, helped by the strong revival of Dubai’s real estate market. Emaar trades at a forward price-to-book ratio (P/B) of 0.8x (vs. 1.3x for Aldar), at par with its historical P/B (below peer median of 0.6x). A slowing global economy, lower oil prices and widespread uncertainties are threats to robust real estate momentum through 2023.

Emaar’s 2023 dividend yield improved to 3.1%, closing the gap against Rival Aldar’s 3.3%. The implied cost of equity for Aldar is 8% vs. 14% for Emaar (8% for peers). Clarity on divided policy over 2-3 years and a regular engagement with investors has helped the rating.

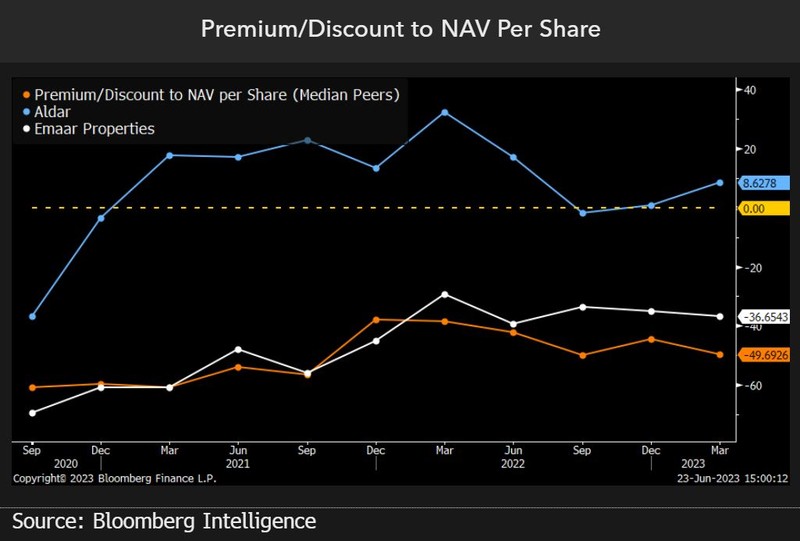

Emaar Group at discount as UAE developer 24% below fair value

Emaar Properties has been trading at a discount to its net asset value (NAV), narrowing to 37% in 1Q (36% in 2022) vs. 48% in 2021, especially vs. peer Aldar since last year. Yet Aldar traded at no premium last year after 3Q22’s inclusion of Apollo’s 11.1% minority interest into the NAV. Yet Aldar is back trading this year at a premium. Emaar’s UAE Development (its largest unit) market value is 24% below our calculated NAV of about 30 billion dirham. Emaar Development market value is 39% of Emaar group capitalization. When Emaar Malls was delisted, its market value was 34 billion dirham (67% of Emaar Properties’ market cap).

Emaar Misr is performing well, with a 2022 margin of 45%, but makes up 8% of Emaar group’s gross asset value vs. 29% from its overseas arm. The legacy book in India is being cleaned up to boost returns.

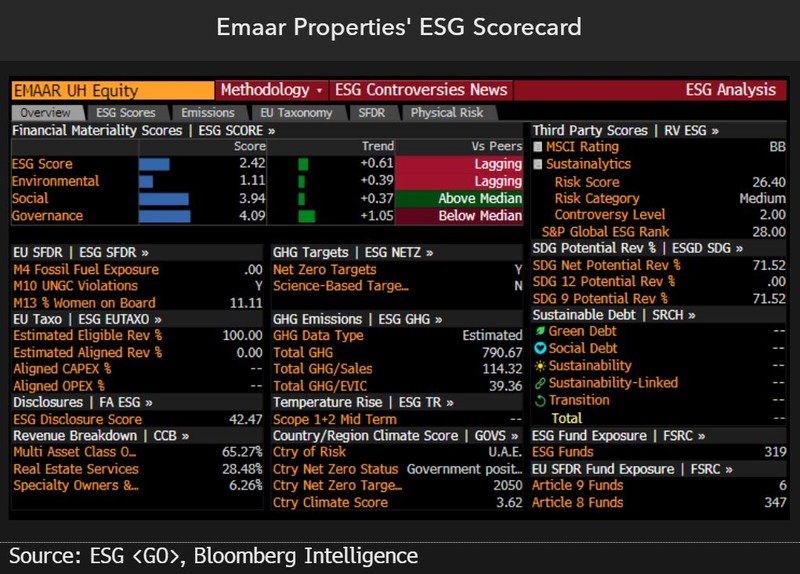

Emaar needs to lift its peer-lagging ESG score

Emaar Properties’ overall ESG Bloomberg score lags peers, with an improvement of 0.61 points over two years. Its environmental score is at 1.11 points (0.39 points higher) and is behind peers. Yet, its social score is above median at 3.94 points and up 0.37 points. Despite being above the median in some areas of governance (like executive compensation and board independence), the overall 4.09 score is below peers’ median. The scores range from 0 to 10; 10 is better.

Emaar scores zero on energy management, but leads in GHG emissions and water management. Yet the former should be given the highest priority, as the IEA has reported that buildings and construction are responsible for one third of global final-energy consumption. GHG emissions management is at the lower end of the spectrum for real-estate developers.

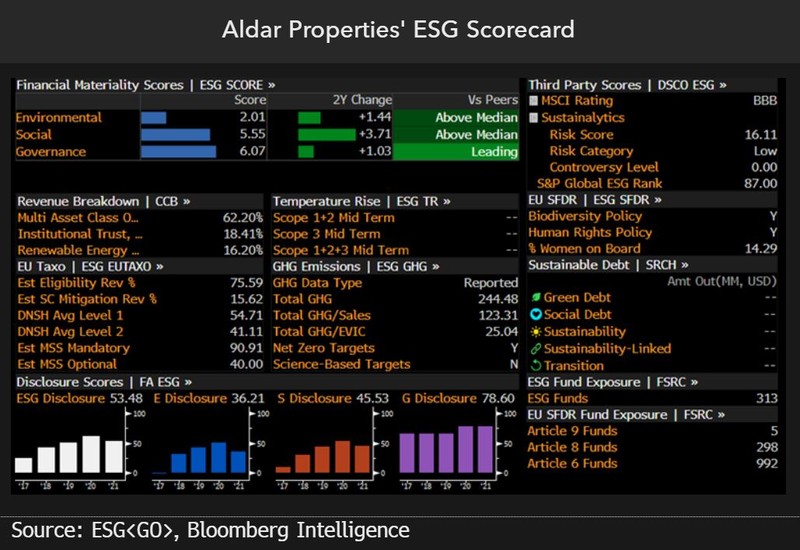

International investors’ ESG lens could shift toward Aldar

Aldar’s stellar ESG scores may put the company at the forefront of international investors’ radar vs. regional peer Emaar Properties. This is evident in the higher number of ESG funds holding the former, at 313 funds vs. 270 for Emaar. The company’s Bloomberg ESG scores (scaled to 10) surpass global peers in all environmental, social and governance categories. Aldar’s environmental score improved in the last two years, to reach 2.3 (1.1 for its rival Emaar), and its governance score rose by 1.03 points to 6.07 (4.1 for Emaar). Its biggest advance was in the social score, improving to 5.1 from 3.5 in 2019 (3.9 points for Emaar).

Third-party providers have also ranked Aldar highly, with MSCI rating at BBB (AAA is the highest) and 94 out of 100 from S&P. Emaar has an MSCI rating of BB and an S&P score of 28.