This analysis is by Bloomberg Intelligence Senior Industry Analyst Jonathan Palmer and Senior Government Duane Wright. It appeared first on the Bloomberg Terminal.

Digital-health use accelerated during the Covid-19 pandemic and is now set to shape demand for tools that can add greater efficiency to the delivery of care as well as aid discovery of novel interventional approaches. Rising health-care costs and the shift to new payment models in this $4 trillion market will increase the focus on care outside of traditional settings, which will rely heavily on connected technologies. Profound changes are underway in virtual care, treatment of chronic conditions and the expanded use of real-world evidence.

We project telehealth will eclipse $20 billion in revenue by 2027 and a $12 billion opportunity in glucose monitors. Big tech isn’t resting on its laurels as it seeks to capture $25 billion in new revenue from emerging technologies by leveraging recent M&A in the sector.

Telehealth set to eclipse $20 billion, see 15% of visits by 2027

Health-care delivery via telehealth will continue to accelerate after the industry’s sea change in value with the pandemic. We believe the channel could reach $20 billion in revenue and represent 15% of outpatient visits by 2027 as barriers to adoption fall and new offerings such as virtual primary care take root. Incumbents like Teladoc and large managed-care companies will drive the next leg of growth.

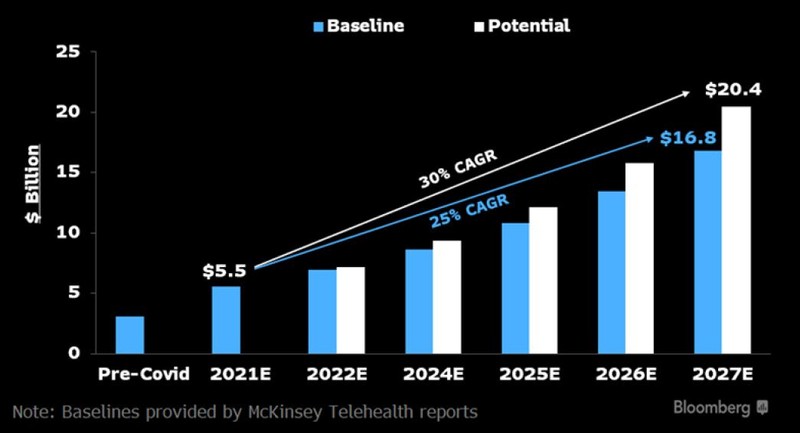

Revenue poised to reach $20 billion by 2027

Teleheath is set to become a staple of health-care delivery as our scenario analysis points to as much as $20 billion in U.S. revenue by 2027. This assumes annual growth for the platforms of 30%, which we believe has been catalyzed by multiple waves of the pandemic and will further expand with a flood of virtual primary-care offerings from both major managed-care companies and technology upstarts. Our view on the overall market growth is informed by Teladoc’s projections as the leading player, consensus across public equities and a premise that growth will accelerate as the fragmented market consolidates and investments by managed care rise dramatically.

At a minimum, we foresee the market expanding by 25% annually which essentially triples revenues to almost $17 billion in 2027.

U.S telehealth revenue scenarios

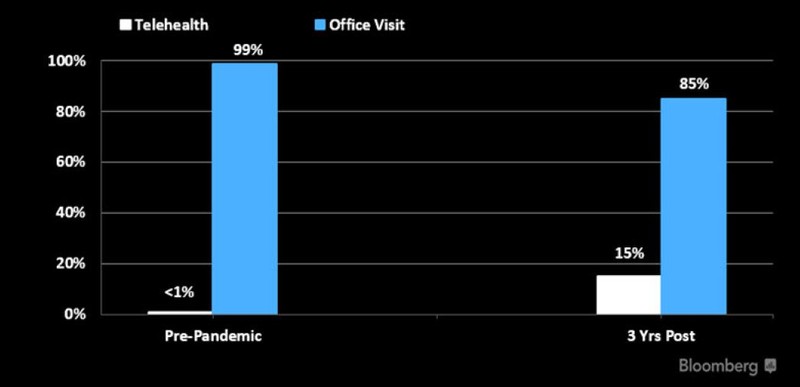

15% of Visits could be virtual in 5 years

Telehealth visits could reach 15% of total outpatient visits within 3-5 years, based on the seismic shifts in behavior and investments in technology due to the pandemic, in addition to the proliferation of virtual primary-care offerings coming to market. Studies showed telehealth reaching up to 50% of total visits in some regions of the U.S. during the worst of the pandemic, though these were likely due to necessity and were on dramatically reduced total visits. We don’t view the 15% estimate as a peak, but rather a waypoint as digital increasingly becomes the front door to health care.

Our methodology is based on a bottom-up analysis. We established an upper bound by cross-referencing claim trends from multiple sources (pre-, during, post-pandemic) by category against the CDC’s 2018 National Ambulatory Medical Care survey.

Breakdown of visits after pandemic normalizes

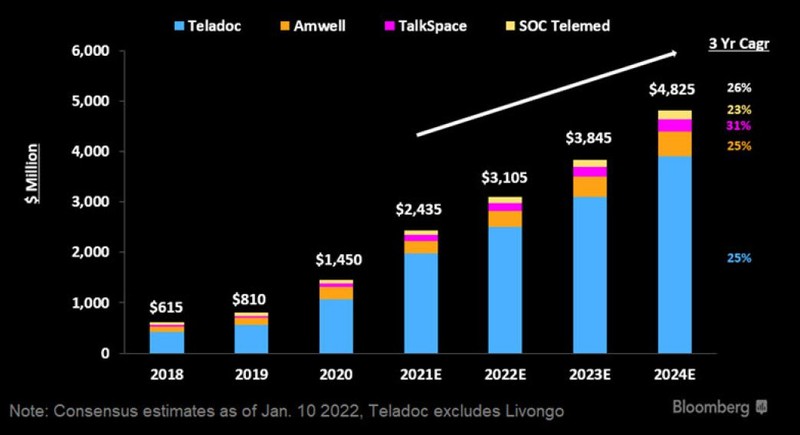

Revenue projections support adoption narrative

Revenue consensus for public telehealth companies supports our view on the massive change underway. The forward three-year compound annual growth of the group is more than 25% and sales in 2021 have tripled from a pre-pandemic base year of 2019. Teladoc represents the lion’s share of revenue but even it is expected to deliver rapid growth off its larger base. The exhibit is illustrative: it doesn’t account for the dearth of private companies, those acquired by larger managed-care companies (like MDLive at Cigna) and extension of telehealth across multiple consumer and patient platforms like those at GoodRx or OneMedical.

We expect increasing consolidation of related assets and businesses as the incumbents at scale increasingly view the virtual channel as a must-have offering within their portfolio.

Consensus projections of telehealth providers

Perfect storm of catalysts spurring next wave of growth

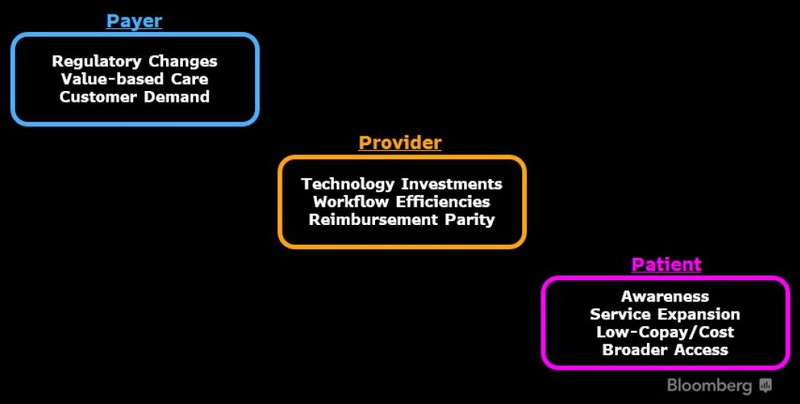

Catalysts to expand the adoption of telehealth abound across the key stakeholders. The pandemic accelerated the industry’s rate of uptake by a factor of years and has created a flywheel effect for the overall virtual ecosystem. The changes in health-care delivery necessitated by shelter-in-place edicts raised awareness and showcased the capabilities of the virtual channel across both patients and physicians. This in turn resulted in increased technology investments by providers and health systems, which are increasingly leveraging the assets to provide care and reduce costs.

Payers have moved more significantly into the space as their customers demand digital solutions and the advent of virtual primary-care programs adds another facet in the drive to value-based care.

Catalysts for telehealth adoption