This article was written by Sandrine Foldvari, Head of BQuant Community.

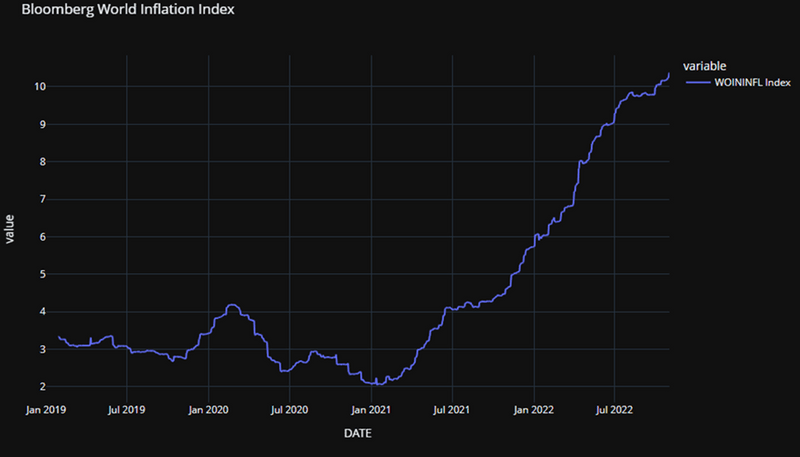

Since the COVID crisis that started in January 2020, the world economy has experienced increasing inflation pressures. Starting with what were deemed to be temporary supply chain disruptions due to the pandemic, aggravated by the war in Ukraine, we went from a scenario that involved transitory inflation to a scenario where inflation will potentially become more structural. Indeed, inflation pressures — if at first were explained by transitory effects —– have been exacerbated by much longer term effects such as the energy transition as well as behavioral changes in and expectations of the workforce.

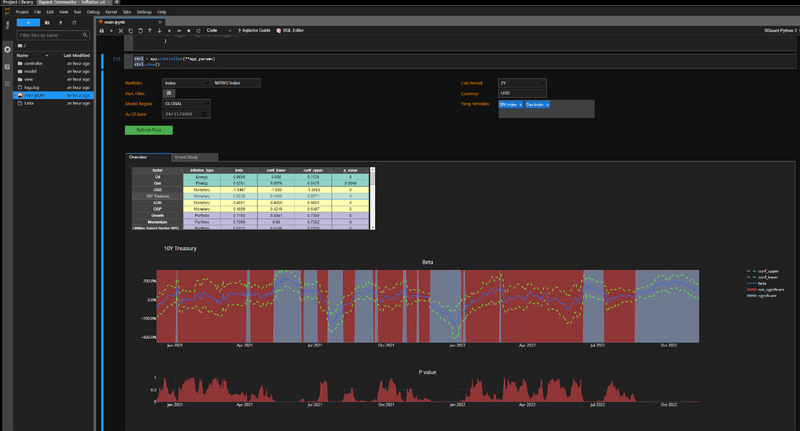

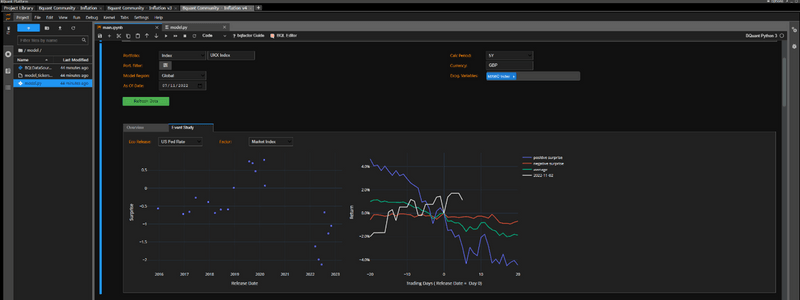

How can investors monitor their portfolios’ sensitivity to inflation? What can they do to hedge themselves against the most affected factors in a likely regime of substantial medium- to long-term inflation?

Since the 90’s the Western world has benefited from a very low inflation regime that partly led central banks to push their interest rate to near zero (and sometimes negative). The cost of risk mechanically decreased as well. The low-inflation regime has been supported by many factors, which now seem to be reverting.

- Globalization: a long and stable process of international opening and globalization seems to be now reverting, with a return to populist/nationalist politics around the world and an increase in tariffs and commercial tensions among main actors (China/U.S.).

- Low-cost workforce: in addition, globalization and workforce mobility enhanced access to low-cost labor. The reversion in globalization impede access to low-cost labor.

- Robotization and labor productivity gains: at the same time, the labor productivity gains mostly provided by higher skilled workforce and robotization have leveled off and even decreased in some areas of the Western world, leading to a relative increase in the cost of labor.

- Structural unemployment rate: for a while, a persistent, non-negligible unemployment rate as well as an historical rise in female employment rate offered a deep pool of available low-cost labor. This tendency is reverting in most Western countries (due in part to declining/aging Western populations) to the historically low current unemployment rates.

- Low energy prices: following the Oil Shocks in the 70’s, energy prices had been going down steadily. However, in the most recent past, energy prices have increased substantially and are more volatile. This tendency is likely to remain as fossil fuels’ natural reserves are declining; we expect the energy transition to lead to alternative energy sources that are structurally more costly for now.

- Low interest rates: monetary policies have pushed reference interest rates to zero to promote growth and reduce the cost of debt. However, inflationary pressures, build-up of high government debt levels and relatively low scope for actions in taxation policies during the living standards crisis are now leading to a sharp increase in interest rates.

- High growth: all the above factors benefited from a long-term stable economic growth. The long-term growth has now been jeopardized, impacting inflation prospects, too.

All these factor reversals contribute to a shift from low to high inflation. We show you how to use Bloomberg’s BQuant platform* to analyze inflation metrics that analyzes inflation metrics’ impacts on specific portfolios and factors

If you are local to the London area, please join the BQuant Community Event for an informal discussion around inflation and proposed methods as how to both hedge and protect your portfolio during inflationary times. Learn more by clicking here.

*BQuant is a cloud-based end-to-end investment research platform specifically designed for quantitative analysts and data scientists in the financial markets. It provides access to Bloomberg’s comprehensive range of high-quality financial data sets along with quant tools in the cloud that significantly reduce financial services firms’ time to market for developing new investment strategies.