Picking a clean energy ETF? Beware: Clean doesn’t mean green

This analysis is by Bloomberg Intelligence Director of ESG Research EMEA & APAC Adeline Diab. It appeared first on the Bloomberg Terminal.

An ETF’s focus on clean energy doesn’t mean it is green. We’ve developed a model to help investors navigate the carbon profiles and strategies among the top 10 clean-energy ETFs, and our analysis reveals some surprises. Some funds with low carbon intensity lag on setting carbon targets and their emissions have actually doubled (QCLN and NRJ among them). Some with high exposure to companies transitioning to low-carbon energy have been actively decarbonizing and deliver an attractive risk-adjusted return profile (ICLN and INRG). This the first pillar of a four-part series.

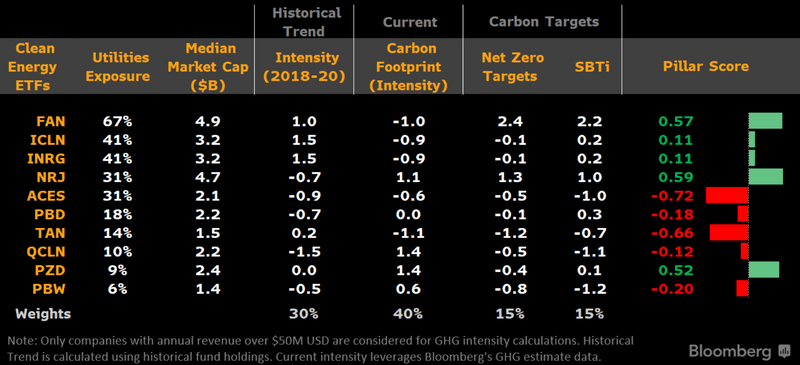

How do clean-energy ETFs score on carbon? It’s a two-sided coin

First Trust Global Wind Energy (FAN) and iShares Global Clean Energy (ICLN/INRG) can be singled out as having the highest current carbon emissions intensity among their holdings and carrying the highest utility exposure. They are also reducing emissions the fastest. ICLN and INRG score relatively well despite the inclusion of companies transitioning to low-carbon energy. Although Lyxor New Energy (NRJ) has the highest emissions score, it hasn’t made good progress on emissions reductions despite having among of the best carbon intensities and targets.

In our BI Clean Energy ETF Tracker, we estimate the funds’ carbon footprint by using the last reports of their holdings’ total emissions where available and filling in with Bloomberg estimates as needed. Finally, we weighted per the company’s weight in the ETF.

Clean-energy ETF green scores: Carbon pillar

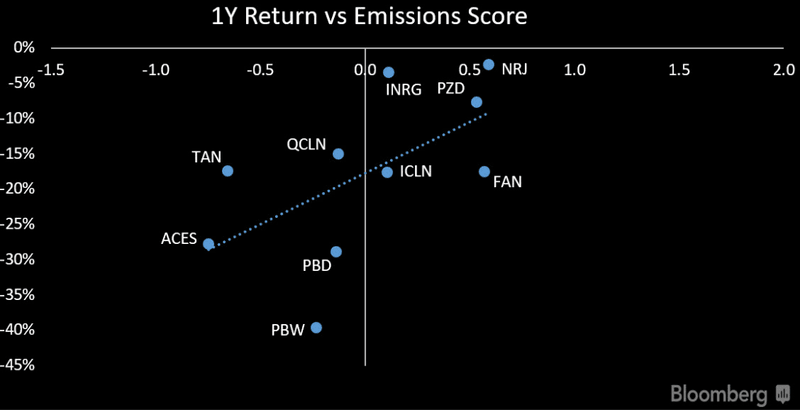

Does clean and green mean a better risk-adjusted return? Oh yeah

The correlation is positive between a clean-energy ETF’s one-year return performance and its shade of green based on the one-year emission pillar score. NRJ and Invesco MSCI Sustainable Future (PZD) are in the high-relative performance, low-emission quadrant — highlighting that carbon-conscious investors have shown market resilience over the 2021 downturn in clean-energy stocks. ICLN and INRG present a growing opportunity, as we expect their expansion into transition stocks will improve their emissions profiles while retaining an attractive return and volatility profile.

The poor emission pillar score of Invesco Wilderhill Clean Energy (PBW) is matched by weaker returns. Having the lowest exposure to utilities could surprise as we expect more companies to express carbon targets.

One-year return vs. Emission pillar score

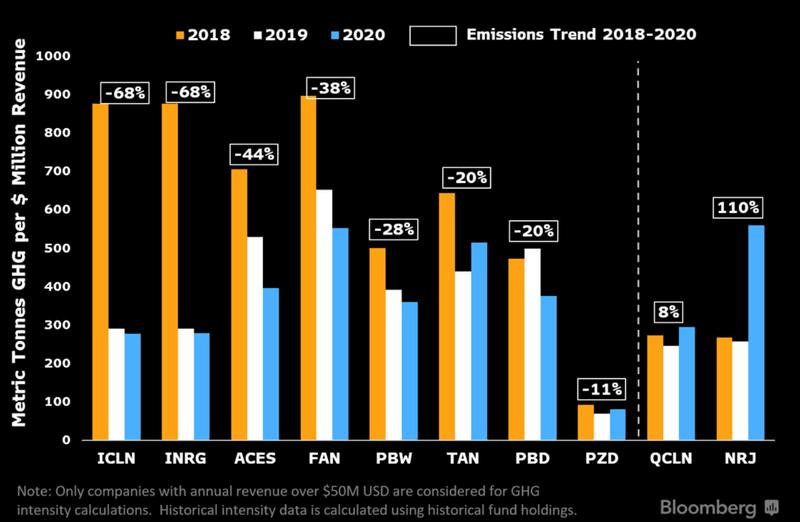

Why falling emissions intensity matters more than being green

A surprise among the shades of green for clean-energy ETFs is that improving their emissions profiles may matter more as a signal for upside and profitability. While some ETFs such as First Trust Nasdaq Clean Edge Green Energy (QCLN) or NRJ exhibit lower emissions, their profiles have deteriorated by increasing carbon footprint as much as twofold. Emissions at broader peers exposed to large utilities have dropped about 70% as the industry decarbonizes. ICLN and INRG improved most despite tripling the number of positions to include transition stocks.

Most clean-energy ETFs have emission intensity profiles exceeding the MSCI World, given they mainly include companies in industrial and utility sectors while the benchmark is 50% made up of technology, consumer discretionary and financials — all low-emission sectors.

ETF emission intensity for 2018-20

How net-zero targets may signal competitive positioning gains

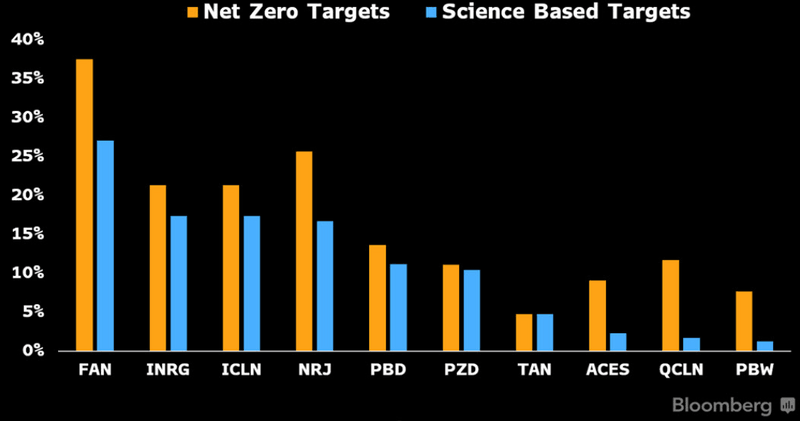

Although FAN has among the highest emission intensities across all clean-energy ETFs we track, it also has the biggest proportion of holdings that have set net-zero emission targets (almost 40% of its companies) and science-based goals (over 15%). This points to a strong emission improvement profile in the mid-term if those targets are met, and that could prove attractive to investors.

In contrast, ETFs showcasing low-emission intensity profiles (PBW, QCLN and TAN) trail their peers. This can be partly linked to a size bias. Those funds hold a much smaller average size of invested companies. Smaller companies lag behind relative to mature companies in articulating carbon targets and strategies.

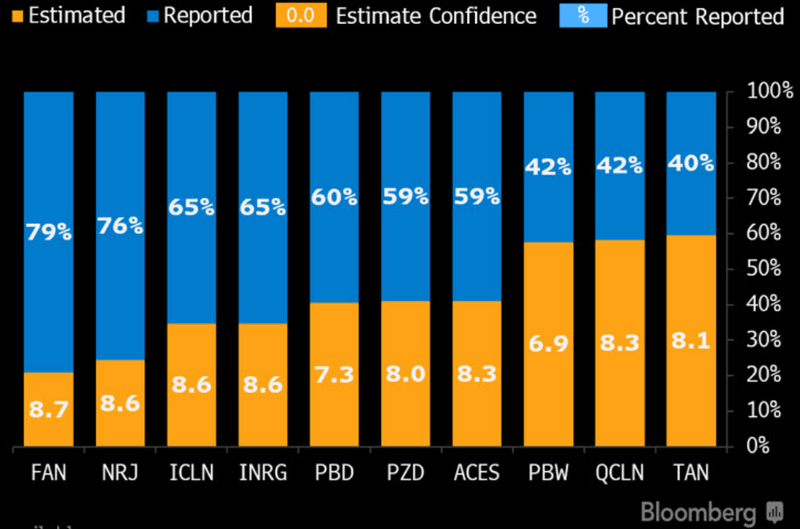

Holdings with science-based & net-zero targets

Why is reporting key? You can’t manage what you can’t measure

Carbon emissions disclosure has improved consistently for most of our universe. ICLN, INRG, FAN and NRJ showcase a carbon-disclosure level that exceeds the MSCI World Index (55%) despite retaining large caps and energy-transition stocks. Complementing reported data with Bloomberg estimates and associated confidence scores shows ICLN, INRG, FAN and NRJ present attractive profiles that reconcile green and reporting credentials — an advantage vs. smaller ETFs where less than half of holdings disclose data. Although hardly 40% of Invesco Solar’s (TAN) holdings report data, Bloomberg estimates provide a strong confidence level.

Our methodology: In the carbon pillar, we consider 30% weight at historical absolute and intensity emissions trends over several periods, 40% for the emission footprint and 30% on the nature of carbon targets.

Emission disclosure level for ETF holdings