This analysis is by Bloomberg Intelligence Senior Analyst Edmond Christou and Associate Analyst Ilia Shchupko. It appeared first on the Bloomberg Terminal.

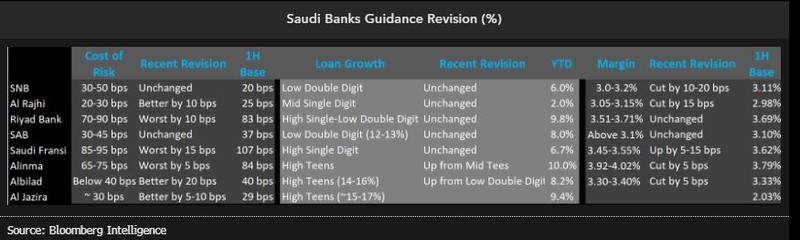

Saudi banks trimmed their margin outlooks on higher-than-expected cost of funding caused by interbank rates over 600 bps and more costly funding mixes. Three of eight banks missed cost-of-risk guidance mainly on corporate-loan quality. Smaller banks hope to expand share with high-teens credit growth as larger peers are cautious on borrowing costs.

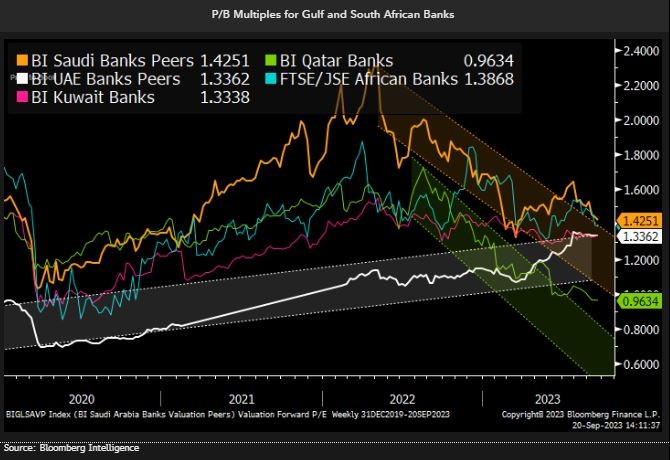

Saudi banks trade at forward price-to-book of 1.5x after 2Q’s earnings misses vs. 1.6x prior results. That’s still a premium over regional peers, aided by a solid asset-growth trajectory, given the kingdom’s $569 billion project pipeline (up from $521 billion in April). Yet price-to-book was lower after peaking at 2.3x in May 2022, reflecting new norms. UAE banks have been on upward path since late 2020, aided by a robust property market and private-sector activity. Though UAE property prices may still gain, likely at a decelerating mid-single-digit pace, the risk to upside is from high borrowing costs and corporate taxes. Qatari banks are trading below UAE peers for first time since May.

A weak economy, escalating electricity-load shedding and high unemployment are dire overhangs for South African lenders’ ratings.

Four banks have worst margin trend, three miss on cost of risk

SNB, Al Rajhi, Alinma and Albilad cut their margin guidance further in 2Q to reflect rising cost of funding and, we also believe, weaker asset-yield growth. Riyad Bank and SAB kept their guidance unchanged while Saudi Fransi upgraded its outlook to reflect solid gains in 1H but 2H’s spread is likely to be challenged. Three banks — Al Rajhi, Albilad and AlJazira — expect better cost of risk or lower provisioning charges for the year while Saudi Fransi, Riyad Bank and Alinma that missed their guidance in 1H downgraded their cost-of-risk outlook. The sector still expects strong credit growth largely driven by corporate loan origination. Alinma, Aljazira and Albilad expect better loan growth in the high teens, while the rest of the lenders kept their growth views unchanged after 2Q results.

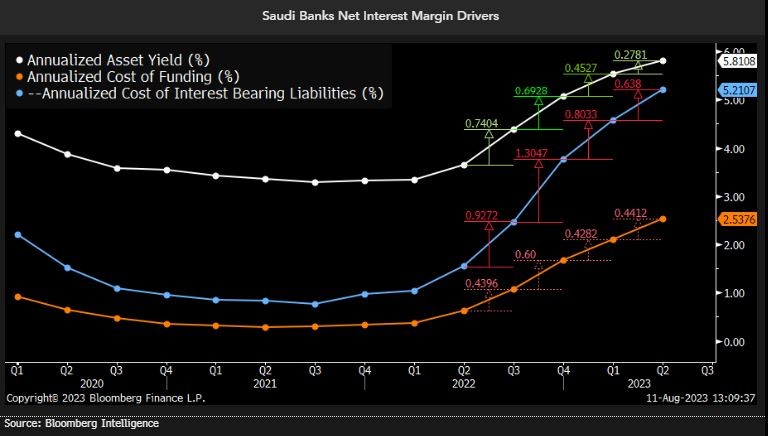

Pricing power key as cost of funding dents margin

Saudi banks’ median asset yield grew just 28 bps sequentially in 2Q, down from 45 bps in 1Q and 70 bps in 4Q and 3Q last year. This may indicate that corporate loans, about 53% of the book, largely repriced prior hikes and pricing power was reduced. Cost of funding (CoF) grew 44 bps sequentially in 2Q, a similar pace to the prior quarter despite slowing increases in interbank rates and the cost of interest bearing deposits, to 64 bps in 2Q from 80 bps in 1Q. This was attributed to falling low-cost deposit “CASA” balances to a median 53% for peers in June vs. 57% in 4Q22.

CoF will still rise reflecting higher interbank rates and a possible fall in CASA balances. Yet, banks ability to stabilize margin depends on pricing power and retail loans that are yet to reprice.

Quality weakens at Albilad and Al-Jazira despite new good loans

Albilad, Al-Jazira and Al Rajhi’s share of Stage 1 “good loans” remained lower in June vs. 4Q22, despite the two former banks’ solid new-loan bookings in 1H implying asset-quality weakness. Loans for these banks migrated into lower-grade Stage 2 “underwatch loans,” as well as Stage 3 “bad loans.” Yet Al Rajhi’s Stage 1 position still bettered that of peers amid exposure to salary-assigned public sector employees. New loans booked by Saudi Fransi lifted its Stage 1 share to 90% after a slight drop in 1Q. SNB also showed good trends after its merger-book clean-up. SAB’s proportion of bad loans continues to fall on writeoffs and recoveries, but it still has a large Stage 2 legacy position.

ANB didn’t report under IFRS 9, but its nonperforming loan (NPL) ratio was 2.3% in June (1.8% in 4Q). Riyad Bank’s NPL fell to 1.4% (1.7%).

Riyad Bank gains share; Cost control still key: Earnings outlook

Post-2Q Earnings Outlook: Riyad Bank tightened up its cost to income ratio guidance to below 31% (30% in 1H) vs. sub-33% initially as cost control remains key to mitigating higher cost of risk in 2H. The bank raised cost-of-risk guidance by 10 bps to 70-90 bps this year (was 83 bps in 1H). A drop in CASA balances and rising costlier deposits lifted cost of funding by 41 bps vs. only 29-bp gains in asset yields, leaving margins 12 bps below 1Q (though in line with expectations). Yet revenues fell shy of expectations due to lower non-interest investment and FX incomes.

Cost of risk of 74 bps in 2Q — in line with our scenario analysis — was used for a writeoff of 948 million riyals and to beef up coverage for Stage 2 and Stage 3 loans, enabling share of bad or nonperforming loans to fall to 1.4% in 2Q, from 1.5% in 1Q.