This analysis is by Bloomberg Intelligence Director Market Structure Research Larry Tabb. It appeared first on the Bloomberg Terminal. Prior to joining Bloomberg, Larry Tabb and The Tabb Group provided consulting services to the financial markets industry.

The stock-market gamification seen in the Robinhood-GameStop trading saga is unlikely to end soon or draw major near-term regulatory actions, according to our analysis. Retail investors are a major force, accounting for 23% of U.S. equity trading volume, and could provoke further “meme” stock gyrations. Greater Robinhood scrutiny and higher Depository Trust and Clearing Corporation (DTCC) margin requirements could curtail some gamification practices and force traders to shift venues, but may not alter their appetite for heavily shorted or lower-priced securities.

Lawsuits against Robinhood, Charles Schwab and other brokers have little chance of success, we believe, and potential enforcement penalties are likely to be low. A congressional review adds to the drama, but new regulatory risk is probably minimal.

GameStop, AMC saga shows retail becoming an unstoppable force

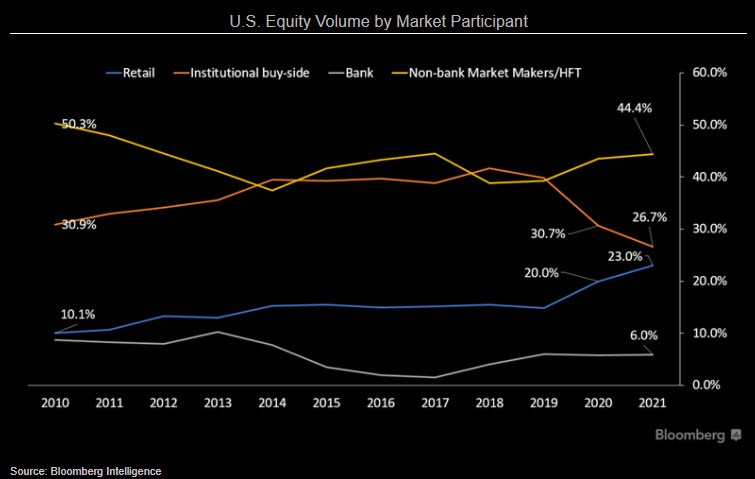

The wild GameStop and AMC Entertainment “meme stock” ride increases our retail equity-volume target three percentage points to 23% of the market, confirming the influence of day traders as institutions settle back. The 55% surge in 2020 U.S. volume vs. 2019 was stimulated by COVID-19-induced volatility and no-fee trading among the many catalysts, but those could soften as 2021 progresses.

Retail up to 23% of equity market; funds less active

The recent volume surge led by GameStop and AMC Entertainment has boosted retail-investor participation to 23% of U.S. equity trading from 20% in 2020, based on our calculation. The massive increase in retail trading of “meme” stocks made popular through social media is reflected in over-the-counter (OTC) volume, benefiting the four largest wholesalers (Citadel Securities, Virtu Financial, G1 Execution/Susquehanna and Two Sigma Securities) and order-flow payments.

Though interest in meme stocks will likely dwindle and reduce our retail-share forecast as the year progresses, the GameStop and AMC frenzy confirms retail’s ever-increasing portion of U.S. equity-share volume.

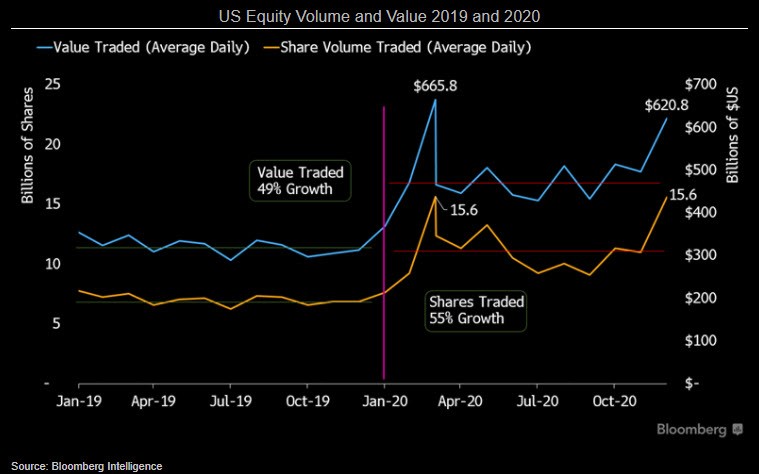

Virus volatility spurs volume more than value traded

U.S. equity-share volume jumped 55% year-over-year in 2020 but value traded only increased 49%, reflecting a retail preference for lower-priced stocks that traditional institutions often can’t touch. The six percentage-point gap may seem insignificant, but demonstrates the growing influence of retail investors. Covid-19 disruptions pushed many to reallocate positions, created a new wave of day traders and upped the activity of experienced traders.

Retail investors tend to trade lower-priced stocks on the misconception of greater upside, and because they can accumulate larger positions.

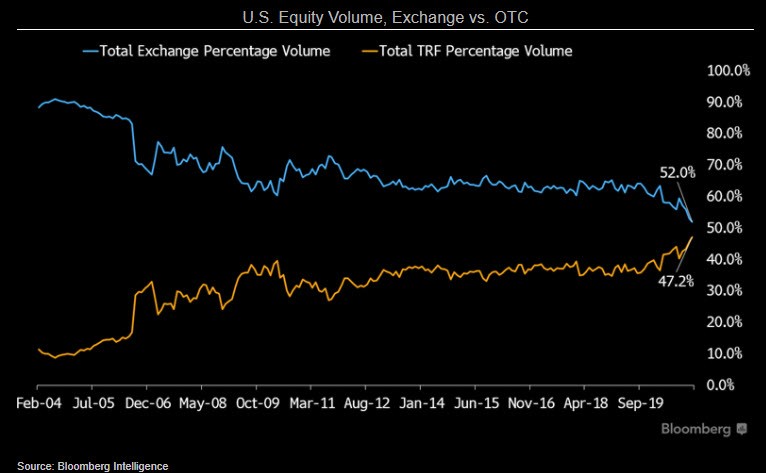

Near-50% OTC volume trouble for price discovery?

OTC trading rocketed 10.5% to another record in January, hitting 47.2% of U.S. equity share, up from 42.7% in December. If annualized, this 4.5 percentage-point one-month jump would equal a 233% compound annual growth rate. The explosive shift was driven by three days of OTC volume breaching 50% of shares, an event that happened once before (December), and was also a function of additional retail activity, as individual investors’ orders are mostly executed by wholesaler market makers over the counter.

The more flow traded off-exchange, the more traders worry that the loss of these orders will degrade the overall market quality and make pricing worse for everyone.