This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Jamie Douglas Coutts. It appeared first on the Bloomberg Terminal.

Competition and diversification among layer 1 blockchains is forming the foundation for a more-resilient decentralized (DeFi) finance ecosystem. While only the fittest cryptocurrencies will survive over the bear cycle, a broadening base of chains lowers concentration risk and marks an important progression in the evolution of DeFi.

Future of DeFi is a multi-chain world

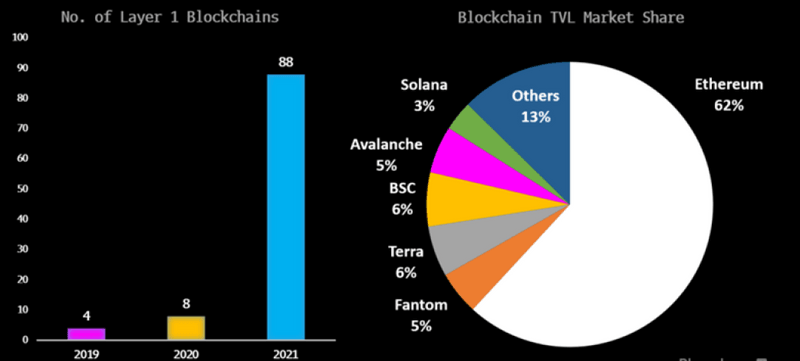

If the current bear market stretches beyond 2H22, attrition may become a theme among the long tail of DeFi protocols and chains as aggressive vesting schedules and capital incentives meet lower price expectations. Nevertheless, the 10x growth in the number of layer 1 chains over the course of 2020-21 has gone a long way to validating different blockchain use cases, each with their own set of trade-offs. While the top 5 Ethereum rivals have yet to break above single-digit percentages in terms of TVL market share, collectively they now account for 25% of the total.

The emergence of a highly competitive ecosystem of layer 1 blockchains has enabled the pie for DeFi applications to grow beyond Ethereum’s capability, while also gnawing at the total market share controlled by the incumbent.

Current layer 1 blockchain landscape

Explosive 1-year TVL growth across top chains

Total value locked (TVL) growth for the past 12 months was explosive, despite the current bear market, rising 357% to $255.39 billion among all layer 1 and 2 blockchains in aggregate. Ethereum, hamstrung by congestion issues and high fees, lagged the market, expanding TVL by 241% to $157.95 billion.

The growth for several of the top alternative chains over 2021 was magnitudes higher. Terra TVL led the way with a rise of 7,729% to $14.73 billion, followed by Avalanche up 6,687% to $13.65 billion. The accelerating bear market in 2022 has withdrawn liquidity from the market with TVL falling 18% in January. Despite this, Fantom’s TVL jumped 85% in the same period as it used aggressive capital incentives to attract developers to its chain and boost liquidity.

Top 6 blockchain TVL performance

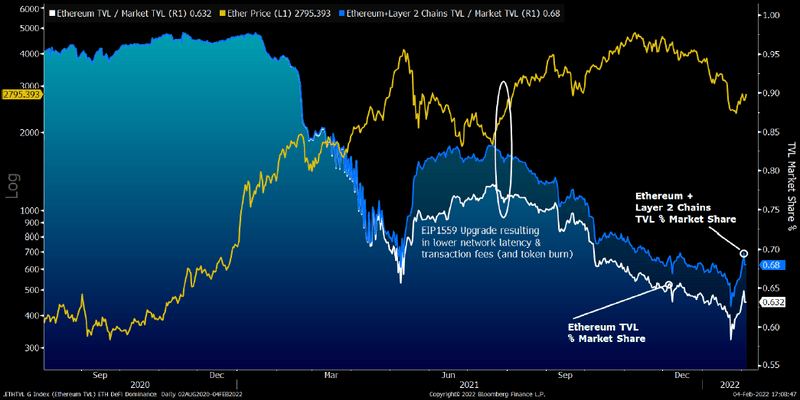

Ethereum DeFi dominance wanes

As DeFi exploded on the Ethereum network in mid-2020, gas fees steadily became prohibitive for certain applications, opening the door to upstart developers wagering on different design pay-offs and employing aggressive incentives to boost strap adoption. Ethereum’s market share fell 30% over 2021 as a result. EIP1559, a protocol upgrade in August designed to address the high fees and the success of layer 2 solutions such as Polygon and Arbitrum improved Ethereum’s overall position, attracting an additional 5% of market TVL. Layer 2 solutions optimize for speed and cost by batching transactions before settlement on the base chain.

A highly competitive ecosystem of chains and layer 2 solutions, all with different trades offs and market-product-fit is ultimately healthy for the future of DeFi.

Ethereum DeFi TVL dominance