Russia’s war on Ukraine: BI’s commodity-price scenarios

This analysis is by Bloomberg Intelligence Senior Industry Analyst Will Hares and Senior Industry Analyst Grant Sporre. It appeared first on the Bloomberg Terminal.

The invasion of Ukraine is injecting historic volatility across a wide swath of commodities because of surging geopolitical risk, a heightened possibility of supply disruption, logistical issues, and the increasing commercial isolation of Russia after heavy sanctions from western allies. Our commodities team has contemplated three potential geopolitical pathways and outcomes ahead: Ease, Extend and Escalate, and assessing potential corresponding price scenarios for key energy, metals and agricultural commodities for each over the next twelve months.

Commodity price scenario analysis summary

Brent oil’s wide range hinges on Russia’s geopolitical outcome

BI’s three scenarios for the average price of Brent oil over the next 12 months — easing ($90), extended ($120) and escalation (over $160) — reflect the wide range of potential geopolitical outcomes stemming from Russia’s invasion of Ukraine. They also include the ensuing scale of the response from NATO countries on Russia sanctions and disruption of the nation’s oil exports.

Easing scenario: $90 Brent hinges on rapid de-escalation

BI’s easing or bear-case scenario for Brent oil this year contemplates a near-term diplomatic solution with a cease-fire and de-escalation of conflict and full withdrawal of the Russian military from Ukraine, resulting in a reversal of western sanctions on Russian oil exports and normalization of flows to pre-crisis levels. Under these circumstances, we would expect Brent oil to revert to pre-invasion levels of nearly $90 per barrel, still reflecting a tight physical market, low inventories, declining OPEC+ spare capacity and climbing global demand.

Given Russia’s intensifying military aggression, this appears the least likely among our scenarios, as the chance of a near-term peace deal and return to pre-invasion operating environment seems remote.

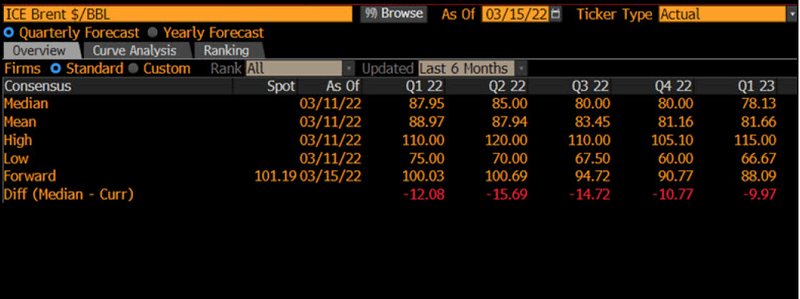

Brent oil consensus {CPFC <GO>}

Extended scenario: $120 Brent contemplates sanctions status quo

BI’s base-case or extended scenario for Brent oil of $120 a barrel is premised on the assumption of a continuing conflict following Russia’s invasion of Ukraine, with disruption of flows resulting from the status quo of sanctions on Russian oil exports from select western allies (U.S. and U.K.). We expect this to exclude participation from eastern European importers, which are heavily reliant on Russian oil, such as Germany. This scenario accompanies continued “self-sanctioning” of Russian oil cargoes via traders, shippers and banks amid increased regulatory and reputational risk and/or ethical reasons, despite not being explicitly sanctioned.

We believe this scenario has the highest likelihood of occurring given it’s our status quo view, which includes a geopolitical risk premium in oil extending.

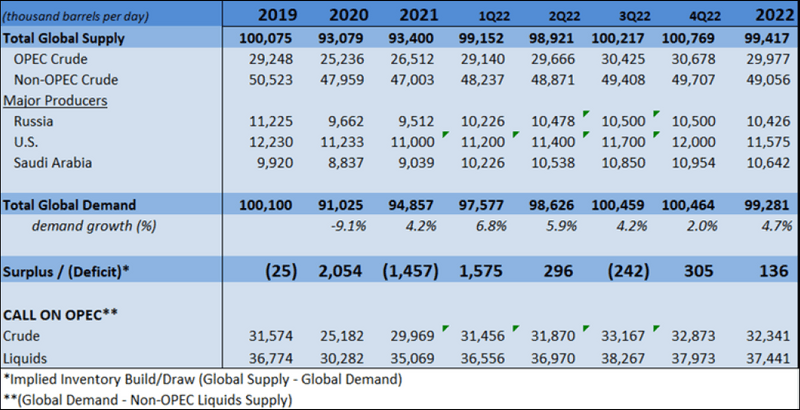

BI oil supply-demand model

Escalation scenario: $160 Brent amid acute Russian isolation

BI’s escalation case, or Brent oil upside scenario at $160 a barrel, is premised on a worsening of the war in Ukraine, including widespread and indiscriminate targeting of civilians, or direct conflict with NATO, forcing a heavy-handed economic response from NATO allies to exact maximum costs. This could include further isolation of Russia with direct sanctions on energy exports, potentially extending to non-western Russian energy importers, which could remove the majority of Russian crude and product exports of 5 million barrels a day from the market, or 5% of global demand.

Given the unprecedented geopolitical landscape and high uncertainty of how Russia’s invasion of Ukraine will proceed and the resultant disruption to energy flows, we acknowledge that prices could rise beyond our escalation case.

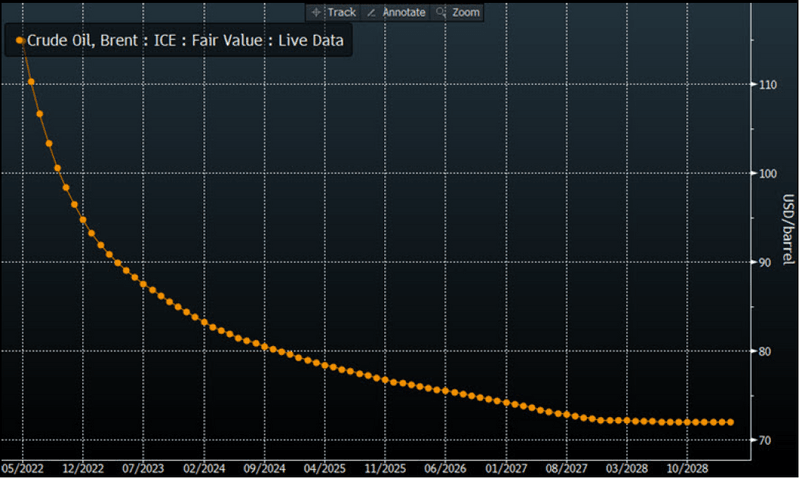

Brent oil forward curve