This analysis is by Bloomberg Intelligence Senior Industry Analyst Herman Chan and Bloomberg Intelligence Associate Analyst Sergio Ferreira. It appeared first on the Bloomberg Terminal.

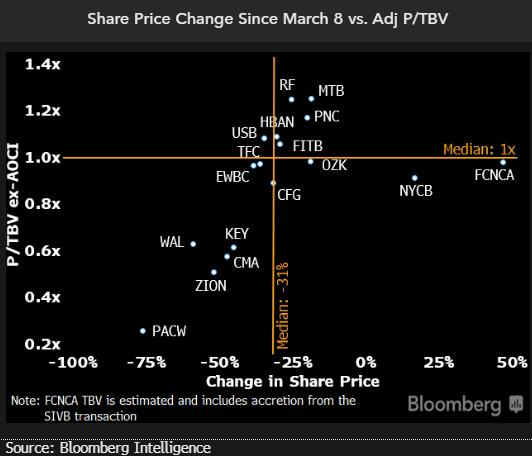

The tension between poor market sentiment and strong liquidity at regional banks is difficult to reconcile as investors take a draconian view of banks’ capital and operating models. Banks have ample liquidity to cover uninsured deposits, and balances are stable thus far in the quarter for PacWest and Western Alliance. Yet the dim market view continues to pressure valuations.

Market dictating reality amid lack of confidence

Perceived weakness can become reality as market dynamics pressure regional banks despite fundamentals that may not necessarily warrant such a visceral response. As of May 3, shares were down a median 31% since March 8, the day of SVB’s announcement seeking an equity raise and disclosure of its sale of AFS securities. The downside risk is apparent after the failures of three large regional banks, while regulatory actions have been insufficient to alleviate concerns. The industry may require a more holistic response, such as a deposit guarantee from Washington, to reinstill confidence.

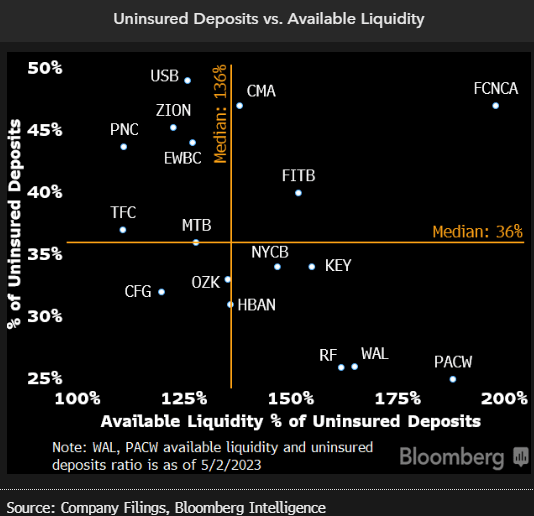

Uninsured deposits managed by ample liquidity

Regional banks hold strong liquidity to manage potential deposit outflows from uninsured deposits, according to updated disclosures. Available liquidity represents a median 136% of uninsured deposits, a healthy metric that suggests banks have ample capacity to manage funding volatility. Regions looks most protected due to lower uninsured deposits, while Western Alliance has been proactive in reducing uninsured balances. Banks hold liquidity in the form of cash, securities and untapped emergency borrowings from the discount window and FHLB.

The level of uninsured balances adjusted for collateralized deposits, at a median of 36% in 1Q, looks more manageable relative to 4Q regulatory data that indicated a median of 58%. Western Alliance and East West’s results improved the most relative to the 4Q view.