This analysis is by Bloomberg Intelligence Rates Strategist Ira F Jersey and ETF Analyst James Seyffart. It appeared first on the Bloomberg Terminal.

Hedging inflation and interest-rate exposure isn’t so easy, with some exchange-traded products performing extremely well when inflation has climbed, while others have stumbled. This note highlights a few successes and failures, and reiterates that TIPS have been a poor hedge unless interest-rate exposure is hedged.

Not All Inflation Hedges Have Succeeded

As far back as late 2020, investors started purchasing perceived inflation hedges, with flows into some products taking in record amounts of cash. Treasury Inflation Protected Securities (TIPS) mutual funds and ETFs had inflows of over $95 billion since 2021. Yet many of the hedges failed to deliver expected returns, while a few did well. We’ve noted for years that outright constant maturity TIPS products had large amounts of interest-rate exposure. Funds that were short Treasuries — TBT, for example — unsurprisingly did well.

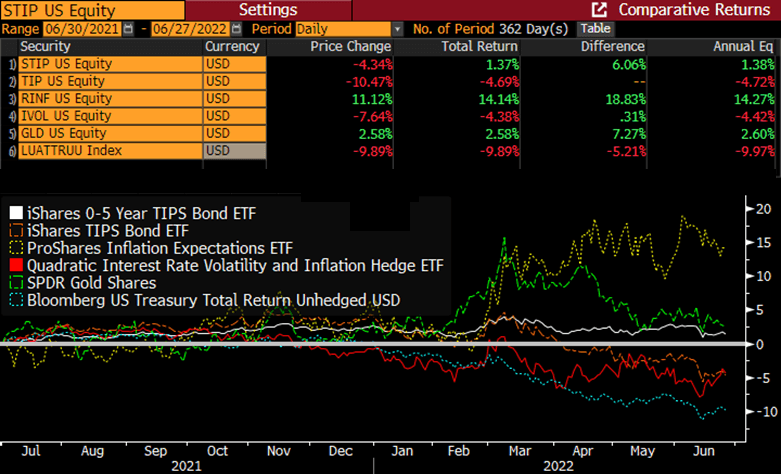

Products designed to benefit from inflation jumps have mixed returns, The Bloomberg TIPS index fell by 8% year-to-date, outperforming nominal Treasuries by nearly 2%. Rate hedged TIPS products were also mixed depending on their structure, while outright TIPS funds didn’t keep up with CPI.

Inflation hedge performance

Hedged TIPS product show mixed results

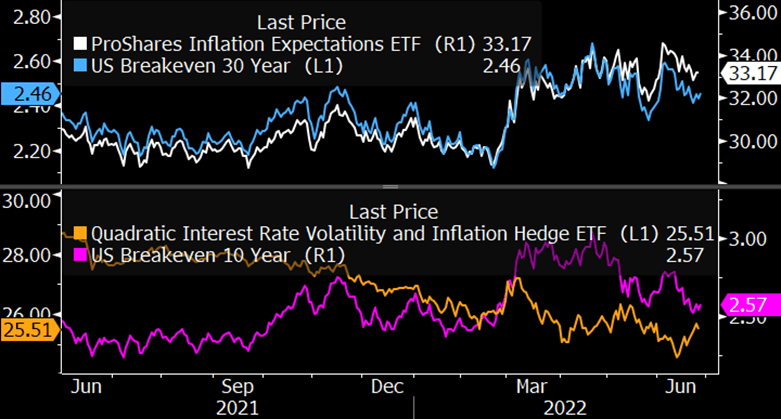

To effectively hedge against inflation, TIPS need to hedge against interest-rate risk. One product attempting this is RINF, which purchases long-maturity TIPS and hedges interest-rate exposure using Treasury futures. RINF has returned more than 13% from the end of May 2021 to present. The fund’s price has tracked 30-year TIPS inflation breakevens well.

IVOL hasn’t demonstrated similar performance to RINF. This funds’ long interest-rate volatility positions should hedge against some of the interest rate risk in the Schwab TIPS ETF (SCHP), the fund’s largest holding. IVOL also has a mandate favoring forward yield-curve steepeners. When inflation rises, central banks typically raise rates, flattening the yield curve. These hedges have helped IVOL do better than some other hedges.

RINF better inflation hedge than IVOL this cycle

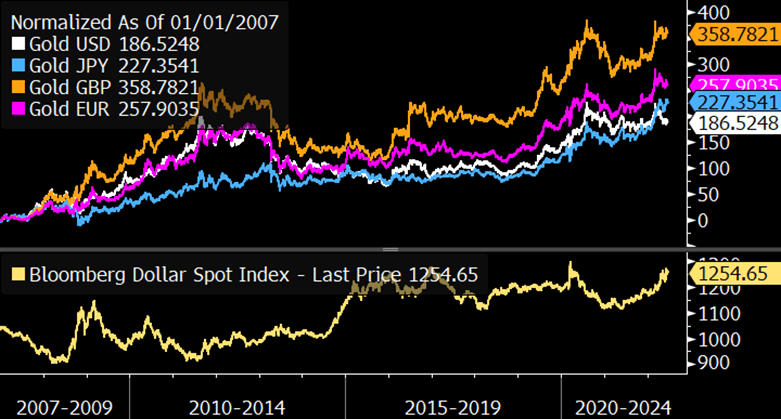

Gold isn’t the inflation hedge you may think it is

Gold is often touted as an inflation hedge, but the correlation is only slightly positive year-to-date. Gold tends to increase with inflation over the very long term, but not always in the short term. The metal isn’t at all-time highs with inflation, largely because the dollar has strengthened since the start of 2021. Gold priced in the pound, yen and euro is near all-time highs, but on a dollar basis, it’s almost 13% off its August 2020 peak.

Compared with a multitude of asset classes, the metal is chiefly uncorrelated over the long term. Its strongest relationship is a negative 0.48 correlation to the dollar, highlighting its usefulness as a currency-debasement hedge. Its correlation to CPI and equities are just 0.11 and 0.07 respectively. This uncorrelated nature does make gold a highly useful portfolio diversifier.

Gold price hindered by soaring dollar

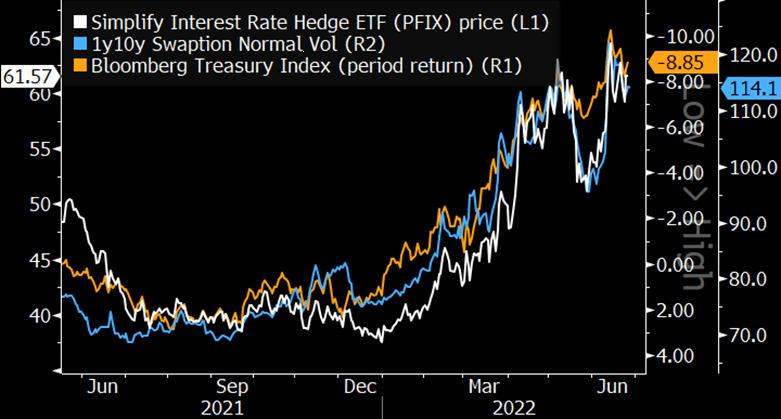

An ETF to hedge rising rates: PFIX

When inflation is high and central banks are raising interest rates, the overall term structure of government bond yields and rate volatility increases. This year offered proof in point. To hedge higher interest rates, institutional investors can short futures contracts, pay interest rate swaps or buy put/payer options on underlying rates from overnight all the way out to 30-year (and sometimes longer). But for smaller investors, buying options can be expensive. The Simplify Interest Rate Hedge ETF (PFIX) has a strategy of buying puts on the rate market through buying payer swaptions, while holding cash and 5-year Treasuries as collateral.

PFIX has done extremely well this year as rates and volatility rose. But the fund could perform poorly if Treasuries rally as they did in mid-2021, but other rate product would rally.

PFIX vs. Treasury returns and Swaption volatility