This analysis is by Commodities Data Analyst Dennis Ting and Global Data interns Gavin Leong, Guang Qi Ong and Liz Cheng.

Background

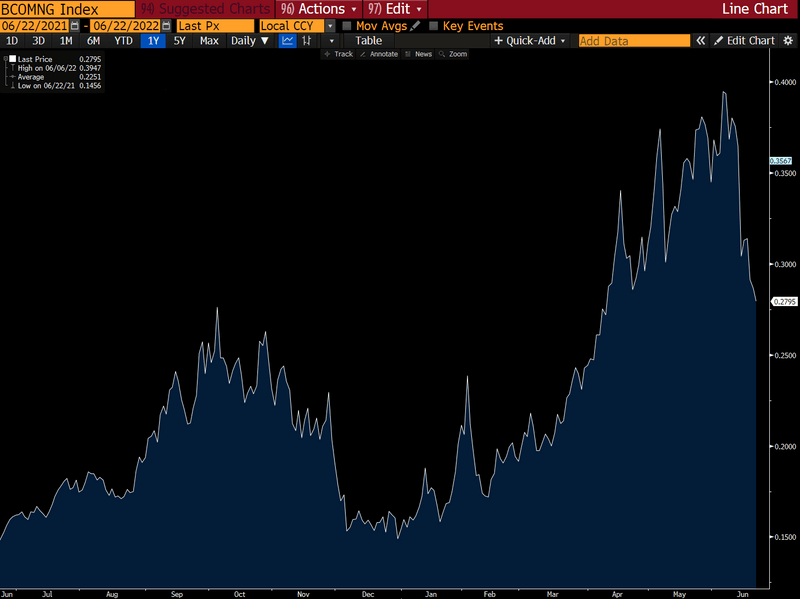

Since the outbreak of the Russia-Ukraine war on February 24, 2022, nations have responded in protest by providing military equipment to Ukraine and imposing a flurry of sanctions against Russia. Of the sanctions imposed, LNG remains one of the most contentious commodities as nations are feeling the pinch — some more than others — of gas shortages. Year to date, the Bloomberg Natural Gas Index is up 136%.

The issue

European natural gas prices jumped as shipments from Russia were disrupted, and Germany said Moscow was using energy as a weapon in an escalating clash over supply. Russia supplied about 40% of the European Union’s gas demand last year, and about a third of that transited Ukraine. The benchmark Dutch TTF contract surged 14% as flows from Russia via Ukraine fell further following interruptions at a cross border entry point due to the war.

Uncertainty over incremental Russian gas flows in the absence of the Nord Stream 2 pipeline calls for an increased reliance on global liquefied natural gas markets, meaning Europe will have to pay a premium to lure cargoes away from Asia.

China, the world’s biggest liquefied natural gas importer has stuck to its Covid Zero approach to quell outbreaks, weighing on energy consumption. Lower Chinese imports will provide some relief to gas buyers in South Asia and Europe, which had been grappling with sky high prices. European nations are seeking to curb dependence on Russian pipeline supplies and will need to maximize LNG imports this summer to refill inventories in time for winter.

Across China, gas demand fell by around 6% from a year earlier to the lowest since September 2021, while industrial consumption was down 8.4%, said Morgan Stanley. Several buyers including CNOOC are trying to sell spare cargoes amid the deteriorating domestic outlook.

While some nations grapple with the gas shortage, others saw opportunity in discounted Russian LNG. In India, companies including Gujarat State Petroleum Corp. and GAIL India Ltd. bought several LNG spot shipments from Russia at prices below prevailing market rates, a move shunned by the international community. As a result, they may purchase more as long as the Russian fuel remains cheaper than rival suppliers. In Europe, some companies were increasingly confident they could keep buying Russian supplies without breaching sanctions with backing of leader such as Italian Prime Minister Mario Draghi. Around 20 European gas buyers had opened accounts in Gazprombank JSC, preparing to pay in rubles for Russian gas.

Tracking

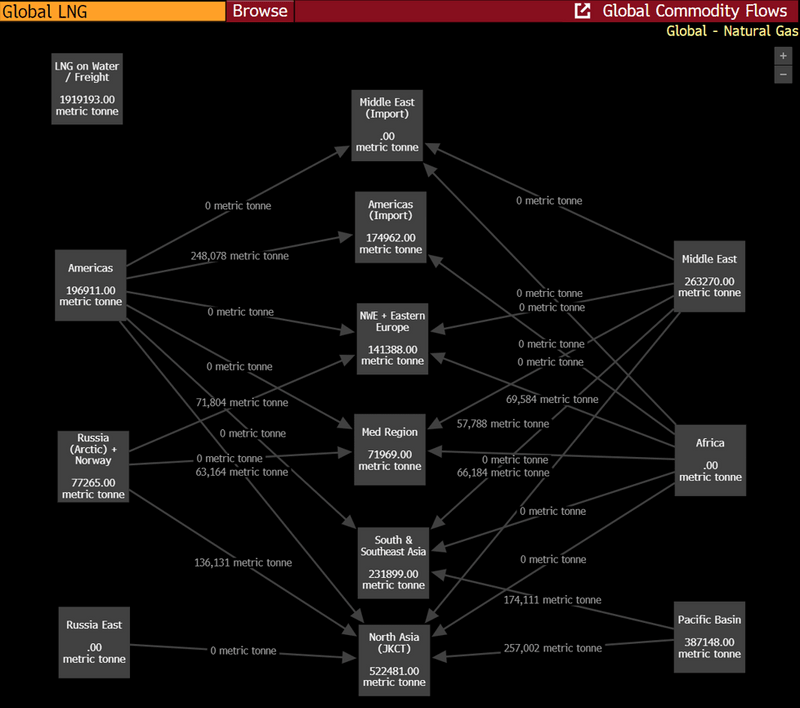

To track LNG trade flows, type “commodity flows” in the command line and select LINE – Global Commodity Flows. Click the first amber box and choose Global LNG. The shortcut is LINE LNG.

LINE LNG combines various LNG-related datasets in one place, helping locate key indicators for each market. It includes newly created trade flow tickers derived from the AHOY – Global Commodities Trade Flows function, which allows us to track global commodity imports and exports. Arrows represent daily flows in metric tons between regions, using destination arrival date. Zeros indicate no cargo arrived the previous day.