This analysis is by Bloomberg Intelligence Senior Government Analyst Nathan R Dean and Senior ESG Analyst Rob Du Boff. It appeared first on the Bloomberg Terminal.

Publicly traded firms in the US will likely face a SEC rule that requires them to provide new disclosures related to climate risk — costing billions of dollars to implement — but comments received during the SEC’s outreach period suggests the agency could loosen the proposal. Many of the comments were focused on the burden of so-called Scope 3 requirements, a provision we believe the SEC is open to altering.

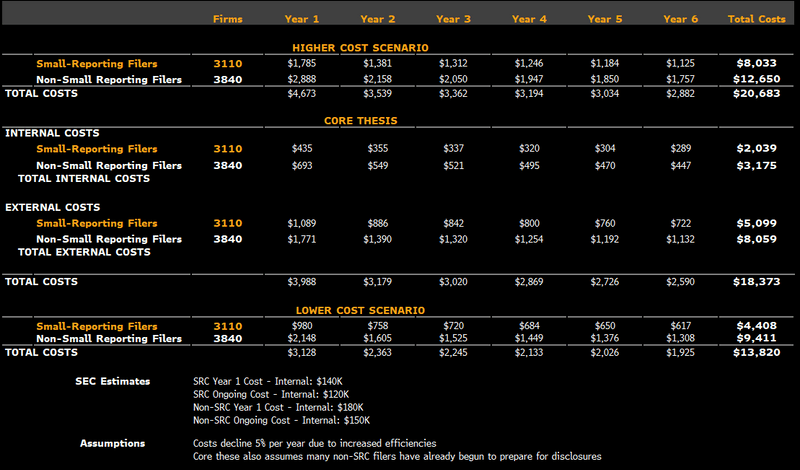

Our thesis: The SEC proposal requiring enhanced climate disclosures could shift $18.4 billion to consulting firms, lawyers and data providers with expertise on climate risks and greenhouse gases as public companies adapt in the first six years, according to our calculations. The heaviest burdens of the rule, which may be finalized as soon as 1H23, may be on smaller firms.

What’s at stake? Compliance costs, investor sentiment

More than 6,000 public companies will need to disclose and identify key climate risks — which will increase costs and potentially impair investor sentiment — under the SEC’s March proposal. The rule requires issuers to use a standardized form with physical and transition risks. It also requires greenhouse gas emissions that cover a company’s direct emissions (Scope 1), emissions from an company’s consumption (Scope 2) and in some cases, emissions from a company’s supply chain (Scope 3).

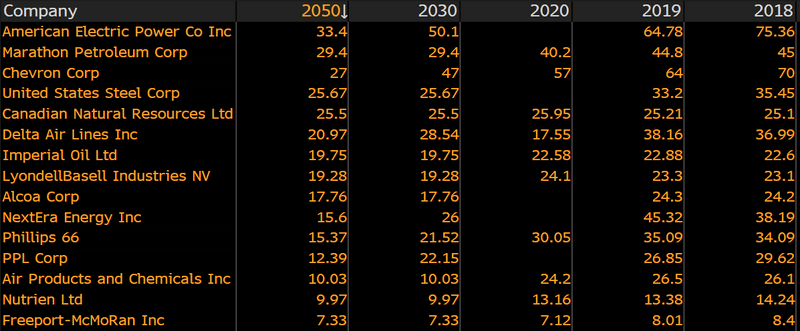

BI Carbon Emission Forecasts – 2050

What’s the outlook? Boon for consultants, legal services

Consultants, law firms and firms specializing in the identification of climate risk may see $2.9 billion in new revenue in the first year the rule’s in effect with costs for the publicly traded firms, reaching $18.4 billion over the first six years, according to our estimates. Costs are both internal — enhancing systems and governance — and external — hiring experts. And as many large companies have begun to assess risk, we expect the regulation will be a heavier burden on smaller firms.

BI Scenario Analysis

What’s next?

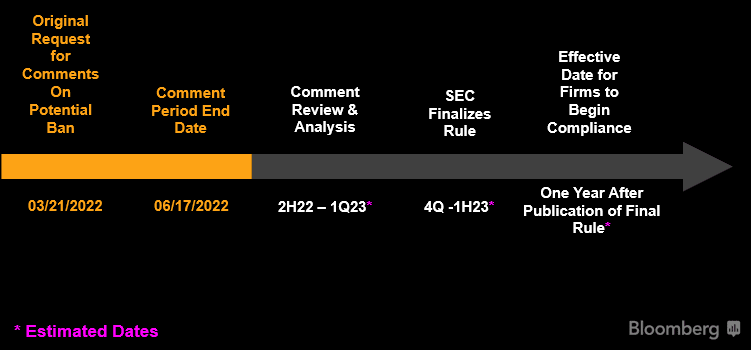

With the comment period completed, the SEC will begin the process of analyzing the comments and laying out a path for finalization. Yet as the proposal received considerable criticism from both industry and lawmakers, we think the SEC is open to easing it, especially when it comes to what are known as Scope 3 requirements. Removing Scope 3 would somewhat decrease compliance costs, but firms would still face billions of dollars in new implementation expenses.

Rule May Be Finalized As Soon As 4Q

What’s the issue? Climate change disclosures

Publicly traded firms in the U.S. would be required to attest to, identify and disclose climate-change risks and emissions data under the SEC’s proposal. Compliance would begin in part a year after the rule takes effect. If finalized in 2022, large companies would have to begin in 2024. Yet while many large corporations already have begun identifying and disclosing such risk, we anticipate a contentious debate over the issue and a potential for litigation once a final rule is in place.

Climate change disclosures.