This analysis is by Bloomberg Intelligence Associate Analyst Chia Chen Chen and Senior Industry Analyst Henik Fung. It appeared first on the Bloomberg Terminal.

Beijing’s net-zero emissions push and global supply-chain shocks may be a natural springboard for China’s energy policy and technology development, which may unlock a $463 billion solar market by 2025. China’s swelling demand for solar assets could power sector profit to as much as 45% annual growth. Xinyi Solar, Flat Glass and Longi may benefit.

Green energy push brightens solar’s outlook

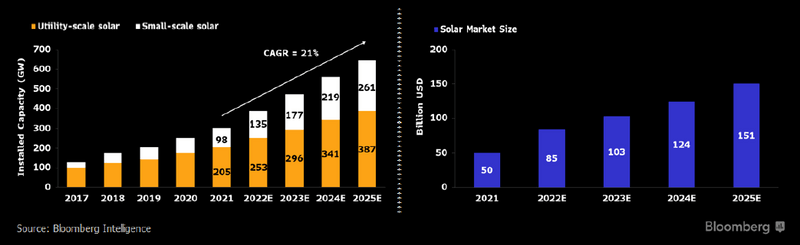

China’s solar power installed capacity may surpass 388 gigawatts (GW) this year after adding 85 in 2021, charting a course to 28% growth vs. 2021’s 20%. A structural shift toward renewable energy and pent-up demand of 10 GW in 2021 may lead the way, with raw material shortages lending a tailwind. More upstream polysilicon production may unleash supply-chain bottlenecks in 2022.

The utility-scale segment’s new projects will add 48 GW of capacity while the small-scale segment will contribute the remaining 37, sparked by higher power tariffs and lower production costs. Our calculations suggest total installed capacity could top 648 GW by year-end 2025, implying 21% average annual growth.

Solar installed capacity, projected market size

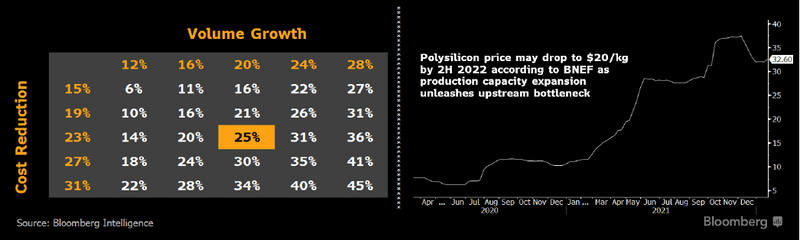

Solar profits could surge 45% on volume, costs

China’s solar industry could deliver 45% average profit growth this year, in an upside-case scenario, with tailwinds from surging volume and falling raw material costs. Growth of 25% in 2022 is more likely in our base scenario, and similar growth is possible through 2025. The country’s new 2022 solar power capacity would amount to 85 GW, or a 28% increase vs. 140 GW outside of China, or a 17% rise. Despite lower module prices made possible by technological advancement, photovoltaic (PV) manufacturers could also achieve margin expansion as raw material costs fall faster than product prices.

We expect the price of polysilicon — a solar panel feedstock — to drop to $20 a kilogram in 2022 from an average of $26 in 2021 for a 23% decline. Margins could widen more if feedstock costs fall further through 2025.

Earnings growth sensitivity, polysilicon price

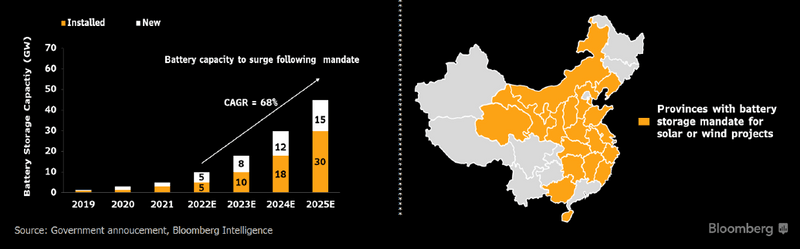

New regulation bodes well for battery storage

New solar and wind farms in more than 20 Chinese provinces must be paired with battery-storage equivalent of at least 10% of their power generation capacity to reduce intermittency, as new policy dictates. We expect around 40 GW of new battery storage capacity to be added by 2025, equivalent to $17.6 billion in new investment, implying 68% average annual battery production growth. In 2022, we calculate 5 GW of battery storage will be added, doubling installed capacity to 9.8 GW. Getting there would require $2.2 billion in investment, or about eight times CATL’s 2020 battery storage revenue.

CATL and BYD would be key beneficiaries. PV manufacturers such as Longi and Trina Solar also stand to gain.

Battery storage capacity China, provincial mandate

Rooftop solar’s prospects bright on policy nod

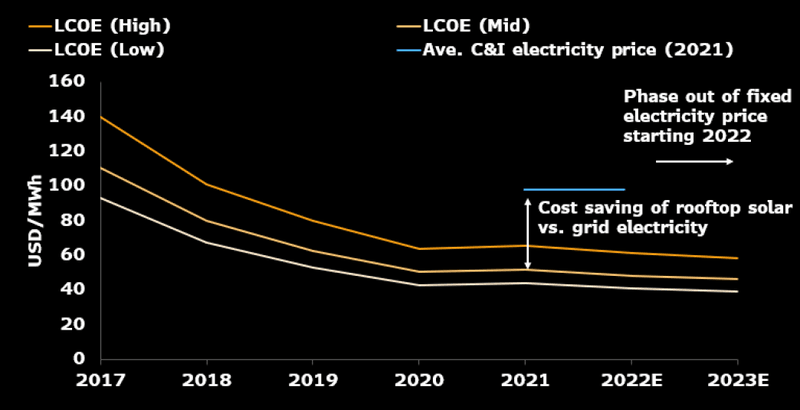

Beijing’s support could add 37 GW to China’s rooftop solar-power capacity in 2022, bringing its total national solar capacity increase to 85 GW, a 38% gain vs. the utility-scale segment’s 23%. China’s leadership expects as many as 50% of the nation’s buildings to install rooftop solar panels as part of a broader clean-energy generation and storage push. Cheaper equipment costs have promoted rooftop projects. Tangible cost savings over grid power has also broadened solar’s appeal.

Rooftop solar could gain even greater favor among consumers for its hedge value against grid outages and tariff swings. China’s state planners phased out fixed-power tariffs for commercial and industrial users in October 2021.

China rooftop solar levelized cost of electricity