This article was written by Louise Carter, Product Manager for Electronic Trading Shared Services and Sarah Brown, Product Manager for Fixed Income Price Transparency at Bloomberg.

At a time when digitization is transforming most industries, trading fixed income securities can seem like a throwback. The global bond market is larger and more complex than its equity counterpart, and yet most bonds are still traded over-the-counter (OTC), with investors and dealers negotiating directly, in many cases over the phone or chat systems.

Consequently, sourcing liquidity in the secondary bond markets can be a delicate dance between finding the right bond, at the right price and from the right counterparty, all the while minimizing the market impact.

Access to information that proves a holistic, real-time view into pricing and liquidity is important part of the process.

Finding clarity in murky markets

Pre-trade transparency is crucial to support intelligent trading, and yet reliable data can be hard to find, particularly during times of market stress, as we’ve seen during the COVID-19 pandemic.

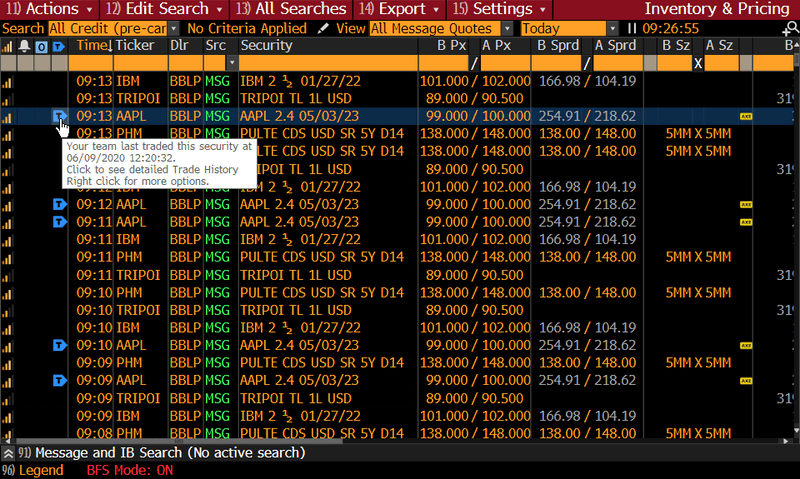

As a leading pricing provider, Bloomberg offers investors data-driven transparency tools such as its Inventory Manager (IMGR <GO>) to source liquidity, quickly and discreetly. IMGR <GO> delivers aggregated information in real time, and serves as a hub to help investors determine how, what, when and where to trade based on multiple sources –– including their own trading history.

Access to dependable pricing data helps provide traders with information needed to execute at the right price. Bloomberg’s transparency tools are backed by a multiple global sources including, exchanges and broker quotes. All of this data is filtered and verified for quality and consistency.

When it’s time to source liquidity, traders often turn to axes to find the other side of their trade. Bloomberg’s axe discovery workflows help identify appropriate counterparties using live, high-quality data fed directly from dealers’ pricing engines. These are fed by firms of all sizes so traders have a broad view of available market liquidity.

IMGR <GO> provides real-time pricing and axes (i.e. securities that a trader has a particular interest in buying or selling) from your counterparties in addition to historical market insight. High-quality axes on liquid products are fed directly from dealers’ pricing engines into Bloomberg. For less liquid products, traders can use more traditional message-based distribution tools to indicate live axes. Here, too, the data goes beyond the basics such as credit details and pricing, and includes dealer performance statistics based on a trader or team’s history with that dealer. Because they can quickly ascertain which dealers have and have not provided liquidity in the past –– and see which transactions were voice –– traders are better positioned to complete transactions efficiently and at the best price. Taking this further, Bloomberg recently integrated its trade reporting tool within the IMGR function. This combines fixed income trading activity (voice and electronic, attempted and executed) on Bloomberg for individual traders and their teams, with pre-trade price transparency.

Better analysis for better execution

It’s one thing to access relevant market data, and quite another to make sense of it at the portfolio level and execute on it. On Bloomberg, there are several tools that help improve workflow, portfolio visibility and trade execution. For instance, the Fixed Income Worksheet (FIW<GO>) allows clients to analyze any group of bonds on Bloomberg by integrating live data. Traders can screen, filter and group their bond universe to create charts, overlaying multiple data sets, and even calculate prices, spreads or yields for a number of bonds simultaneously.

Among other key features, the Fixed Income Worksheet allows clients to analyze relative value for any group of bonds on Bloomberg and integrates real-time axes as an indication of liquidity. They can screen, filter and group their bond universe to create charts, overlaying multiple data sets for example axe status. They can also compare prices, spreads or yields for a number of bonds simultaneously.

On Bloomberg, all of this information is aggregated and embedded in its fixed income execution management system (TSOX <GO>), making it possible for investors to source, price and complete transactions quickly, and with minimal impact on the market.

At a time when information is critical but transparency is still a challenge it’s important to rely on systems and tools that help investors see the market from many angles, including their own trade history.

Contact us to learn more about how Bloomberg Electronic Trading Solutions improve pre-trade transparency, workflow and execution.