The battle to break China’s battery-making supremacy, in five charts

The COP27 summit that has just drawn to a close was all about finding common ground and working together to tackle the climate crisis. But the race to net-zero emissions isn’t just a collective journey the world must undertake together, it is also a competition between countries to secure the resources required to power their individual energy transitions.

The Covid-19 pandemic and fallout from Russia’s invasion of Ukraine have underscored the need for robust supply chains, sparking a retreat from globalization as production is brought closer to home. This is especially clear in the battery industry as the likes of Europe and the US look to break free of their dependency on China and build their own local ecosystems.

Batteries will be crucial to sustain the electric vehicle boom and balance electricity grids as renewables become more prevalent. China’s rivals will have to significantly step up their game — and fast — if they want to have a chance of meeting their share of the anticipated explosion in demand.

Here are five charts from BloombergNEF on how this clean energy battle is playing out.

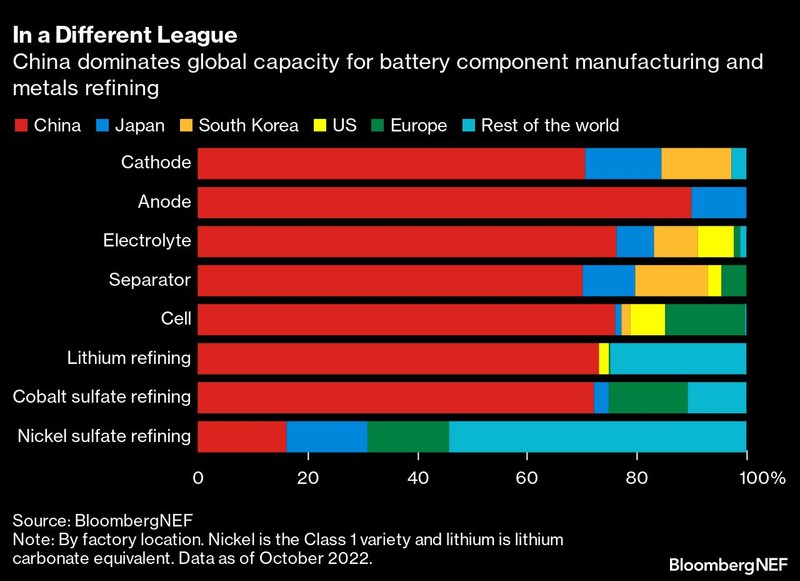

1. All roads (or at least most) lead to China

China is a manufacturing powerhouse in general and moving early in batteries means it now has a stranglehold across much of the industry’s supply chain. Having amassed strategic positions at every stage of the battery production process — from mining of raw materials around the globe through to final assembly at home — China has made itself almost indispensable for other countries when it comes to meeting their climate goals.

As competitors seek to become more self-sufficient and curb their dependence on China, they face an enormous challenge. Right now, to procure the batteries needed to decarbonize transport and prepare electricity grids for more intermittent renewables, the world relies on China for around 75% of lithium refining and cell manufacturing capacity. That proportion is even higher for components such as anodes and electrolytes.

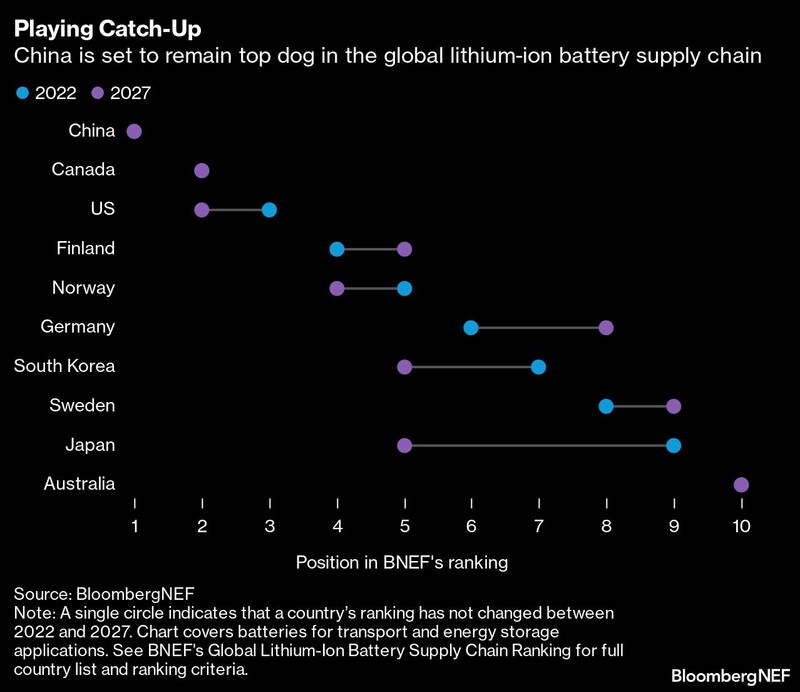

2. China is set to remain in the lead

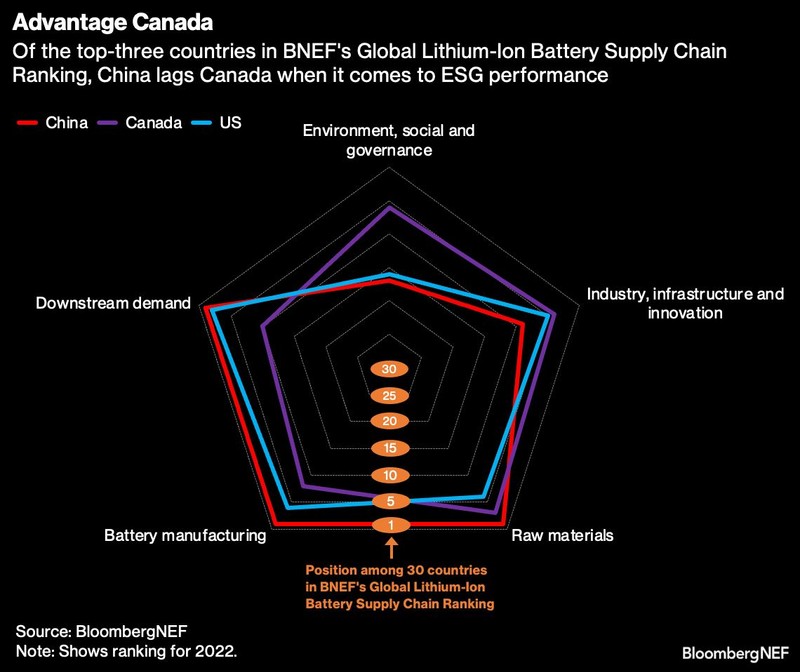

China’s dominance in the global battery supply chain is expected to continue. It has topped BNEF’s ranking of 30 leading countries for three years in a row and is projected to remain in the number one position in five years’ time as well.

Its closest competitors are in North America, with Canada having climbed from fifth to second in this year’s ranking thanks to efforts to exploit its metals resources and growing appeal as a location for battery manufacturing.

Automaking giant General Motors Co., for example, has teamed up with South Korea’s Posco Chemical Co. in a $327 million joint venture to build a cathode plant in Quebec. The province could also see another cathode production facility established if a reported partnership between Ford Motor Co., cell manufacturer Sk On Co. and component maker EcoPro BM Co. comes to pass.

Canada leapfrogged the US in this year’s ranking, although the two countries are projected to come joint second in 2027. The US will enjoy tailwinds from the Inflation Reduction Act passed over the summer, which will accelerate downstream demand for both EVs and stationary energy storage, and also bolster the domestic supply chain through incentives for localized production.

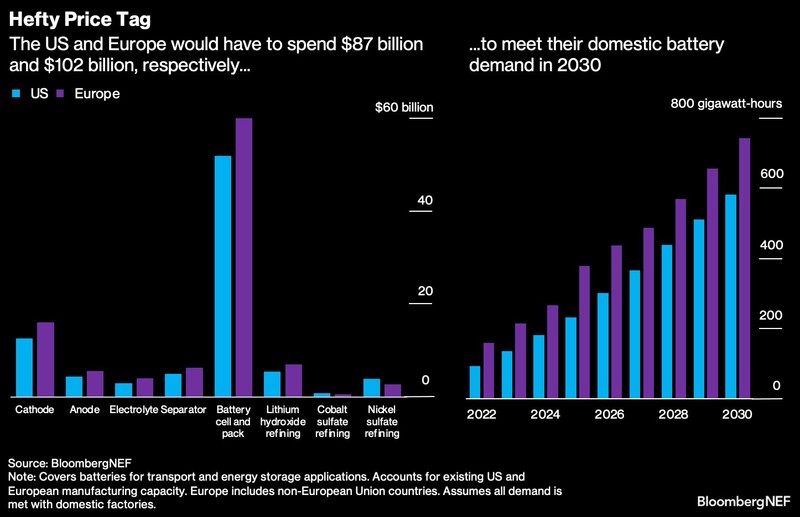

3. The battery arms race will be an expensive endeavor

Eroding China’s dominance in the battery industry won’t be easy — or cheap. The latter stages of production, in particular, are more capital intensive and technologically complex.

BNEF estimates the US and Europe — two of the main players looking to establish regional hubs to rival China — will have to invest a whopping $87 billion and $102 billion, respectively, across the supply chain to meet their forecast domestic battery demand in 2030. These sums could be even higher if inflationary pressures persist.

Building battery manufacturing capacity is by far the largest upfront expense and costs average $100 million a gigawatt-hour in North America versus $60 million a gigawatt-hour in China.

There are then also operating costs to account for, which are typically higher than in China, though that’s assuming projects are first able to overcome barriers such as lengthy permitting processes. A US lithium refiner, for example, usually pays 1.3 times as much for power and 2.9 times as much for labor than a Chinese counterpart.

Expertise isn’t something that should be overlooked either. While collaborations with foreign manufacturers from Japan and South Korea remain welcome in the US and Europe, any protectionist policies that make it harder for experienced Chinese battery makers to set up shop abroad could hinder the transfer of knowledge, particularly for cutting-edge technologies.

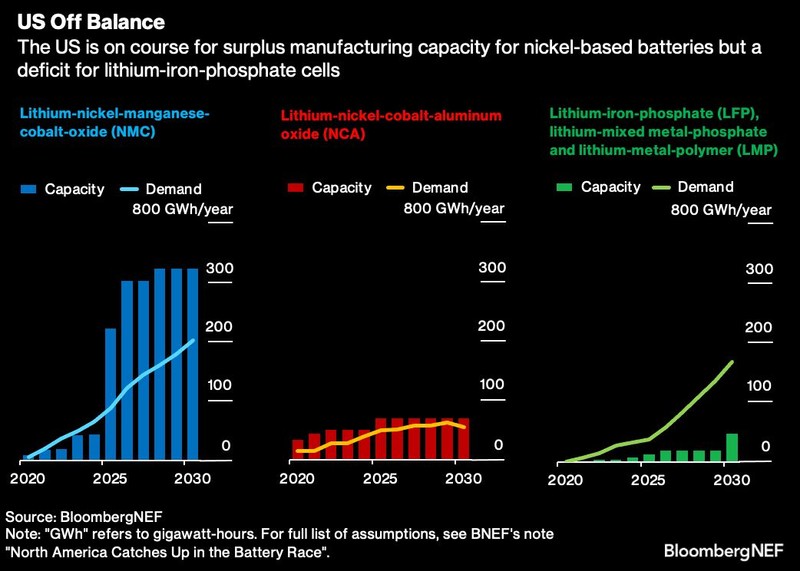

4. US headed in right direction but risks remain

Landmark climate legislation in the US in the form of the Inflation Reduction Act has made it more attractive to invest in the country’s battery supply chain. Automakers face domestic sourcing requirements for battery components to be eligible for EV tax credits and there are also production incentives for localized battery manufacturing.

The EV tax credit also hinges on a certain share of critical minerals being produced in the US or in countries with which it has a free trade agreement. While lithium nickel and cobalt supply capacity in FTA countries is set to outstrip US demand, the US will be competing with the likes of Europe and China for this supply and will also need to ramp up its ability to refine these materials into battery-grade products. There is scope to increase recycling efforts to reduce reliance on primary production, something that specialist Redwood Materials Inc. is hoping to capitalize on.

Meanwhile, in terms of cell manufacturing, nickel-based chemistries have traditionally dominated in the US due to their high energy density and suitability for EVs. But a growing number of carmakers are turning their attention to cheaper lithium-iron-phosphate batteries, which avoid the use of costly nickel, as well as ethical issues surrounding the sourcing of cobalt. This includes Ford, which will add LFP batteries to the line-up for its F-150 Lightning pickup truck in early 2024.

Based on commissioned, under construction and announced battery manufacturing capacity today, the US is facing a surplus for nickel-based batteries compared with forecast domestic demand but a shortfall for LFP. This could handicap its battery ambitions.

For now, Europe is adopting the approach of nurturing home-grown startups such as Northvolt AB and Freyr Battery SA, and is also leaning on global leader and Chinese titan Contemporary Amperex Technology Co. Ltd., who is expanding its footprint in the continent.

5. China isn’t infallible

While China reigns supreme in the world of batteries, and looks set to do so for some time, it does have vulnerabilities. Compared with competitors in North America and Europe, China’s battery supply chain is less well developed when it comes to environmental, social and governance metrics. Indeed, the country lies in 17th in this area in BNEF’s ranking, behind Nordic leaders Norway, Finland and Sweden. Rival Canada is sixth thanks to stronger ESG regulations and a hydropower-rich electricity mix.

While access to raw materials, refining capability and manufacturing capacity are all essential when it comes to building a local battery supply chain, ESG considerations will become increasingly significant as automakers look to meet sustainability targets and markets such as the European Union push ahead with “battery passports” that require information about the carbon footprint of products.