Oil majors’ Russia exodus will hurt the energy transition

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

Oil and gas industry energy transition could be badly impacted

While ditching carbon-intensive assets may be beneficial to individual producers when it comes to their decarbonization targets, strengthened ties between the world’s largest national oil companies may be bad news for the environment.

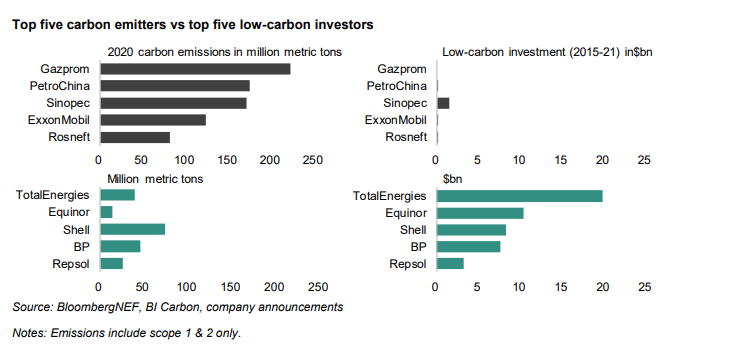

Of the top five carbon emitters in the oil and gas industry, national oil companies (NOCs) occupy four spots, including Russia’s Gazprom and Rosneft, as well as China’s PetroChina and Sinopec. Together, the top five emitters contributed to some 45% of the industry’s total carbon emissions in 2020. Their share of the industry’s total low-carbon investment from 2015 to 2021 totaled 3%.

European oil majors have predominantly been leading the energy transition within the oil and gas sector, with TotalEnergies, Equinor, Shell, BP and Repsol together accounting for over 70% of the industry’s investment in low-carbon technologies from 2015 to 2021. Combined, they account for just 10% of the industry’s carbon emissions. As big oil and gas offloads carbon-intensive assets to NOCs, monitoring may become more difficult, as will reducing the sector’s carbon emissions.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.