Sustainable debt issuance slows after strong start to year

This article was written by Jonathan Gardiner, Sustainable Indices Product Manager at Bloomberg and Tom Freke, Fixed Income Data Specialist at Bloomberg.

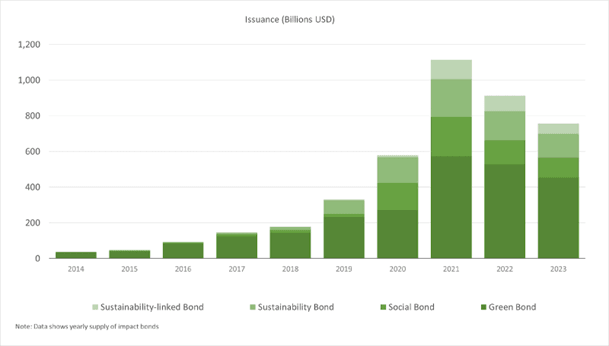

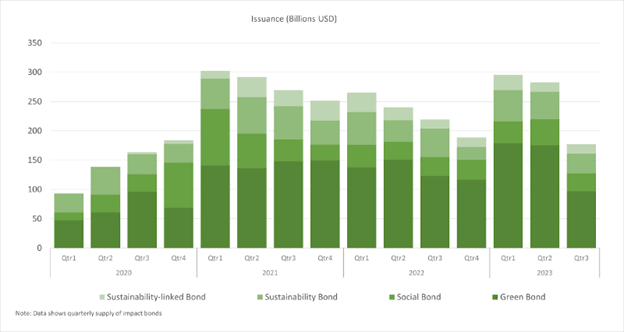

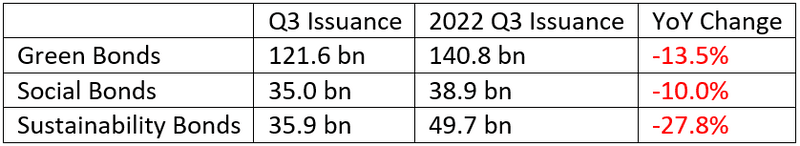

Issuance of impact (defined as green, social, sustainability and sustainability-linked) bonds totaled $181 billion in the third quarter, down 17% on the same period last year, and 36% lower than the previous quarter. Despite the downturn in new issues of green, social, sustainability and sustainability-linked notes in Q3, the total for all historical issuance of sustainable debt now exceeds $7 trillion.

Green bond sales in Q3 were down 18% compared with the same period last year but on a year-to-date basis issuance remains 10% higher than the same period, at $454 billion. This eclipses the previous record for the first nine months of the year, from 2021, when $424 billion was issued.

The largest sale of the quarter was from the UK government, which tapped its existing green bond for an additional £3 billion. With the French government also issuing green bonds at size this ensured that national government made up the largest sector for new impact bonds. Some $100 billion of green bonds were issued in Q3, of which $46 billion came from sales in September.

Social bond sales in Q3 dropped to £31 billion, 3% lower than the same period last year. On a year-to-date basis issuance increased 12%, to $112 billion, compared with 2022, when $101bn was issued. This marks the most active three quarters for social bond issuance since the record volumes observed in 2021. La Caisse d’amortissement de la dette sociale (CADES), owned by the French government, borrowed the largest social bond issuance of the quarter, of $4 billion.

Sustainability bond sales were impacted the most by the wider slowdown in issuance in Q3, with quarterly sales down 33% to $33 billion compared with the same period last year. This type of bonds has also seen a drop on a YTD basis, with volumes this year 6% lower than last year. Meanwhile, sustainability-linked bonds saw a 7% increase in Q3, at $16 billion, though sales YTD are down 17%.

Bloomberg’s Global Aggregate Green, Social and Sustainability (GSS) bond indices (webinar link) provide investors with an objective and robust measure of the global market for fixed income securities issued to fund projects with direct environmental and/or social benefits. The year-to-date return for the GSS index is -1.74%, some 173 bps above that of the Global Agg Index, highlighting improved returns for investors with an appetite for sustainability-focused investment.

Summary of total GSS issuance Q3 2023 (includes Gov, Corp, Muni & Mtgs)

Visit IN ESG on the Terminal or browse our website to find out more about Bloomberg’s Sustainable Indices and request a consultation with an index specialist.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.