Green bonds heat up while emerging markets set for debuts

This analysis is by Bloomberg Intelligence Head of ESG and Thematic Investing EMEA Adeline Diab. It appeared first on the Bloomberg Terminal.

Green bonds have outperformed twofold since the pandemic. Higher-quality issuers, the exclusion of non-green sectors, and longer duration explain the performance. Though the trend reverted this year amid rising rates, we expect green bonds’ run to continue as new issuers join. While Europe leads and China surpassed the U.S., emerging market green-bonds issuance (ex-China) has grown threefold since 2019 — a trend set to accelerate.

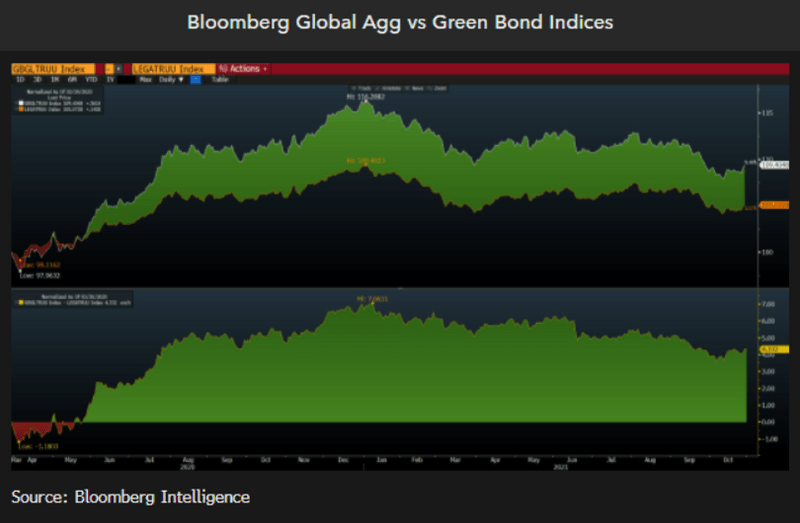

Green Bond Index declines vs. Global Agg Index, but well poised

Though green bonds strongly outperformed through 2H20 — gaining faster as long-duration instruments thanks to economic uptake post-crisis, spreads declining and central banks aggressively cutting rates, the Bloomberg MSCI Global Green Bond Index (GBGL) lost ground in 2021 vs. the Bloomberg Global Agg Index (LEGA) amid rising interest rates, modest relative carry and a stronger dollar. While this macro environment may persist, we expect green bonds to remain attractive, driven by a higher quality of issuers, the exclusion on non-core sectors as green-recovery momentum grows, and a diverse group of issuers joining the race.

GBGL is overweight in Europe-denominated bonds, compared with LEGA, which is more U.S.-focused. Both include 80% and 40% corporate and governments issuers.

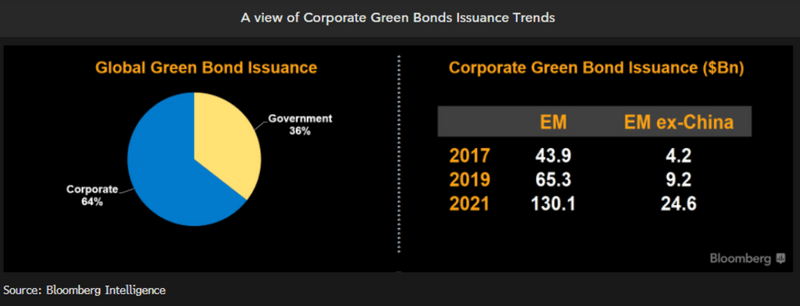

Financials spur green gains; Emerging markets companies rise up

As markets cash in on green investments — a prominent issue at investors’ days and earnings presentations — companies lead with about 65% of the global green-bond issuance market so far this year. Financials have driven the increase, followed by Utilities and we see both sectors expanding. Emerging-market companies are gaining significant growth — sixfold in four years, with two-thirds in the past two. If the current pace can be an indicator of the future, emerging-market companies may sell more than $320 billion of green bonds by 2025 — over 5.5% of the expected global green-bond issuance in our base-case scenario, a significant share gain in an already active market.

Green bonds’ appeals remain: though the top bond’s size has tripled in two years, it remains over 2x oversubscribed.

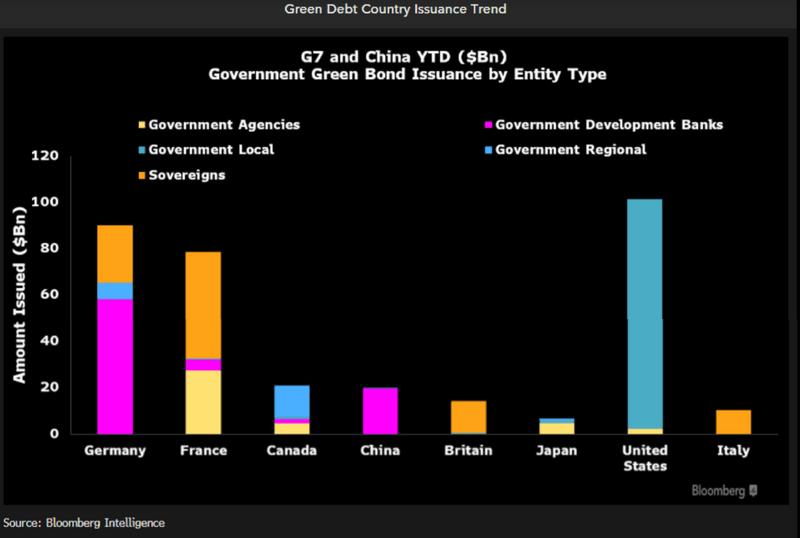

EU leads on green bonds; Emerging nations may bring next wave

Western Europe has 50% of the global green-bond market, and China’s 15% share pushed it past the U.S. But debuts by emerging nations (excluding China) are pointing to a profound shift. After bonds from Nigeria, Chile and China, plans by Saudi Arabia and Kenya to fund their transition to greener industry are good examples of the change. France remains the world’s biggest sovereign green-bond issuer, with over $40 billion of green debt outstanding. Germany, Italy and the U.K. joined France in issuing over $8 billion in long-dated green bonds in the past six months, securing strong deals in a rising-rate environment. California, not the federal government, is leading the U.S. in green-bond issuance with 25% share.

The EU is set to continue to lead, gearing up to issue 250 billion euros of NextGeneration green bonds by 2026.

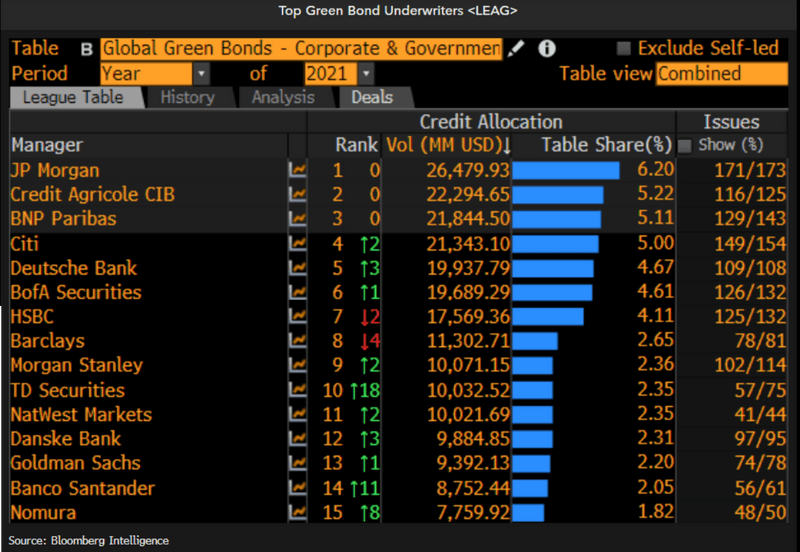

Who’s big on green? JPMorgan, Credit Agricole lead issuers

JPMorgan is the top green-bond underwriter so far in 2021, in-line with its $2.5 trillion pledge for the next decade toward climate action, with $1 trillion earmarked for green projects including renewable energy. European banks such as BNP Paribas, Credit Agricole and HSBC represent half of the top 15 underwriters. U.S. banks including JPMorgan, Citigroup, Bank of America, Morgan Stanley and Goldman Sachs make up about 20% of corporate and governmental green deals this year, up from 2% in 2019. Canada’s TD broke into the top 10 with a EU green bond that closed in October.

Utilities, infrastructure and real estate issued the most corporate green bonds. France and Japan are among the largest sovereign green-bond sellers this year.

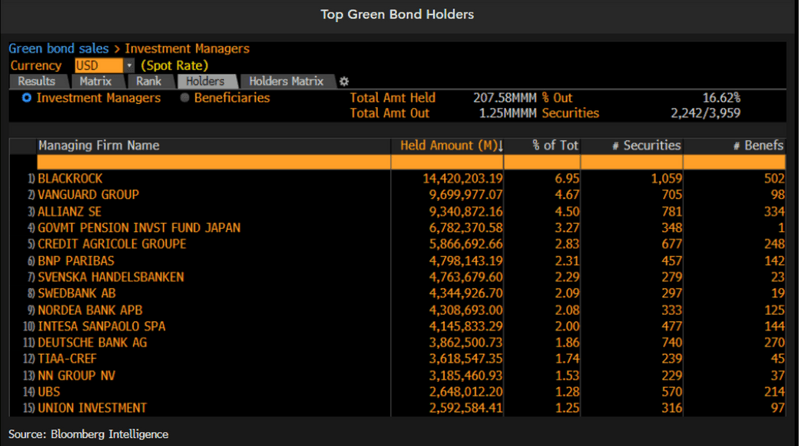

Who owns green bonds? BlackRock dominates with 7% market share

BlackRock was the top holder of green bonds, with about $14.5 billion of assets as of November (doubling its year-to-date position) and increasing its market share by about 2% to 7% this year. BlackRock’s positions include Swedbank, Iberdrola and Daimler in Europe, and NextEra, Apple and Verizon in the U.S. It also holds green bonds issued by European governments, Japan, Chile and China. Vanguard holds the second spot (4.7%), followed by Allianz (4.5%), Credit Agricole and Japan’s government Pension Investment Fund (both around 3%). Two-thirds of the top 15 investment managers are concentrated in Europe.

The EU’s pledge to issue 225 billion euros in green bonds, the ECB’s asset-buying program and the global race to net-zero are fueling the green-debt market as an asset class.