This analysis is by Bloomberg Intelligence Senior Industry Analyst. Julie Chariell It appeared first on the Bloomberg Terminal.

The odds of another crypto-currency winter — marked by multiyear price cycles spanning 80% drops from peak to trough — should be lower, we believe, since the market matured from the last extended downturn ended in 2019. Greater participation by institutional and retail investors, more services and applications, and added investment vehicles all stand to limit the extent and duration of the downside.

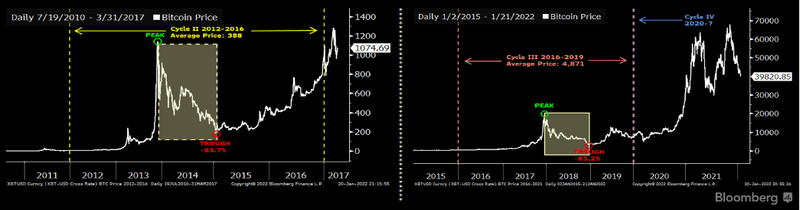

Major Bitcoin price swings of 80% may not repeat

There have been three prior Bitcoin price cycles to date since the cryptocurrency’s 2009 inception, each lasting 2-4 years with roughly 80% price drops from each peak to trough. Importantly, the average Bitcoin price moved significantly higher with each cycle. The last bottom was in late 2019, and the most recent high was recorded in November at $68,617. Bitcoin was 44% below that level as of Jan. 21.

We believe institutional investors were the early buyers coming out of the downturn. For instance, in the four quarters coming off the 2019 trough, Coinbase’s institutional volume rose 61% from pre-trough levels, while its retail trading volume dropped 53%. Retail investors eventually returned, and penetration for both groups has grown steadily to about one-third of qualified participants.

Bitcoin’s latest price cycles

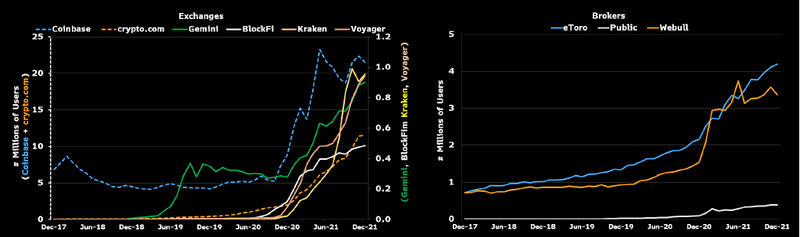

More institutional trading, broker support

Better ease and availability are additional factors supporting crypto-asset prices. Institutions taking positions rose to 34% last year, from 20% in 2019, bring more liquidity and, possibly, less volatility. They’ve been shown to enter or add to positions in declining crypto markets. Furthermore, growth in the number of broker-dealers offering crypto supports new retail-investor involvement. The convenience and simplicity also creates a compelling on-ramp for entry-level investors, and their low or no commissions are a real draw.

Not wanting to miss out on revenue, banks are getting in on the game as well. Besides the large money-center banks supporting top clients, 300 community banks are planning to offer crypto trading through mobile banking apps in 1H.

Growth in exchange and broker users (retail apps)

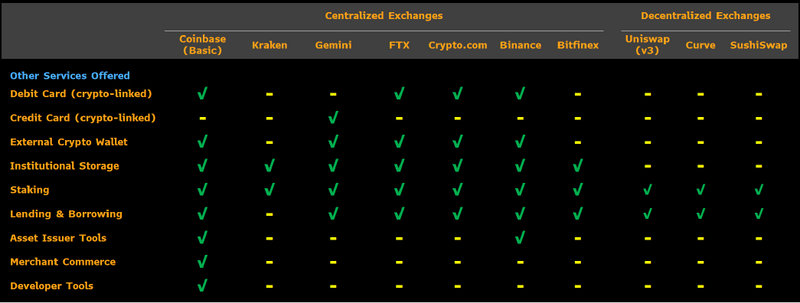

More services, applications reinforce ownership

Another source of support for crypto asset prices are related services and applications. Services include custody, debit cards for account-linked spending, education-based rewards, borrowing based on crypto-asset balances and staking, where fees are earned for pledging assets to validate non-Bitcoin transactions. The more ease, utility and secondary earning opportunity for holders, the less likely they are to sell and forget their coins.

Non-fungible tokens (NFTs) and DeFi for trading and lending are applications that run on various crypto tokens beyond Bitcoin, and their investment potential and transactional utility support token demand and thus, prices. NFTs are averaging over $1 billion in weekly trading volume this year, 10 times the 2021 average, and DeFi value in play is up fourfold in the past year, to $120 billion.

Crypto exchanges services offered

More products bring more ways to play, hedge

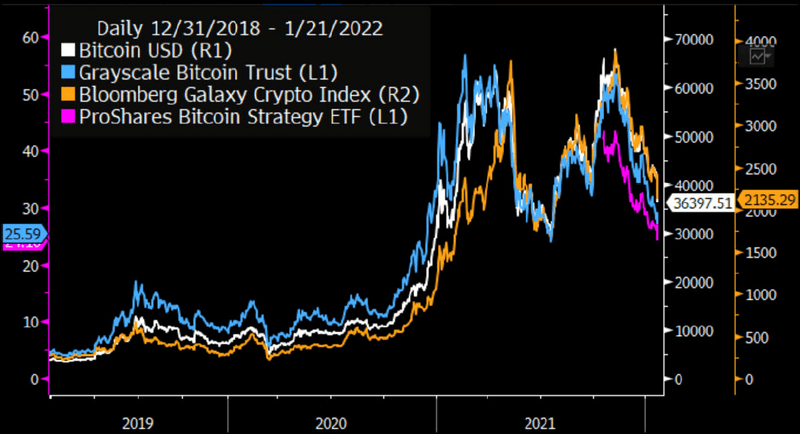

The most recent factor in support of crypto-asset prices is the breadth and innovation in such investing, beyond the spot tokens alone. These added opportunities to hedge and diversify give investors reasons to get or stay involved in crypto. In just the past few years, exchanges have added margin and derivatives trading, along with tens of more tokens and greater liquidity with rising participation among institutions. Asset managers are looking to meet growing derivatives and diversification demand, with trusts such as those from Grayscale, and exchange-traded funds from Galaxy and others in Canada.

Pure digital-asset funds and ETFs haven’t yet been authorized in the U.S., but three Bitcoin futures ETFs have been approved since September, and 11 direct crypto ETFs await SEC approval.

Price performance off trusts, EFTs and indexes