This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

Global carbon markets have grown exponentially since 2018. New markets have been set up after a wave of countries pledged net-zero targets, while existing markets have increased their prices to chase additional emission reductions. Despite the expanding coverage of carbon markets, their ambitions vary greatly. The rest of this year and the next will be a defining time as governments reform their carbon markets against the backdrop of the war in Ukraine, high energy prices and raging inflation. BloombergNEF has identified eight key drivers for carbon in 2022 and beyond.

By the numbers

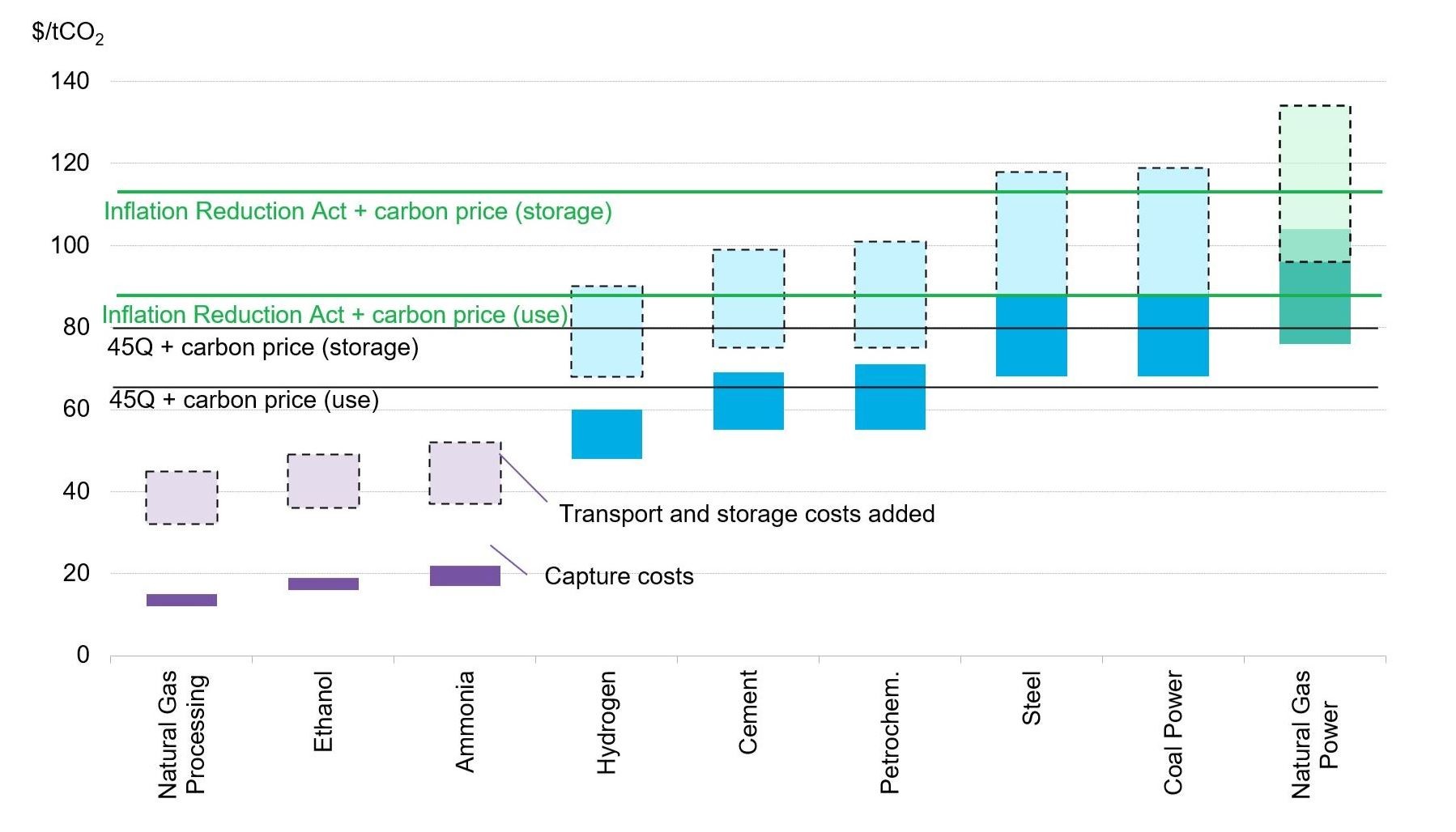

California carbon price and cost of carbon capture utilization and storage

- Policy: Market-tightening reforms, such as the Fit for 55 package in the European Union, and more ambitious emission reduction pledges from countries such as the UK and South Korea, will boost carbon prices. BNEF forecasts the EU carbon price will reach 136 euros per metric ton ($134/ton) by the end of the decade, up from around 80 euros/ton at present. A carbon border tax is still on the cards but remains up for debate. Over in the US, advances in carbon market policy have been more muted, with California set to lean less on its carbon market to reach its climate goals and the expansion of the Regional Greenhouse Gas Initiative to Pennsylvania struggling.

- Power sector: Higher emissions in the EU and US are expected to provide price support for their carbon markets in 2022. Gas supply risks in the EU are pushing up emissions from the bloc’s power sector as more coal is burned, while low nuclear and hydro output in the US is promoting gas-fired generation. A lack of firm capacity in both regions could see power sector emissions elevated for longer than anticipated, bolstering demand for carbon allowances.

- Industrial sectors: Recession risks and cost inflation have taken a toll on European industrials, lowering their demand for carbon allowances for 2022-23. US industrials, meanwhile, appear to be resilient so far. Carbon pricing is starting to impact industries, having reached the break-even price of some clean technologies. This could enable industrial emissions abatement and lead to reduced allowance demand, although could also spur companies that are not able to reduce their emissions today to hedge against rising carbon prices, increasing allowance demand.

- Financials: We expect financial intermediaries to provide support for carbon prices in 2022-23. Carbon markets give investors access to a tool that tracks the energy transition with a diversified approach. They could also attract investors looking to shield their returns from rising interest rates and inflation.

- Offsets: Today’s voluntary carbon offset market is oversupplied. However, tightening supply due to the war in Ukraine and registries shunning low-quality projects mean the window for cheap offsets could be closing. Further policy reforms could see prices skyrocket to over $200/ton before 2030. In Asia Pacific, compliance markets lack critical mass and the main focus is on voluntary offset exchanges. Meanwhile, the United Nation’s global carbon trading mechanism, Article 6, remains a watching brief.