October commodities outlook – Dumps can be enduring

This analysis is by Bloomberg Intelligence Technical Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

Selling the rips gaining fuel vs. buying dips? Commodity outlook

The mantra that bear markets can take money from everyone is playing out in 2022, and fuel from spiking commodity prices may be burning out rapidly. The timing of Russia’s invasion of Ukraine, which pumped commodities and inflation, came at a unique time for the Federal Reserve as it seeks to arrest rising prices, with enduring deflationary implications. Leaders of the 2020-21 rally — lumber and copper — have dropped at a similar pace as during the financial crisis, with a key difference now is that it’s global and the Fed is tightening, not easing.

The US, its currency and rising status as an energy and agriculture exporter are primary forces for what’s normal in commodities: enduring dumps following ephemeral pumps. Due to elevated prices, South America’s 2022-23 grain season may set production records.

How low before the trough? Elevated commodity reversion risks

Market sentiment turned negative in 3Q for most risk assets (notably commodities), which may result in short covering rallies, but the high price cure appears to be the predominant force at the start of 4Q. It’s a question of what might stop the trajectory of most commodities following copper’s drop, and it’s probably not the Fed.

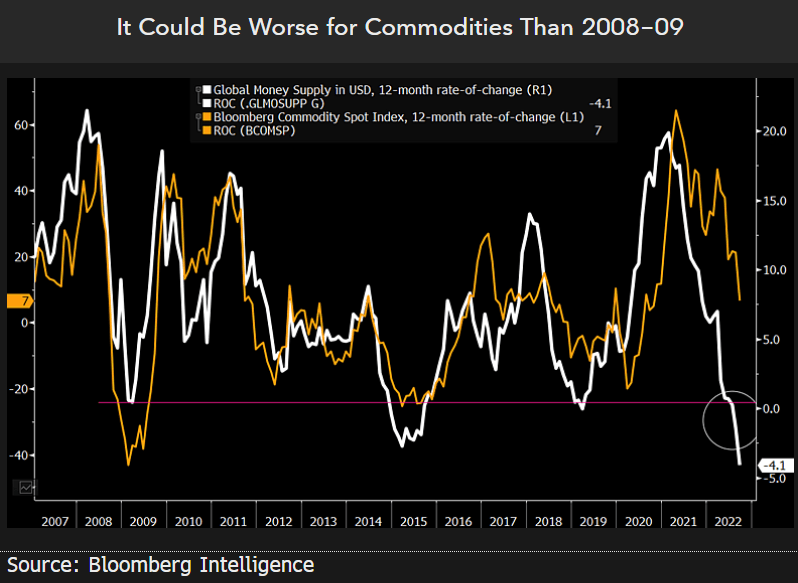

Commodities melting 10% gain faces more heat

The balance of about a 10% advance in the Bloomberg Commodities Spot Index (BCOM) on a 12-month basis may keep eroding, particularly if plunging global money supply is a guide. Our graphic shows money/liquidity reaching a new low of about minus 5% to Sept. 30, below the 2009 trough of around 0%. The BCOM bottomed with about a 40% annual drawdown during the financial crisis, which was more US-centric. Commodities are global, and the greatest number of central banks in history raising rates, and liquidity dropping faster than in 2009, may portend a similar outcome for raw-material prices.

Copper appears more likely to add to a decline of around 23% in 2022, providing guidance for broad commodities, many of which are still up for the year. Central banks aggressively fighting inflation is good resistance for commodity prices.

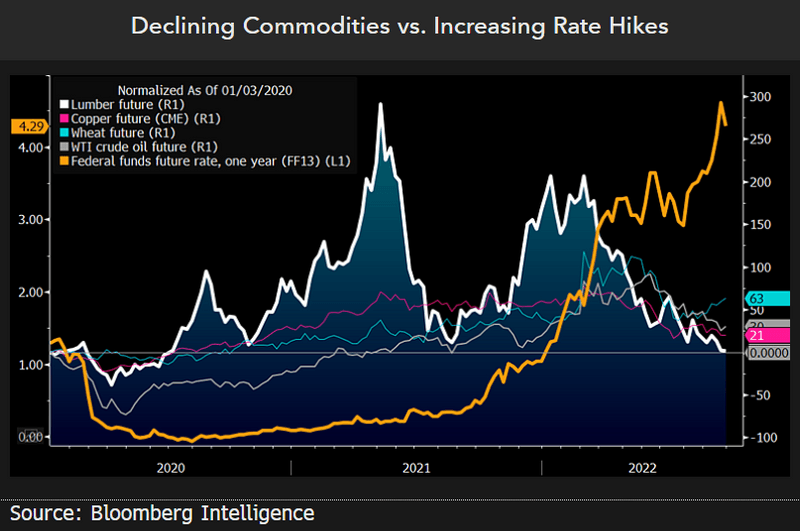

Rising Rates vs. Falling Commodities and Deflation Risks

That the rabbit of commodity appreciation in 2020-21 — lumber — has given back all its gains since 2019 may have implications for most commodities, the Fed and inflation. What’s notable from our graphic is the rapid rise in Federal Reserve rate-hike expectations as commodities spiked in 1H. The lessons of Milton Friedman, Adam Smith, plunging money supply and mean reverting commodity prices may guide inflation measures to drop as fast as they rose.

A big difference from past Fed rate-hike cycles is the central bank typically stops tightening when markets decline sufficiently, but it may be the most reluctant ever to start easing due to the lessons of too much liquidity and inflation from 2020-21.

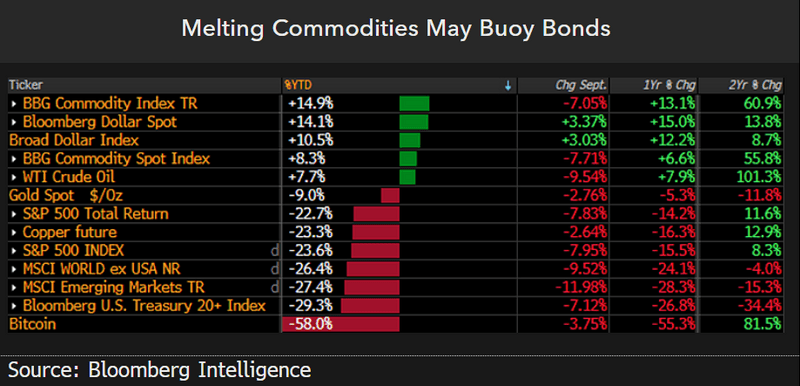

Commodities, bonds may swap fortunes in 4Q

Up almost 40% at its 2022 peak, the Bloomberg Commodity Index’s Total Return of about 15% to the end of 3Q may be leaning toward trading places with the Bloomberg US Treasury 20+ Index’s decline of around 30%. What stops the downward trajectory of most risk assets may be the key question in 4Q, and this year’s roughly 23% decrease in copper and the S&P 500 to Sept. 30 appear to face greater pressure from emboldened central banks fighting inflation as the world teeters toward recession. The Fed typically stops tightening when something breaks in the US, but it’s the global economy that is disintegrating, as evidenced by declines of about 20% for the yen and 15% for the euro.

WTI crude oil is still up on the year at the end of 3Q and may be a top commodity shoe to drop in 4Q, akin to 2008.

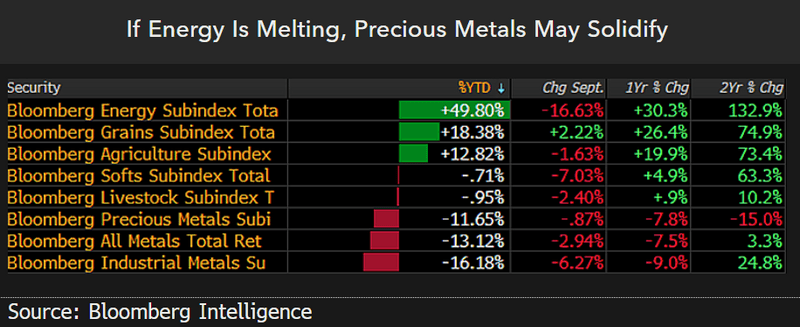

Energy eyes escalator down, precious metals up in 4Q

Spiking energy prices are proving their own worse enemy at the end of 3Q, which may prevail into year-end and have implications for inflation, the Fed and broad commodities. Having taken back about half of its 100% gain to the 2022 peak in June, the Bloomberg Energy Subindex Total Return is tilting toward staying the 3Q course in 4Q, we believe. It’s a question of what might stop the typical mean reversion tendency of crude oil and natural gas, and the Fed’s commitment to fighting inflation as the world leans toward recession adds headwinds.

Gold may shine in 4Q, particularly if broader commodities continue to deflate and curtail Fed rate hikes.