This analysis is by Bloomberg Intelligence Commodity Strategist Mike McGlone and Senior Market Structure Analyst Jamie Douglas Coutts. It appeared first on the Bloomberg Terminal.

A common theme in crypto assets is to embrace the bear and build a better financial system, notably from the institutional and longer-term focused, akin to 2000-02’s bursting internet bubble. Purging the excesses of excess was the state of all risk assets in 1H, leaving high beta, speculative cryptos the most room to fall. But with the Bloomberg Galaxy Crypto Index nearing a similar drawdown as the 2018 bottom and Bitcoin’s discount to its 50- and 100-week moving averages similar to past foundations, we see risk vs. reward tilting toward responsive investors in 2H.

Bitcoin at $20,000 may be looked back upon like $2 in 2011, $200 in 2015 and $3,000 in 2018. Bitcoin and Ether risk measures are falling vs. equities and the potential for US regulation (Lummis-Gillibrand crypto plan) shows mainstream maturation.

Embracing the bear: Crypto dollar proliferation and bottoms

Cryptos were a leading indicator of speculative excesses in 2020-21 and are likely poised to resume outperforming most risk assets when the dust settles from the great reversion of 2022. Slightly below $1 trillion at the start of 1H, the crypto market cap is a fraction of the about $25 trillion wiped out from global stock markets.

Cryptos are rounding error vs. Risk-asset plunge

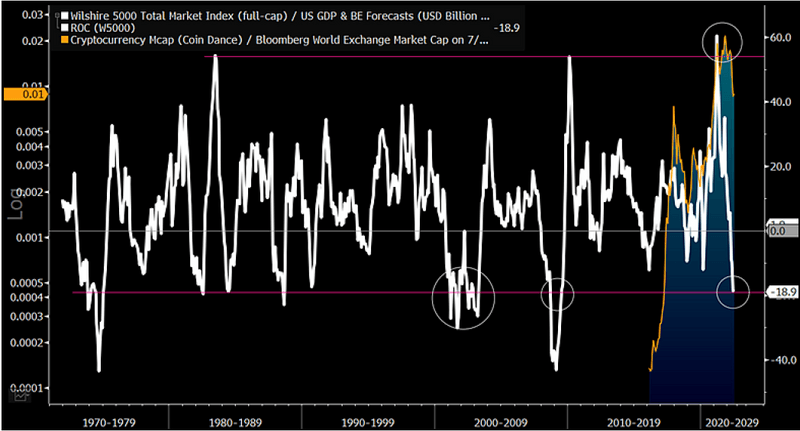

The sharpest drawdown of US stock market wealth to GDP in our database since 1970 shows the rounding error status of crypto assets, which appear more likely to continue rising. At about 1% of global stock-market capitalization at the start of July, cryptos are down from their peak of about 2%, but up roughly 10x from closer to 0.1% in 2017. Our graphic shows the 12-month rate of change of the Wilshire 5000 Wilshire Total Market Index vs. US GDP pumping to its highest ever in 2021 and dumping in 1H to the lowest since the financial crisis.

What’s also notable is cryptos’ recent entrance on the stage of risk assets. The rising adoption of Bitcoin as global collateral in a world going digital and the proliferation of crypto dollars are trends we expect are in their early days.

The great 2022 reduction of equity wealth vs. GDP

What stops the proliferation of crypto dollars?

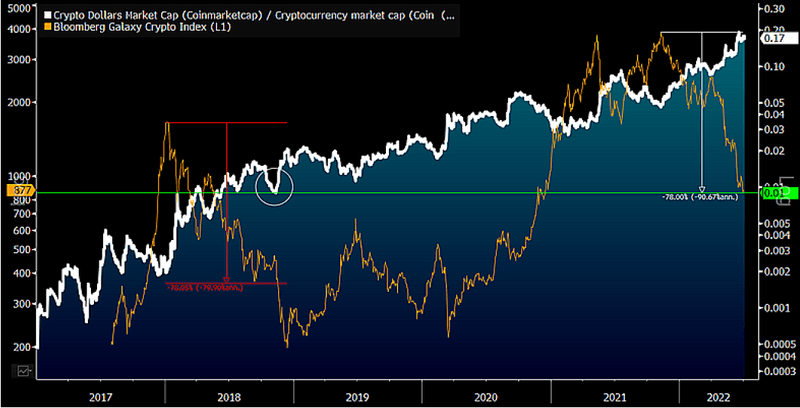

The about 80% drawdown in the Bloomberg Galaxy Crypto Index (BGCI) is historically indicative of limited further downside and the proliferation of crypto dollars. Our graphic depicts a top consistency in cryptos — the rising tokenization of the greenback. Approaching 20% on July 5, the market cap of stable coins tracking the dollar listed on Coinmarketcap is the highest ever as a percent of total crypto assets from Coin Dance. The failure of the TerraUSD algorithmic stable coin was a top example of the excesses of excess in cryptos that needed purging and a likely catalyst for about the last 10% decline in the BGCI.

In 2018, the BGCI dropped almost 90% before bottoming, suggesting there may be more to go for this bear market, but four years ago crypto dollars were only about 1% of the total market.

Crypto dollars show the technology here to stay

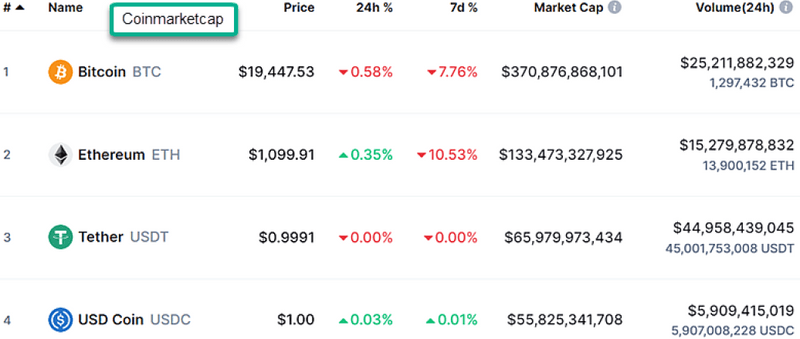

Bitcoin, Ethereum and crypto dollars

That two of the top four cryptos listed on Coinmarketcap on July 5 are stable coins tracking the greenback is indicative of a bear market and the potential for crypto dollars to continue their ascent. Tether and USD Coin are the leading stable coins and represent a majority of the about $150 billion of tokens tracking the dollar on Coinmarketcap. That they were made possible notably by Ethereum implies the value of the technology. Akin to futures being a better way to mitigate risk and obtain asset exposure, we see little to stop the tokenization of all assets.

The 2022 crypto bear market is a rounding error compared with the about $25 trillion wiping out of global stock markets, but with the highest beta, cryptos had the farthest to fall. We see Bitcoin, Ethereum and crypto dollars continuing to outperform.

An enduring crypto trend – Dollar dominance

Terminal subscribers may access the full outlook on the Bloomberg Terminal.